ZAANDAM, the Netherlands – Ahold Delhaize reported solid second-quarter results, with its U.S. operations showing steady comparable sales growth and continued momentum in online channels. U.S. comparable sales excluding gasoline increased by 3.4% in Q2, driven by strong performances in online grocery and pharmacy.

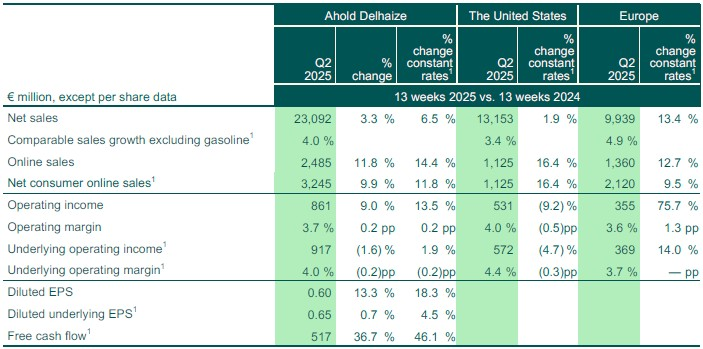

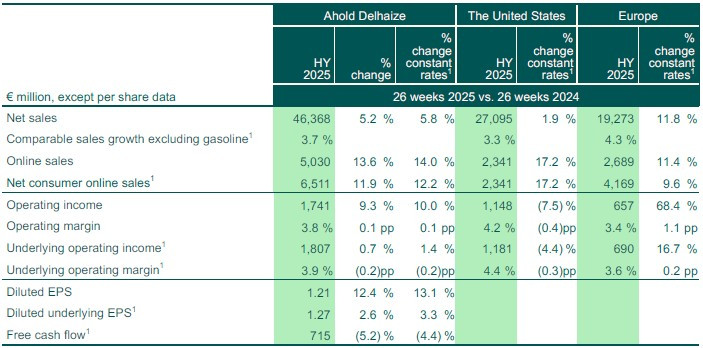

Net sales in the U.S. rose 1.9% at constant exchange rates to €13.2 billion, though they declined 3.1% at actual exchange rates due to currency fluctuations. Calendar shifts contributed approximately 0.9 percentage points to comparable growth. Performance was impacted by the closure of underperforming Stop & Shop stores and lower gasoline sales, which resulted in a 1.1 percentage point reduction in net sales.

“I am pleased to report solid second quarter performance, with strong sales growth supported by positive volumes in both regions. In an environment where customers prioritize value and convenience, our Growing Together strategy stands out as a key strength. Our brands’ unwavering commitment to delivering exceptional customer value has enabled us to maintain or improve our market positions and continue to drive momentum in growth,” said Frans Muller, President and CEO of Ahold Delhaize.

Online sales in the U.S. grew 16.4% in constant currency, led by Food Lion, marking the fifth consecutive quarter of double-digit online growth. The company also highlighted progress in launching price investments across all its U.S. brands and continued innovation in private-label offerings. So far this year, Ahold Delhaize has introduced 300 new own-brand products in the U.S., with sales in that category outpacing the rest of the store.

“So far this year, we have introduced 300 new own-brand products and seen sales growth outpace the rest of the store in both dollars and units. It has also been one year since we announced decisive and deliberate actions to ensure a stable and thriving future for Stop & Shop. We are encouraged by customers’ response to the initiatives we have implemented thus far. Where we have made investments, we are attracting new customers and seeing increasing volumes and an improving net promoter score,” said Muller.

The underlying operating margin in the U.S. was 4.4% for the quarter, a 0.3 percentage point decline year-over-year, reflecting strategic price investments and a shift in the mix toward online and pharmacy sales. IFRS operating income in the U.S. was €531 million, down €42 million from the underlying figure, primarily due to store impairments.

Company-wide, Ahold Delhaize reported Q2 group net sales of €23.1 billion, up 6.5% at constant exchange rates, supported by the acquisition of Profi in Romania and growth in both U.S. and European operations. Total online sales grew 14.4% at constant rates, with e-commerce profitability reached for the first time on a fully allocated basis in the first half of the year.

The company reaffirmed its full-year 2025 outlook, including:

- Underlying operating margin of around 4%

- Free cash flow of at least €2.2 billion

- Gross capital expenditures of approximately €2.7 billion

- Diluted underlying EPS expected to grow at a mid- to high-single-digit rate, based on a EUR/USD exchange rate of 1.10

Ahold Delhaize continues to invest in its omnichannel infrastructure and proprietary technologies. In Q2, the company completed the rollout of its PRISM e-commerce platform at Food Lion, with plans to expand it to Hannaford in the second half of the year. Updates to its proprietary Spectrum technology are also underway to simplify and modernize online order management across U.S. brands.

Muller concluded: “Our focus on striking the right balance between investing in growth and creating opportunities to drive operational excellence continue to fuel the positive outlook for our company. With our strong culture – known for its agility, consistency, ability to drive transformative change and commitment to sustainability – I am confident we are well prepared to navigate the complexities of the current business environment and position the company to drive brand strength and market share growth in the coming periods.”