CHICAGO — Hispanic households, long a key driver of growth for U.S. consumer brands, are tightening their budgets, signaling a sharp shift in spending behavior. Once the fastest-growing non-White ethnic group in consumer spending, Hispanics accounted for 15% of all U.S. household spending in 2025, up from 13.6% in 2020. However, per-household spending growth has slowed dramatically, from 3.2% in 2024 to just 0.8% this year, falling below that of White households for the first time since 2021, according to new Numerator data.

Population gains now make up 72% of Hispanic spending growth, compared to just 23% in 2024—an indication that individual household purchasing power is slipping. Unacculturated Hispanic households saw the steepest decline, with a 4.8% drop in per-household spending year-over-year.

Hispanic consumers are shifting away from mass retailers and department stores toward club and grocery formats such as Costco, Sam’s Club, Wakefern, and Publix. Subscription shopping services are also under pressure, with Hispanics 80% more likely than other groups to cancel memberships like Walmart+ or Amazon Prime.

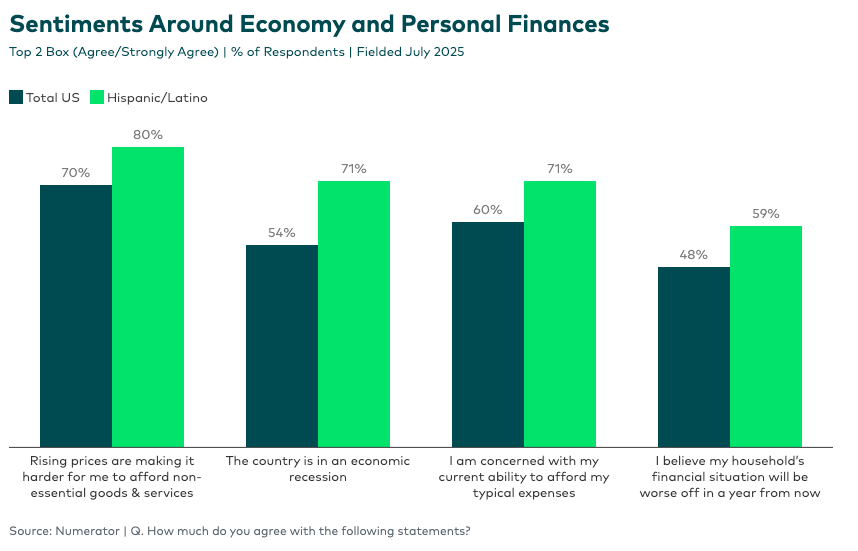

Economic anxiety is rising. Seventy-one percent of Hispanic households believe the economy is already in recession, and four in five say discretionary purchases are becoming harder to afford. Price sensitivity is at record highs, and potential cutbacks loom in big-ticket categories such as vehicles, homes, and luxury goods.

How Brands and Retailers Can Connect with Hispanics

Hispanic consumers are openly voicing their financial concerns and values, rendering previous playbooks for engaging this segment outdated. To sustain growth, brands must act now. Numerator sees four key pathways for growing with Hispanic consumers:

- Tailor Strategies on Cost-Consciousness: Focus pricing and promotions on cost-sensitive Hispanic households in high-density markets. Target CBSA clusters in Texas, Florida, and California where over 40% of households identify as Hispanic.

- Focus on Self-Care: Align messaging and brand initiatives with the mental health priorities prominent within Hispanic communities. Numerator’s premium people health profile indicates that 1 in 4 Hispanics is concerned about managing anxiety, and 34% about stress. Showcasing how your products address everyday problems to enhance brand relevance.

- Leverage Emerging Channels: Engage with rising platforms like TikTok Shop and value-forward retailers like Costco to meet Hispanic consumers where they’re shopping and experimenting. Adapt your digital strategy to align with fast-evolving shopper behaviors.

- Stay Close to Your Hispanic Consumer: Develop an insights scorecard to monitor Hispanic spending trends by acculturation, informing your channel, brand, and category strategies. Conduct surveys among verified Hispanic purchasers of your brand to assess economic concerns relative to the broader US population.