CINCINNATTI—Kroger Co. today announced solid first quarter results for fiscal 2025, driven by gains in pharmacy, e-commerce and fresh categories. The grocery giant also raised its full-year guidance for identical sales without fuel to a range of 2.25% to 3.25%, up from prior estimates.

“Kroger delivered solid first quarter results, with strong sales led by pharmacy, eCommerce and fresh. We made good progress in streamlining our priorities, enhancing customer focus, and running great stores to improve the shopping experience,” said Chairman and CEO Ron Sargent.

“Our commitment to driving growth in our core business and moving with speed positions us well for the future. We are confident in our ability to build on our momentum, deliver value for customers, invest in associates and generate attractive returns for shareholders,” he added.

Key first-quarter highlights include:

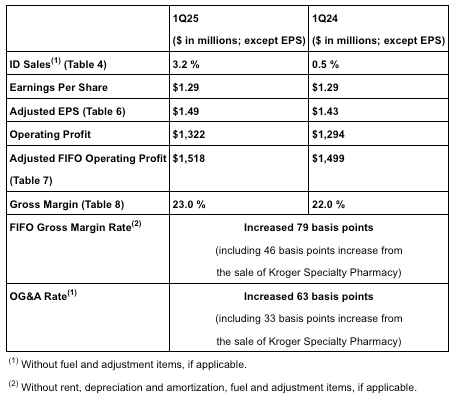

- Identical sales without fuel rose 3.2% year-over-year.*

- eCommerce sales surged 15%.

- Operating profit totaled $1.32 billion, with adjusted EPS of $1.49, up from $1.43 a year ago.

- Adjusted FIFO operating profit reached $1.52 billion.

- Gross margin improved to 23.0%, boosted by the sale of Kroger Specialty Pharmacy, lower shrink and supply chain costs.

Total revenue for the quarter was $45.1 billion, compared to $45.3 billion in Q1 2024, which included $917 million in sales from Kroger Specialty Pharmacy.

Chairman and CEO Ron Sargent credited the results to the company's renewed customer focus and operational efficiency.

Kroger also announced a $100 million impairment charge related to the planned closure of around 60 stores over the next 18 months, a move expected to yield modest financial benefits. The company committed to offering affected employees roles at other store locations.

Capital Strategy and Shareholder Returns

Kroger reiterated plans to invest in business growth and shareholder value. The company is progressing through a $5 billion accelerated share repurchase program as part of a larger $7.5 billion authorization, with plans to resume open market repurchases later in the year.

Full-Year 2025 Guidance**

Updated

- Identical Sales without fuel of 2.25% – 3.25%

Reaffirmed

- Adjusted FIFO Operating Profit of $4.7 – $4.9 billion

- Adjusted net earnings per diluted share of $4.60 – $4.80

- Adjusted Free Cash Flow of $2.8 – $3.0 billion***

- Capital expenditures of $3.6 – $3.8 billion

- Adjusted effective tax rate of 23%****

Chief Financial Officer David Kennerley added:

“Our strong sales results and positive momentum give us confidence to raise our identical sales without fuel guidance, to a new range of 2.25% to 3.25%. While first quarter sales and profitability exceeded our expectations, the macroeconomic environment remains uncertain and as a result other elements of our guidance remain unchanged. We continue to believe that our strategy focusing on fresh, Our Brands and eCommerce will continue to resonate with customers and our resilient model positions us well to navigate the current environment.”

* Excludes adjustment items

** Without adjusted items, if applicable. Kroger is unable to provide a full reconciliation of the GAAP and non-GAAP measures used in 2025 guidance without unreasonable effort because it is not possible to predict certain of our adjustment items with a reasonable degree of certainty. This information is dependent upon future events and may be outside of our control and its unavailability could have a significant impact on 2025 GAAP financial results.

*** Adjusted free cash flow excludes planned payments related to the restructuring of multi-employer pension plans, payments related to opioid settlements and merger litigation costs.

**** The adjusted tax rate reflects typical tax adjustments and does not reflect changes to the rate from the completion of income tax audit examinations and changes in tax laws and policies, which cannot be predicted.