U.S. online grocery sales surged in November, highlighting a fundamental shift in how high-value households purchase food. New data from Brick Meets Click and Mercatus reveals that online grocery is no longer mainly a supplemental channel. For many shoppers, it is becoming the preferred method of shopping.

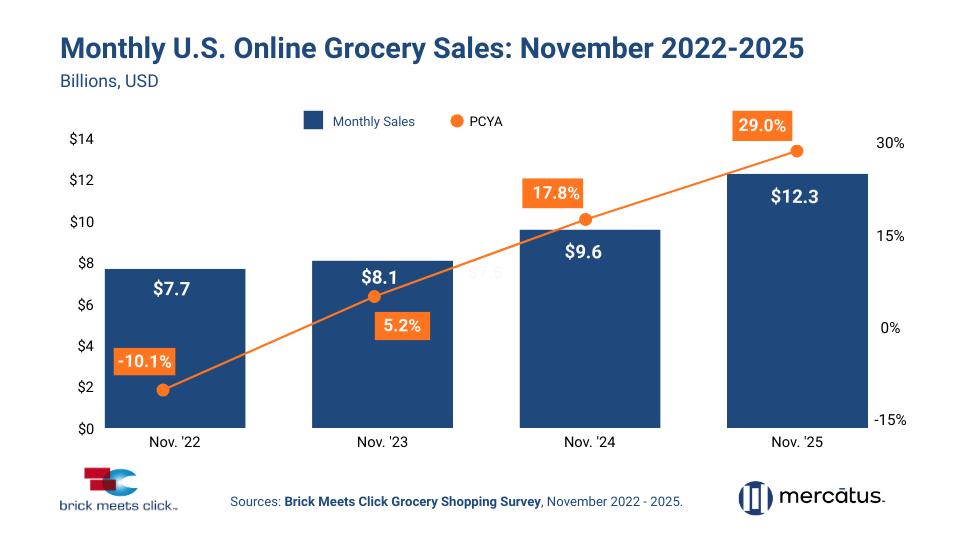

Total U.S. online grocery sales increased by 29% year over year in November 2025 to $12.3 billion. The robust performance followed a slower October impacted by the government shutdown and continued a multi-year trend of growing November results. Online grocery sales have shown stronger year-over-year growth each November since 2022.

While topline growth stays important, Brick Meets Click highlighted that November’s results were driven more by shifts in shopping behavior among existing users than by new customer acquisition.

Higher Shopping Frequency Drives Growth

The November sales increase was fueled by rising order frequency among monthly active users.

Order frequency rose 12% year over year to an average of 2.8 orders per month, marking the 15th consecutive month of year-over-year growth. Nearly half of all monthly active online grocery shoppers placed three or more orders during the month, setting a new record for high-frequency usage.

The 30–44 age group continued to drive performance. This key online grocery demographic increased their order frequency by more than 20% year over year, averaging 3.1 orders per shopper in November.

Online Share of Grocery Spend Expands

Online grocery’s share of total weekly grocery spending increased by 340 basis points year over year to 17.1% in November. Growth was focused on higher-income households making $100,000 or more annually, shoppers aged 30–44, and households in large metropolitan areas.

Average order value rose 11% year over year, though results varied by retailer type and fulfillment method. Mass merchants outperformed supermarkets when delivery and pickup orders were combined, reflecting ongoing competitive pressure across the channel.

Ship-to-home experienced the highest average order value growth at 12%, partly due to Amazon’s expansion of same-day fresh grocery services. Pickup remained a consistent fulfillment option with an 11% increase in AOV, while delivery saw an 8% year-over-year rise.

Shoppers Expand Fulfillment Choices

Online grocery shoppers are increasingly using multiple fulfillment options rather than committing to a single method.

In November, the percentage of monthly active users relying on only one receiving method dropped to historic lows. Meanwhile, the percentage of shoppers using a mix of delivery, pickup, and ship-to-home increased significantly.

As a result, individual fulfillment methods saw double-digit growth in monthly active users, even though the overall user base grew only in the mid-single digits for the month. Brick Meets Click said the trend indicates deeper engagement, not fragmentation, as shoppers customize fulfillment options to different shopping missions.

Looking Ahead

“Online grocery is evolving from just a convenient option to the preferred way to get groceries for many,” said David Bishop, partner at Brick Meets Click.

As retailers look toward 2026, the data indicates that success in online grocery will rely on more than just availability. Retailers that can offer strong value, consistent service, and loyalty-focused omnichannel experiences will be better equipped to maintain market share against mass merchants and platform-driven competitors.

For retail leaders, the message is becoming increasingly clear: online grocery is no longer just a secondary channel. It is becoming core to how the industry’s most valuable shoppers interact with food retail.