CHICAGO — In a retail environment shaped by inflation, shifting generational power, and evolving ideas of value, private label brands are experiencing a renaissance, and Generation Z is leading the charge.

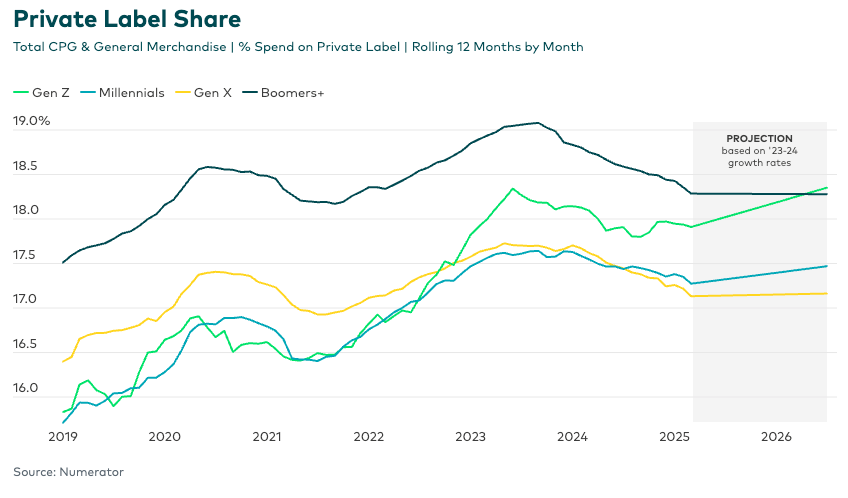

Once hesitant about store brands, Gen Z is poised to surpass Baby Boomers in private label spending by mid-2026, according to new insights from Numerator. The change is fueled by tightened budgets, shifting consumer expectations, and a broader redefinition of what private label means.

From Budget Necessity to Lifestyle Choice

While the pandemic helped normalize private label shopping, inflation cemented the habit, especially among younger, price-sensitive consumers. Gen Z and Millennials now represent the most budget-constrained demographics, with growing numbers in the lowest tier of purchasing power.

Store brands are no longer a fallback for these groups—they’re a first choice. Gen Z is driving the largest gains in private label adoption, challenging long-held assumptions about brand loyalty and opening doors for more values-driven engagement from retailers.

What Private Label Means Across Generations

Numerator’s data underscores that private label shopping isn’t monolithic. Gen X favors commuter lifestyle brands like Kwik Trip and Wawa. Boomers lean toward home improvement staples at Lowe’s and Harbor Freight. Meanwhile, Gen Z and Millennials gravitate toward aesthetically appealing, mission-driven, and identity-aligned store brands like Wild Fable, Ulta Beauty, and Kirkland Signature.

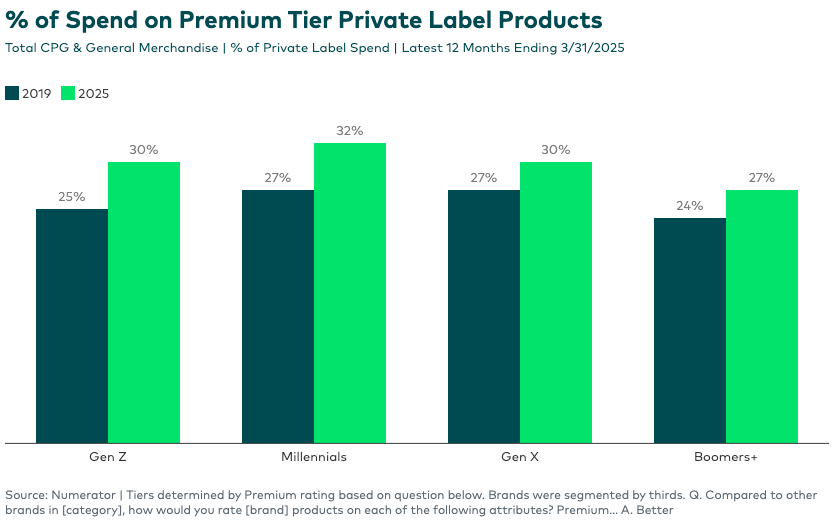

Notably, these younger generations are embracing premium private label, with spending in the category up five percentage points year-over-year.

Gen Z Is Rewriting the Rules

Compared to older shoppers, Gen Z is more likely to associate store brands with discovery, trendiness, transparency, and values. Social media is key in introducing new private label products, while design-forward packaging and sustainability claims drive preference.

Walmart’s bettergoods, for instance, exemplifies how store brands can blend aspirational aesthetics with accessible pricing—key attributes for younger shoppers navigating tight budgets without compromising on identity or values.

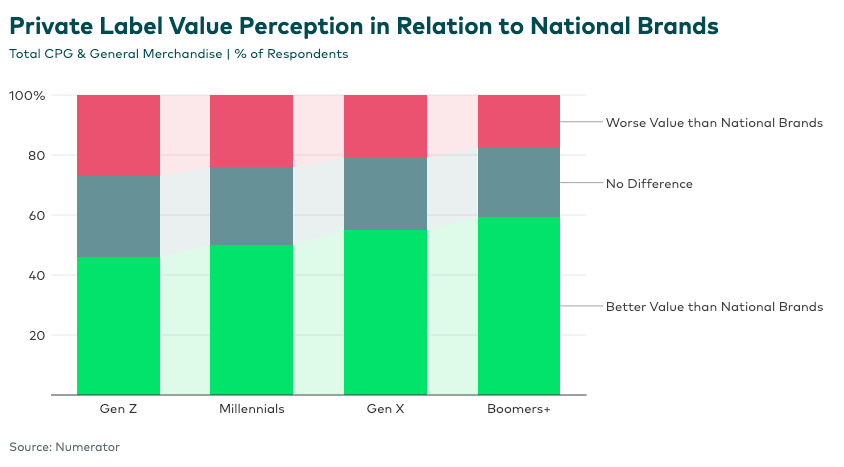

National Brands Face Growing Pressure

As private label gains steam, the gap between store and name brands has widened. Private label often wins on value and aligns better with Gen Z priorities. The U.S. still trails other markets in private label penetration, signaling untapped potential for retailers to further invest in their owned brands.

Still, national brands aren’t out of the game. As household income levels shift, so do loyalties—particularly if brands can adapt messaging to meet evolving perceptions of quality, identity, and innovation.

Strategic Takeaways

Numerator recommends two key actions for brands and retailers navigating this generational pivot:

Track Private Label Momentum by Life Stage and Category

Use survey and panel data to monitor how generational behaviors shift around key life events that influence purchasing power, such as becoming a parent or buying a

home. These insights can help identify white space for launching new private

label offerings or co-creating products with retail partners.

Use Sentiment Data to Identify Gaps

Even with rising private label usage, satisfaction is not uniform. By mapping where

expectations specific to your categories around innovation, transparency, or

sustainability fall short through survey, brands can adjust packaging,

messaging, and retail experience to better resonate with younger shoppers.

With Gen Z reshaping private label from a bargain alternative into a brand of choice, the stakes are clear: adapt to their evolving expectations—or risk falling behind.

For more insights, visit Numerator.com