By Sri Rajagopalan & Peter V.S. Bond, The CPG Guys

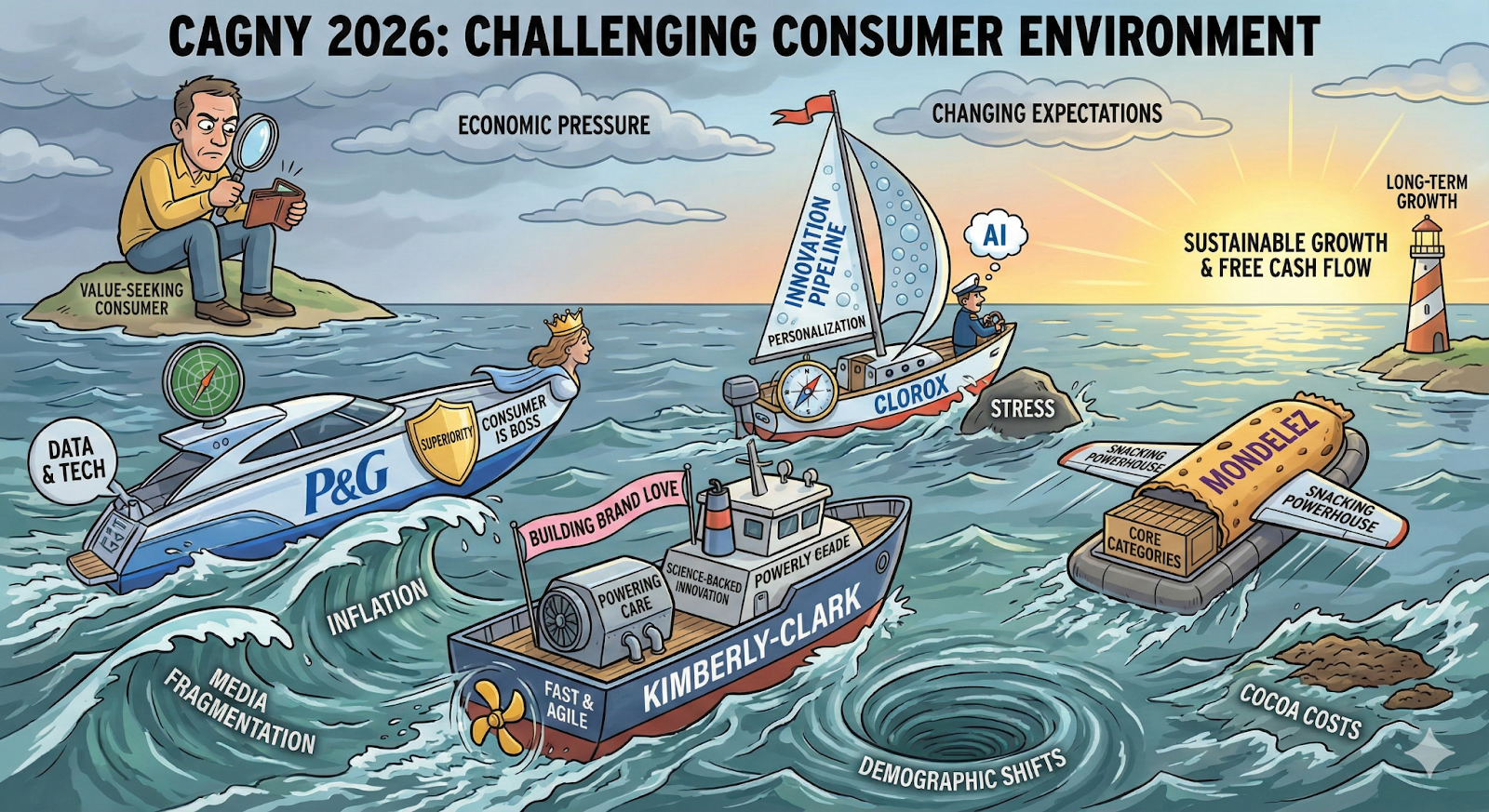

ORLANDO — If Day One of CAGNY 2026 was defined by the industry's giants navigating consumer headwinds, and Day Two by protein premiumization and pragmatic portfolio discipline, Day Three brought the sharpest contrasts of the conference. Seven presentations — from Kraft Heinz, P&G, Reckitt, Kimberly-Clark, Clorox, e.l.f. Beauty and Celsius Holdings spanned the full spectrum of CPG maturity, strategic ambition, and operational sophistication. The through-lines: a bifurcated embrace of AI (some leading, some absent), the continued centrality of Revenue Growth Management, and a wave of transformational M&A reshaping portfolios for the next decade.

Kraft Heinz: Volume Recovery on the Clock

Kraft Heinz arrived at CAGNY with a clear diagnosis and a prescription. The U.S. business has lost retail market share for a decade, and management was candid about it. FY2025 organic net sales guidance sits at (3.5%) to (1.5%) — a number that reflects both structural work still underway and macro headwinds including SNAP benefit reductions. The $600 million in incremental 2026 investment is the company's bet that its new tiered portfolio architecture — "Hold," "Win," and "Win Big" — will unlock the volume recovery the top line demands.

What stood out most from a retailer perspective was Kraft Heinz's price pack architecture work. The company is actively managing both ends of the value spectrum simultaneously: bulk pack share rising from 25.6% to 26.7% of industry sales, and small pack share growing from 15.2% to 16.4%. The target is a meaningful improvement in the share of promotional spend delivering net positive ROI in 2026. The Capri Sun bottle format entering convenience and c-store channels — achieving 60% sales incrementality across 16,000+ new stores — is a concrete proof point that format innovation can unlock entirely new distribution corridors.

One notable absence: AI. In a conference where virtually every peer cited artificial intelligence as a strategic enabler, Kraft Heinz made no mention of it. For a company investing heavily to recover share, the absence of advanced analytics and AI-powered consumer insight tools from the public narrative is worth watching in future communications.

P&G: The AI Factory in Motion

P&G delivered arguably the most sophisticated AI narrative of the entire conference. While organic sales growth has decelerated sharply — from 7% in FY'22–'23 to just 1% in 1H FY'26 — P&G's investment in the infrastructure of future growth is unmistakable. The "AI Factory" framework (data lake → AI models → agents, deployed across all employees, data scientists, and analysts) is not aspiration — it is operational.

The Pantene Sunkiss Glow campaign is the case study worth understanding. P&G used AI to identify a whitespace — sun protection is the #1 skin care growth driver in summer, yet no hair care equivalent existed — then deployed AI across concept generation, packaging design, and creative asset production, claiming 5x faster execution than traditional workflows. Separately, Unstopables Luxe used AI-driven molecular discovery to solve a fragrance longevity challenge, producing the #2 SKU in the Unstopables portfolio and a top driver of U.S. Fabric Enhancer growth.

For mass market retailers, P&G's omnichannel execution is equally instructive. The Old Spice/Walmart NFL partnership — integrating in-store displays, Walmart app express delivery, and digital creative simultaneously — and the Kroger "Homegating" collaboration demonstrate how P&G is treating retail execution as co-investment rather than transactional volume play. FY'26 guidance of 0–4% organic sales growth embeds a back-half recovery that will require these bets to land.

Reckitt: Focused, Funded, and Winning Where It Competes

Reckitt presented one of the most operationally focused stories of the day. With 11 Powerbrands driving more than 80% of Core net revenue — and most holding #1 market positions — the company has completed the portfolio simplification work and is now in execution mode. The headline innovation is significant: Mucinex 12HR Cold & Fever Multi-Symptom represents the first FDA-approved New Drug Application in upper respiratory in 15+ years, entering a $2.5 billion U.S. market. Lysol Air Sanitizer — the first EPA-approved germ-kill-in-air product — is another category-creating launch.

Reckitt's omnichannel sophistication is among the best in the field. China generates approximately 80% of net revenue through e-commerce after nine consecutive quarters of double-digit growth. In North America, e-commerce is growing at more than 5x the rate of the total business, and a Walmart 30-minute delivery partnership for Mucinex drove 68% new-to-brand customers. The insight that 75% of physical shoppers use their phone at shelf, and that cross-channel shoppers spend 2x more than in-store-only shoppers, is the kind of data that should be driving every joint business planning conversation.

AI is deployed operationally, with Reckitt claiming up to 70% time savings on consumer insight access and up to 2x improvement in innovation concept quality. The company's 4–5% Core LFL net revenue growth target, with half from volume, is grounded in category structures with significant global penetration runway — 14% global dishwasher penetration and 1% of sex occasions including Durex are market development opportunities that few peers can claim.

Kimberly-Clark: Transformation With a Transformational Deal

Kimberly-Clark's CAGNY presentation was anchored by two things: a genuinely impressive internal transformation story and the pending acquisition of Kenvue that will reshape the company's strategic identity. The internal story is real — innovation gross margins running 280 basis points above the base business, a pipeline 1.6x larger than 2020 with margins projected 670 basis points higher, and R&D consolidated from 300 projects into 11 global platforms in 12 months. North America delivered 3% organic sales CAGR since FY21; International Personal Care grew 4.5% organically in Q4 2025.

The Kenvue acquisition — Neutrogena, Aveeno, Band-Aid, Listerine — would create a combined entity exceeding $32 billion in revenue with $7 billion in EBITDA pre-synergies and approximately $2.1 billion in projected synergies. The combined portfolio would shift Global Health & Hygiene from approximately 40% to over 50% of sales. This is a strategic transformation, not a bolt-on.

On AI, K-C is active: ML-driven media auto-optimization reduced content turnaround from two weeks to two days, and propensity modeling with combined datasets is powering personalized audience targeting. The Indonesia digital playbook — replicating the China model — delivered 190% growth in store GMV and 1,000 basis points of market share improvement within months of launch.

Clorox: Navigating the ERP Valley to Get to the Summit

Clorox is in the most uncomfortable position of the day's presenters — executing a major strategic pivot (the GOJO/Purell acquisition) while simultaneously absorbing a significant ERP transition headwind. FY26 guidance of (9%) to (5%) organic sales growth — or (1.5%) to +2.5% excluding ERP impact — reflects a business temporarily obscured by implementation noise. The long-term IGNITE targets of 3–5% sales growth and 25–50 basis points of annual EBIT margin expansion remain intact.

The GOJO acquisition deserves attention from retail buyers and category managers. Purell brings a $20 million installed B2B dispenser base, 680+ patents, and deep professional channel expertise. Expanding Clorox's Health & Hygiene segment from approximately 40% to over 50% of sales creates a category powerhouse with complementary channels and meaningful cross-sell opportunity. Synergies exceeding $50 million in run-rate cost savings are the financial floor, not the ceiling.

Clorox's RGM work is among the most granular of the conference. By repricing Glad trash bag counts and sizes using new price elasticity modeling, the company grew dollar share at a key retailer from approximately 25% to 32–35% on 80-count bags — the highest since 2022. AI is embedded in both content creation (an Agent Orchestration system accelerating creative briefs, legal reviews, and copy generation) and supply chain (commodity inflation forecasting cycle time cut by nearly 90%).

e.l.f. Beauty: The Outlier That Keeps Outperforming

e.l.f. Beauty is the conference's clearest reminder that CPG fundamentals — brand equity, consumer proximity, and value architecture — can drive extraordinary results without requiring complexity. A 23% net sales CAGR over the last decade, 28 consecutive quarters of net sales growth, and four brands among only 14 cosmetics and skincare brands to surpass $200 million in annual retail sales is a track record that deserves sustained study.

The Rhode acquisition adds a prestige tier — $1 billion deal, $128 million contribution to Q3 net sales, and the #1 brand at Sephora North America — to a portfolio that has historically thrived on democratized value (75% of the e.l.f. Cosmetics portfolio priced at $10 or less). The combination of mass accessibility and prestige aspiration in a single portfolio is a deliberate architecture shift with significant omnichannel implications.

Two gaps are worth flagging. AI is absent from the formal strategic narrative — notable given peer articulation. And international remains underpenetrated at approximately 20% of net sales versus 70%+ for legacy beauty peers, which is either a significant risk or the most visible growth runway in the portfolio, depending on how Rhode's international momentum translates.

Celsius Holdings: Platform Maturity in Real Time

Celsius closed the day with a story of rapid platform evolution. From a single brand to a three-brand energy platform — Celsius Live Fit (10.6% energy share), Alani Nu (7.2%), and Rockstar (2.2%) — representing approximately 20% combined market share, the company has executed a distribution and portfolio transformation in compressed time. Retail sales grew 22.4% in 2025; Alani Nu shelf space grew 102% in 2026 allocations.

The consumer insights depth is noteworthy. Celsius has granular understanding of gender-differentiated consumption patterns (male consumption is impulse-driven and later in the day; female is routine-driven and earlier), and the data that Hispanic consumers rank #1 in trip growth at +10.6% signals meaningful multicultural opportunity. The formal RGM capability being built out — covering pricing architecture, pack and mix optimization, promotion effectiveness, and ROI tracking — is the maturation signal of a company transitioning from hyper-growth to disciplined execution.

AI is absent from this presentation as well, but for a company at Celsius's stage of development, the near-term priority is clearly distribution consistency and RGM foundation-building. That said, as PepsiCo's Energy Captain, the expectation should be that advanced analytics capabilities follow quickly.

| Company | Score (Out of 10) |

|---|---|

| Procter & Gamble | 8.0 |

| Kimberly-Clark | 7.9 |

| Reckitt | 7.7 |

| Clorox | 7.3 |

| e.l.f. Beauty | 6.0 |

| Kraft Heinz | 5.1 |

| Celsius Holdings | 5.1 |

Portfolio Stability & Innovation • AI Acknowledgement • Omnichannel Understanding • PPA/RGM • Consumer Insights Depth • Organic Volume Growth • M&A

Submit Your Press Release

Have news to share? Send us your press releases and announcements.

Send Press Release