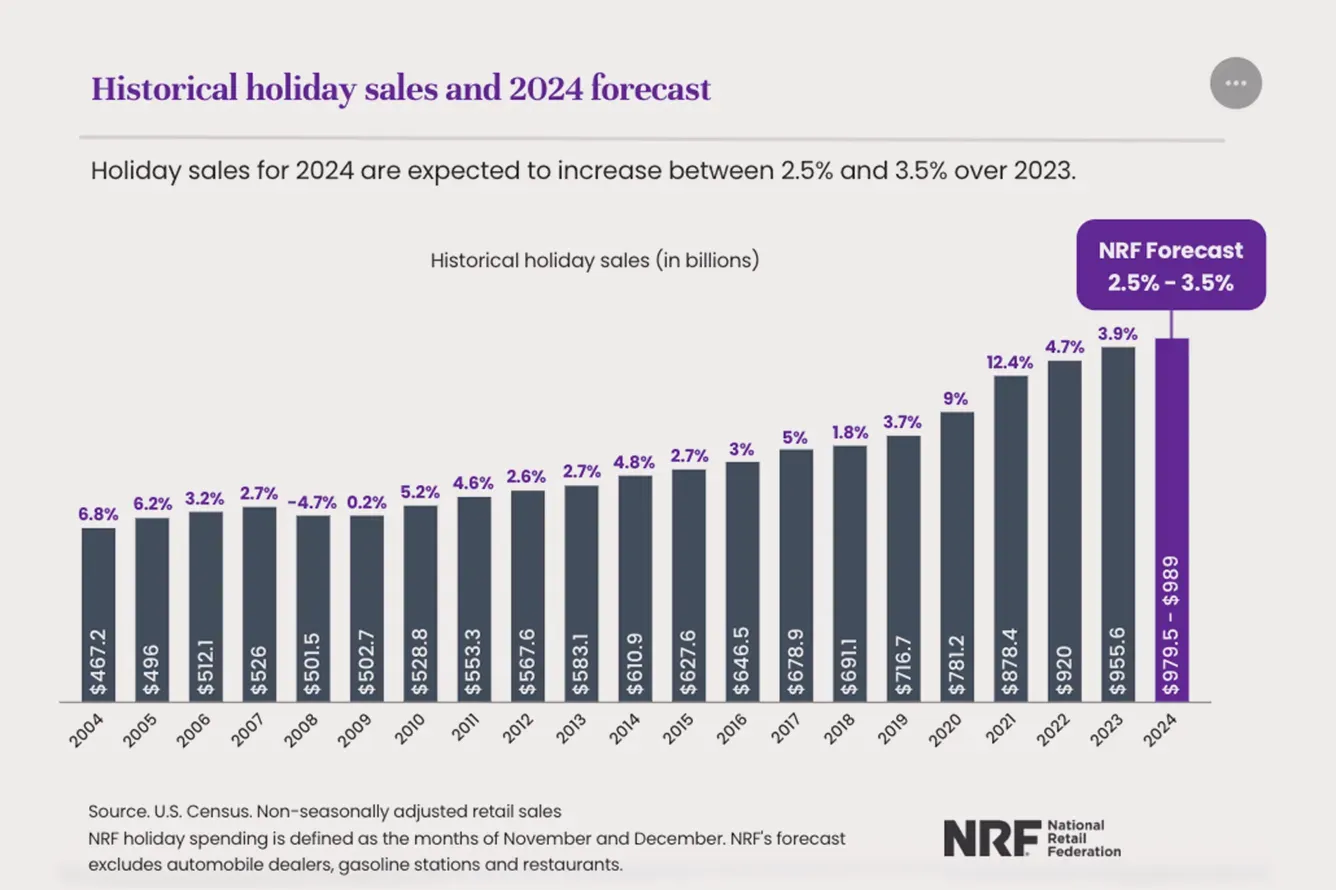

WASHINGTON – The National Retail Federation (NRF) is forecasting strong holiday sales growth this winter, with spending expected to rise between 2.5% and 3.5% over 2023 levels. This equates to a total holiday expenditure between $979.5 billion and $989 billion for November and December, up from $955.6 billion during the same period last year. Retailers are optimistic as they prepare for a busy season, with online shopping projected to play a significant role in driving sales growth.

"The economy remains fundamentally healthy and continues to maintain its momentum heading into the final months of the year," said NRF President and CEO Matthew Shay. "The winter holidays are an important tradition for American families, and their capacity to spend will continue to be supported by a strong job market and wage growth."

Online shopping is expected to be the primary driver of holiday sales growth this year. The NRF predicts that online and other non-store sales will increase by 8% to 9%, totaling between $295.1 billion and $297.9 billion, a notable rise from last year’s $273.3 billion. Though this year’s projected growth is slightly lower than last year’s 10.7% increase in non-store sales, the continued expansion of e-commerce shows how consumer preferences have shifted toward online shopping.

“Household finances are in good shape and are providing a foundation for strong spending heading into the holiday season, though households will spend more cautiously,” said NRF Chief Economist Jack Kleinhenz.

While economic conditions remain favorable, Kleinhenz also noted that consumers may approach spending with more caution due to factors such as inflation and rising interest rates. Still, the robust employment landscape and wage growth are expected to underpin holiday spending this year, keeping the outlook optimistic.

One key difference in the 2024 holiday season compared to last year is the shortened shopping period between Thanksgiving and Christmas. This year, there are only 26 days between these two holidays—five fewer than in 2023. Despite the compressed timeframe, retailers remain confident that consumer demand will stay strong.

In response to expected holiday traffic, retailers are also gearing up to hire additional staff, though at slightly lower levels than last year. The NRF expects between 400,000 and 500,000 seasonal hires, compared to 509,000 in 2023. Some of this hiring has already begun, with retailers pulling in workers earlier to support holiday shopping events in October.

“The shorter shopping period might push consumers to start earlier, as we’ve seen in recent years with Black Friday sales kicking off well before Thanksgiving,” said Kleinhenz. Retailers, in turn, are preparing for a compressed but intense shopping season.

While the overall economic outlook is positive, external factors could influence consumer behavior this holiday season. The economic impacts of Hurricanes Helene and Milton could dampen spending in certain regions. Additionally, the 2024 U.S. presidential election falls within the holiday season, though its impact on retail spending remains difficult to predict.

"While the election might add an element of uncertainty, it's nearly impossible to gauge its precise effect on consumer behavior during the holidays," Shay added. "The focus remains on the core drivers of retail, including job stability, wage growth, and inflation management."

Despite these potential challenges, the NRF remains confident that consumer resilience and the fundamental strength of the economy will support robust holiday sales growth.

The NRF’s holiday forecast is grounded in rigorous economic modeling, analyzing various key indicators such as disposable personal income, employment, wages, inflation, and previous retail sales data. The forecast does not include sales from automobile dealers, gas stations, or restaurants, instead focusing on core retail categories such as clothing, electronics, and home goods. The holiday season, as defined by the NRF, runs from Nov. 1 through Dec. 31.

Overall, the retail industry is heading into the holiday season with high expectations, supported by a strong labor market and a growing reliance on e-commerce. While consumers may spend more cautiously due to economic uncertainty, the NRF remains optimistic that the season will be a success for retailers and shoppers alike.

As retailers gear up for the rush, businesses across the country are preparing to meet consumer demand, ensuring they are well-staffed and fully stocked to take advantage of what is expected to be a significant holiday sales season.