Retailers and suppliers accustomed to thinking of the United States or Western Europe as the epicenter of innovation should take a moment to consider China, a nation of more than a billion increasingly affluent people who are reshaping the way consumer products are bought and sold. A look at new developments in the dynamic Chinese market was provided by Coresight Research during a standing-room-only session at the National Retail Federation’s recent Big Show in New York City and in a subsequent report.

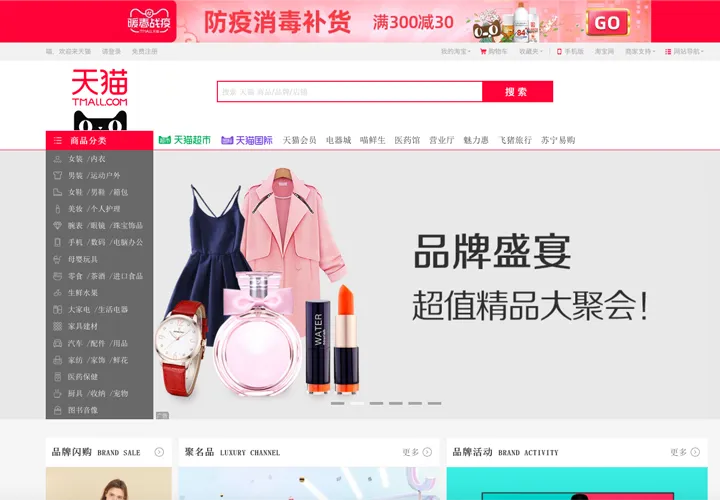

Titled “Retail Innovation at China Speed,” the session, moderated by Coresight founder and CEO Deborah Weinswig and featuring Christina Fontana, head of Tmall’s fashion and luxury division in Europe, and Erick Haskell, international president of Allbirds, focused on how Tmall, which is owned by Alibaba, and other online platforms help brands establish a presence in Asia and forge relationships with consumers there. Fontana, who works with European suppliers interested in establishing a solid foundation in China, and Haskell, whose environmentally conscious footwear company is in the midst of that journey, spoke about the innovative ways brands are harnessing the power and reach of e-commerce platforms to connect with shoppers.

Titled “Retail Innovation at China Speed,” the session, moderated by Coresight founder and CEO Deborah Weinswig and featuring Christina Fontana, head of Tmall’s fashion and luxury division in Europe, and Erick Haskell, international president of Allbirds, focused on how Tmall, which is owned by Alibaba, and other online platforms help brands establish a presence in Asia and forge relationships with consumers there. Fontana, who works with European suppliers interested in establishing a solid foundation in China, and Haskell, whose environmentally conscious footwear company is in the midst of that journey, spoke about the innovative ways brands are harnessing the power and reach of e-commerce platforms to connect with shoppers.

Two developments, which are also treated in the Coresight report “Retail 2020: 10 Trends for China E-Commerce,” exemplify a field burgeoning with novel approaches. Live-streaming by social media influencers, a group that includes a rising number of key opinion consumers, or KOCs, has become a powerful selling tool. According to data cited by Coresight, more than 100,000 brands appeared during live-stream events on Alibaba’s Taobao Live during last November’s Singles Day shopping event, which Fontana noted generated more sales than Back Friday and Cyber Monday combined. Over an eight-hour period, Viya, Taobao’s most popular live-streaming host, attracted more than 43 million buyers.

The numbers alone should be enough to command the attention of CPG suppliers, but companies are benefiting in other ways as well. The instant interconnectivity with shoppers has led to the emergence of a consumer-to-manufacturer, or C2M, model in China that is impacting the way products are developed and made. Haskell said C2M input influences decisions about Allbirds’ line, and enables the company to identify concerns specific to Chinese consumers.

Marketers in other parts of the world clearly have a lot to learn from what’s occurring in Asia. To remain relevant, retailers and suppliers everywhere will have to innovate at “China speed.”