By Sri Rajagopalan & Peter V.S. Bond, The CPG Guys

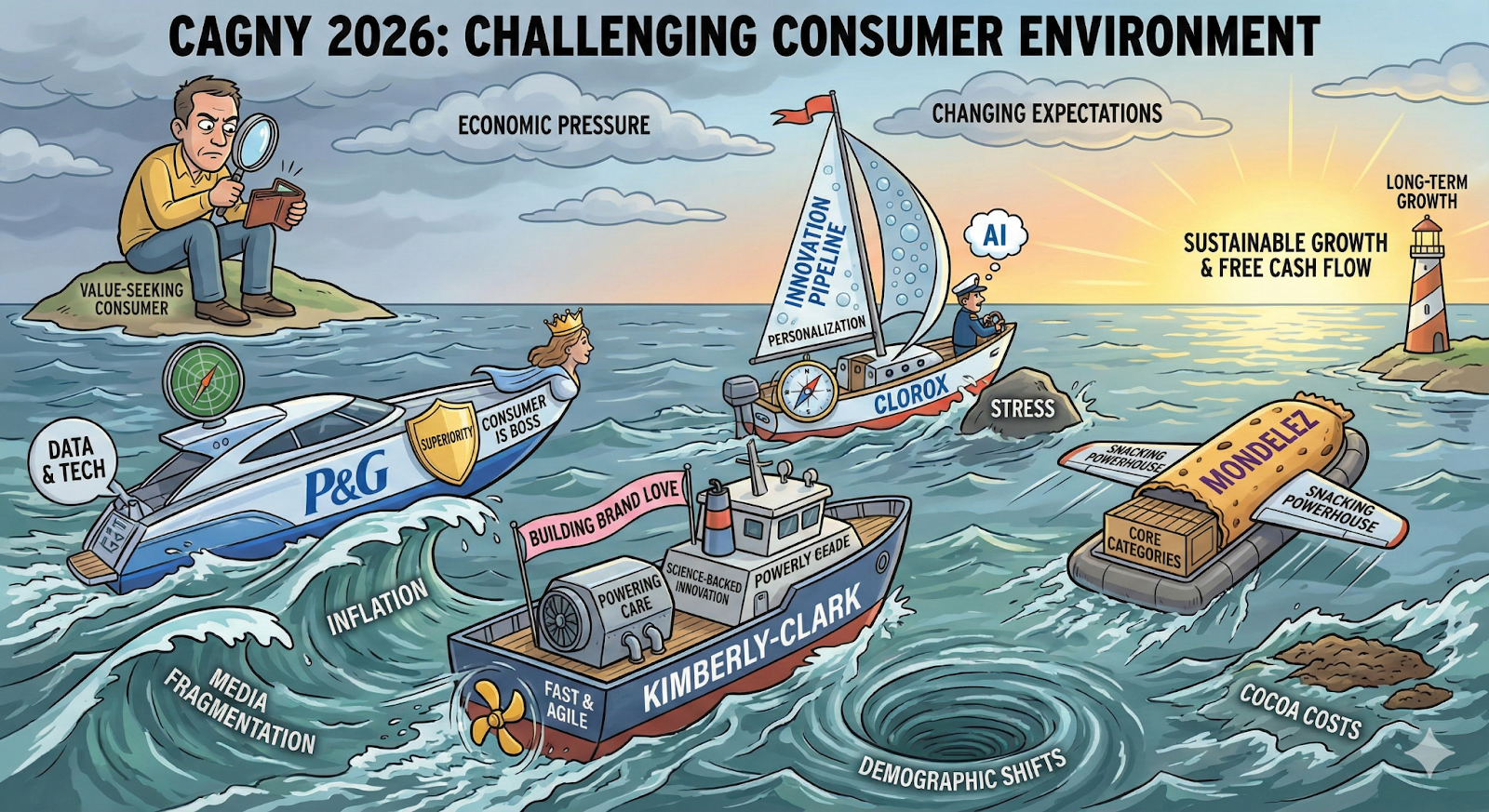

ORLANDO — If Day Three of CAGNY 2026 delivered sharp contrasts — AI leaders and laggards side by side, transformational M&A sitting alongside volume crises — Day Four offered something more textured: a study in strategic maturity. Four companies across oral care, beauty, beverages, and household products stepped to the podium, each at a distinct inflection point, and each with a different answer to the central question of this conference: where does durable growth actually come from?

Colgate-Palmolive, L'Oréal, Vita Coco, and Newell Brands collectively illustrated a spectrum that runs from AI-at-scale sophistication to AI silence, from M&A-as-growth-engine to deliberate inorganic restraint, and from category momentum riding a genuine tailwind to turnarounds still grinding through recovery. For mass market retailers, the Day Four message is this: your CPG partners are not monolithic. They are navigating very different trajectories — and the sophistication of their commercial partnerships should reflect that reality.

Colgate-Palmolive: The Quiet Sophisticate

There is a version of Colgate's CAGNY story that sounds unremarkable on the surface — a 3–5% long-term organic growth algorithm, modest 2025 results, and no blockbuster M&A to announce. But that reading misses the depth of commercial infrastructure Colgate has quietly assembled.

The company's AI and analytics story is one of the most operationally mature at the conference. With 85% net sales coverage via Marketing Mix Modeling, 80% Revenue Growth Management coverage, 500 harmonized global data sources, and 16 clean rooms spanning five retailers across 11 markets, Colgate has built the kind of commercial precision architecture that most peers are still aspiring toward. The clean rooms alone are generating measurable results — a 16% lift in incremental sales and a 2x improvement in conversion optimization, with 70% of U.S. media spend now covered by clean room data. This is not a PowerPoint aspiration. It is a deployed commercial capability.

Innovation follows a disciplined Strategy → Discovery → Incubation → Scale model, with recent examples spanning Visible White Purple whitening platforms, menopause-focused personal care under Sanex, and premium dermatology through PCA Skin. But the standout portfolio story remains Hill's Pet Nutrition, which has grown nearly 60% over five years and continues to gain share in both Science Diet and Prescription Diet — functioning as a genuine growth engine rather than a stable contributor.

For retailers, Colgate's omnichannel model centers on Zillennials as digitally native, multi-touchpoint shoppers — and the company has built content, retail media, influencer commerce, and personalized veterinary engagement frameworks to reach them across channels. The message for joint business planning: Colgate is coming to the table with more analytical rigor than its headline numbers suggest.

Scoring Summary: Portfolio Stability & Innovation: Strong | AI & Analytics: Conference-leading | Omnichannel: Advanced | PPA/RGM: Globally scaled | Consumer Insights: Science-driven | Volume Growth: Steady, improving | M&A: Not a current priority

L'Oréal: The Beauty of Compounding

L'Oréal CEO Nicolas Hieronimus arrived at CAGNY having just delivered a record year — 725 patents filed, €1.5 billion invested in technology, and broad-based growth across all categories and all regions. In a conference week defined by companies managing headwinds, L'Oréal presented from a position of structural momentum.

The portfolio story is genuinely differentiated. Haircare grew 12.9% on a like-for-like basis in 2025, fragrances grew 10.4%, and even the relatively softer categories — skincare at +0.4%, hair colour at +0.6% — maintained positive trajectories. E-commerce reached 30% of total sales, growing approximately 13% LFL, with haircare styling content generating over 10 billion monthly views and signaling the kind of social commerce integration that turns content investment into commercial conversion.

AI is woven across all four value creation pillars: augmented consumer journey, augmented advertising ROI, augmented creativity, and augmented research. The €1.5 billion technology investment is not a line item — it is infrastructure for the next decade of category leadership. The framing is end-to-end AI integration rather than isolated point solutions, a distinction that matters when evaluating the durability of competitive advantage.

The demographic segmentation underlying L'Oréal's growth strategy is among the most sophisticated at the conference. The company has identified three parallel growth engines: 400 million consumers under 25 (Gen Z fragrance and styling boom), 125 million consumers over 60 (the longevity opportunity), and 170 million emerging middle class consumers projected by 2030 — with a stated ambition of reaching 2 billion total L'Oréal consumers within the decade. That is not a marketing narrative. It is a category development thesis backed by acquisitions, including Color Wow (haircare leadership), a 20% participation in a longevity-focused scientific partnership, and a major fragrance move following the expiration of the Coty license.

For mass market retailers, L'Oréal's price ladder discipline is directly relevant. The skincare portfolio spans from €31 in Brazil to €450 in China, and the fragrance line covers the full market from accessible mists to haute parfumerie. Pack and price architecture is not an afterthought — it is structural market access strategy.

Scoring Summary: Portfolio Stability & Innovation: Exceptional | AI & Analytics: Record investment, fully integrated | Omnichannel: Social commerce leader | PPA/RGM: Deliberate and global | Consumer Insights: Among conference's deepest | Volume Growth: Sequential acceleration through 2025 | M&A: Record year, strategically targeted

Vita Coco: Riding the Tailwind, Building the Platform

Vita Coco's inaugural CAGNY appearance delivered one of the conference's clearest category momentum stories. With $610 million in full-year net sales — up 18.2% versus 2024 — and branded coconut water growing 26% globally to $496 million, Vita Coco arrives as a high-growth outlier in a week defined by category headwinds. The company's 42% U.S. market share in coconut water, combined with international growth approaching 40%, provides a structural foundation that few Day Four peers can match.

The retail execution story is concrete. The Walmart reset in mid-to-late November 2025 added 27,000 new points of distribution and a 150% increase in shelf space year-over-year — a distribution unlock of significant scale. Convenience channel expansion is progressing with similar discipline, with 1-liter base ACV in convenience jumping from 8 to 15 and multipack ACV improving from 63 to 71 in MULO+. Vita Coco is managing distribution as a precision tool, not a blunt instrument.

The honest tension in the Day Four presentation is the Q4 volume picture. After three quarters of volume growth at 21%, 14%, and 29% respectively, Q4 case equivalent volume declined 4% even as net sales grew 0.4% — meaning pricing carried the quarter. Some of this reflects expected normalization following the inventory rebuild from the Walmart reset, but the deceleration is worth watching heading into 2026, particularly as the company guides for low-to-mid-teens net sales growth.

What Vita Coco does not have at this stage is an AI narrative. There is no mention of machine learning, analytics infrastructure, or data-driven commercial optimization anywhere in the presentation. In a conference where this gap is increasingly conspicuous, it is a capability area the company will need to develop as it scales. Innovation in formats — Vita Coco Treats, PWR LIFT protein coconut water, Vita Coco Milk — shows purposeful extension beyond core hydration, and the $197 million cash position with zero debt provides real acquisition firepower. M&A is the fourth strategic growth pillar, and with the balance sheet to execute, that pillar may soon move to the front.

Scoring Summary: Portfolio Stability & Innovation: Category leader with format extensions | AI & Analytics: Absent — the notable gap | Omnichannel: Retail execution strength, limited digital narrative | PPA/RGM: Pack architecture precision, pricing holding | Consumer Insights: Category-level, not behavioral | Volume Growth: Strong full-year, Q4 moderation | M&A: Signaled, war chest ready

Newell Brands: The Turnaround Gets Serious

Newell Brands came to CAGNY 2026 with something it has not had in years: a credible innovation pipeline, a genuine AI story, and early signs that a multi-year restructuring is producing durable results. The company still faces real headwinds — core sales declined 4.6% in 2025, leverage sits at 5.1x, and tariff headwinds created a $174 million cash impact requiring three rounds of pricing action. But the direction has changed.

The innovation story is the most tangible evidence of a turnaround taking hold. Newell went from one Tier 1 or 2 product launch in 2023 to 25 planned for 2026. Graco's EasyTurn 360 gained 860 basis points of share since its January 2025 launch. Coleman's world-first collapsible hard-sided cooler — the Snap 'N Go — represents the kind of category-creating innovation that builds retail partnership value. These are not incremental line extensions. They are shelf-worthy, attention-capturing launches that give retailers a reason to invest behind the brand.

The AI story is perhaps the most underappreciated element of Newell's presentation. The "Quantum Leap" program features CEO sponsorship, 33 dedicated AI Navigators across the enterprise, 2,000-plus employees actively enabled, and over 100 deployed use cases spanning ideation, design, consumer co-creation, content creation, and workflow redesign. Crucially, Newell has positioned AI as an enterprise operating transformation — not a collection of pilot programs — which places it among the conference's more sophisticated AI narratives despite its overall financial complexity.

On tariffs and price architecture, Newell's domestic manufacturing footprint — 57% of U.S. business manufactured domestically — provides structural insulation across 19 tariff-advantaged categories. The Oster blender lineup ($22.98 to $199.99) exemplifies deliberate price tier breadth designed to maximize distribution. And with 2026 guidance projecting core sales of -2% to flat — an improvement from 2025 — the trajectory is moving in the right direction even if the destination is still some distance away. With roughly 50% gross margins and 45% operating margins on incremental sales, the volume recovery math is compelling when it arrives.

M&A is appropriately off the table. Newell's capital allocation priority is de-leveraging to 2.5x, and every dollar of capital is needed for that mission. The question heading into 2027 is whether the innovation pipeline, AI-powered commercial capabilities, and domestic manufacturing advantage translate into enough volume recovery to make the financial math work.

Scoring Summary: Portfolio Stability & Innovation: Accelerating — 2026 pipeline is credible | AI & Analytics: Underappreciated strength, enterprise-scale | Omnichannel: Focused, distribution recovery underway | PPA/RGM: Tariff-aware, margin-protective | Consumer Insights: Self-described turnaround, AI-enabled now | Volume Growth: Declining but improving trajectory | M&A: Deliberately paused — balance sheet first

The Day Four Themes

Three themes emerged with clarity across Friday's presentations.

AI is now table stakes — but maturity varies enormously. Colgate's clean rooms and MMM infrastructure, L'Oréal's €1.5 billion technology investment, and Newell's Quantum Leap program all represent serious AI commitments. Vita Coco's complete silence on the topic is a gap that will need to close as the company scales. The divide documented across CAGNY 2026 is not between companies that know about AI and those that don't — it is between those deploying AI at commercial scale and those still at the starting line.

Science-backed differentiation is a durable moat. Colgate's Hill's therapeutic nutrition, L'Oréal's 725 annual patents, Newell's Graco safety engineering — the Day Four companies investing most heavily in proprietary science are generating the most defensible share positions. In a category environment where private label pressure remains persistent, science is the clearest long-term differentiator.

Volume recovery requires more than pricing discipline. Several Day Four presenters are navigating the tension between maintaining margins through pricing and recovering volume through value. Colgate's 3–5% long-term algorithm, L'Oréal's sequential acceleration through 2025, Vita Coco's Q4 volume moderation, and Newell's cautious 2026 guidance all reflect an industry still working through the post-inflation recalibration. The companies building the most durable path forward are those pairing pricing discipline with genuine innovation investment — giving consumers a reason to choose their brands at any price point.

For mass market retailers, CAGNY 2026's fourth day reinforces what the week has shown in aggregate: your most sophisticated CPG partners are investing in the data, the science, and the commercial infrastructure to grow categories with you. The joint business planning conversations that start from that shared ambition — rather than from trade terms alone — are the ones most likely to drive mutual growth heading into the back half of the decade.

| Company | Score (Out of 10) |

|---|---|

| L’Oreal | 9.0 |

| Colgate Palmolive | 7.7 |

| Newell Brands | 5.0 |

Portfolio Stability & Innovation • AI Acknowledgement • Omnichannel Understanding • PPA/RGM • Consumer Insights Depth • Organic Volume Growth • M&A

Submit Your Press Release

Have news to share? Send us your press releases and announcements.

Send Press Release