The convenience store industry is undergoing a radical transformation, shedding its gas-and-gum reputation to become a powerhouse of foodservice, tech-driven loyalty, and retail media. According to Intouch Insight’s 2025 Convenience Store Trends Report, c-stores are now competing head-to-head with QSRs—and winning—by leveraging craveable food, gamified rewards, and in-store digital advertising.

Here’s what’s driving the shift:

1. Made-to-Order Food: The New Foot Traffic Engine

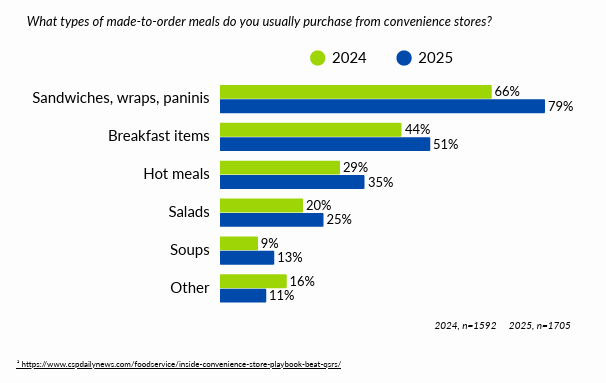

- Eighty-five percent of consumers have tried made-to-order (MTO) food at convenience stores, with sandwiches (66%) and hot meals (35%) being the top sellers. Salad consumption increased by 5 percentage points year over year, indicating a growing preference for healthier choices.

- Foodservice sales grew 5% in 2024, with a projected rise of 5.7% in 2025. Brands like Buc-ee’s and Wawa dominate with dwell times 2–3× longer than average, thanks to brisket sandwiches and expansive MTO menus.

- 43% of shoppers now rate c-store food as fresh as grocery or fast food, challenging QSRs on quality.

2. The Value Wars: C-Stores vs. QSRs

- 72% of consumers see c-stores as a QSR alternative—up 27 points since 2022—driven by aggressive value meals (e.g., Circle K’s $5 deals and GPM’s $3.99 chicken offers).

- 75% say MTO food delivers "serious bang for the buck", outpacing QSRs on perceived value.

- Pizza taste ratings at c-stores (86%) now top Domino’s (85%) and mid-size chains (83%).

3. Loyalty 2.0: Gamification & Personalization

- 72% of shoppers are enrolled in loyalty programs, with 85% more likely to join if the rewards align with their habits.

- Gamified apps like 7-Eleven’s drove 150% higher coupon redemptions, while TXB’s location-based challenges boosted sales.

- Missed opportunities: Cashiers failed to mention loyalty programs 65% of the time, resulting in lost revenue.

4. Tech & Retail Media: The Silent Salesforce

- EV charging stations attract 20% more visits from millennials, turning charge time into an opportunity for shopping.

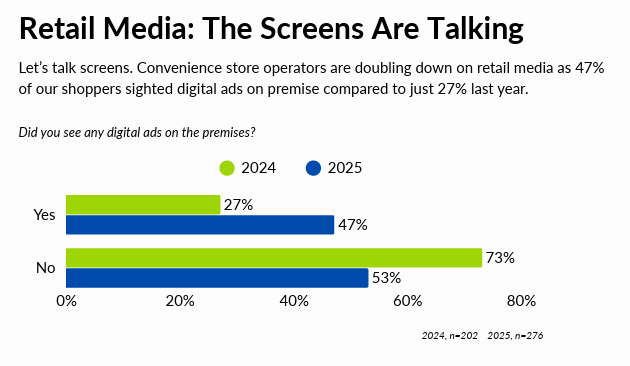

- Retail media ads saw a 74% YoY surge in visibility, with 34% of shoppers buying promoted items. Pump-side screens and checkout lanes are now prime ad real estate.

- Self-checkout preference dipped to 42%, but Gen Z/Millennials still favor zero-human interaction (55%).

5. Cleanliness & Service: The Trust Builders

- Seventy percent of customers judge food freshness based on store cleanliness. Chains such as Nouria and Stinker Stores stand out with spotless restrooms and dust-free shelves.

- Friendliness boosts retention: 75% rated service as "friendly," but 87% of cashiers missed upsell opportunities.

The Bottom Line:

C-stores are no longer just pit stops—they’re destinations. To compete, operators must, according to Intouch:

- Double down on MTO food quality and variety.

- Embed gamification into loyalty programs.

- Monetize digital touchpoints (screens, apps, charging stations).

- Audit cleanliness and staff training to build trust.

Download the full report: Intouch Insight 2025 Convenience Store Trends