CHICAGO — Emerging brands seeking to secure and maintain shelf space must arrive at retailer meetings armed with hard numbers, not just a compelling story. That was the central message of Numerator’s recent webinar, Winning the Shelf: Data-Driven Sell-In Strategies for Emerging Brands, which highlighted how behavioral insights can drive incremental growth and reduce leakage for retail partners, using examples such as Garage Beer, Legendary Foods, and Cameron’s Coffee.

The session outlined a repeatable playbook for sell-in, assortment expansion, and defending distribution: quantify the market opportunity, prove shopper value, show incrementality, and directly connect the pitch to a retailer’s performance gaps.

For emerging brands looking to get into new retailers, Numerator highlighted Garage Beer as an example of how to match brand momentum with a retailer’s challenges. Before approaching Target, Garage Beer can recognize that Target’s premium beer category is decreasing in households and projected sales, while Garage Beer is quickly expanding nationwide. With projected household growth of nearly 390 percent year over year and buy rates on the rise, the brand can show a rapid wave of new buyers entering the category.

Numerator data also shows that Garage Beer’s shoppers tend to be younger, have higher incomes, and are already active Target shoppers. Additionally, the Numerator Verified Voices survey indicates they are motivated by discovery and report high satisfaction with the brand. With limited overlap between Garage Beer buyers and the existing Target beer selection, the brand can argue that it would attract new households to the category rather than cannibalize current sales.

At the same time, the brand can directly measure leakage and growth potential: 33 percent of Target shoppers buy premium beer elsewhere, but only 4 percent do so at Target. One additional dollar of premium beer sales is worth more than 24 million dollars to the retailer, while Target shoppers spent 53 million dollars on Garage Beer outside of Target last year. Capturing just 10 percent of that spend would represent a significant gain without acquiring new shoppers.

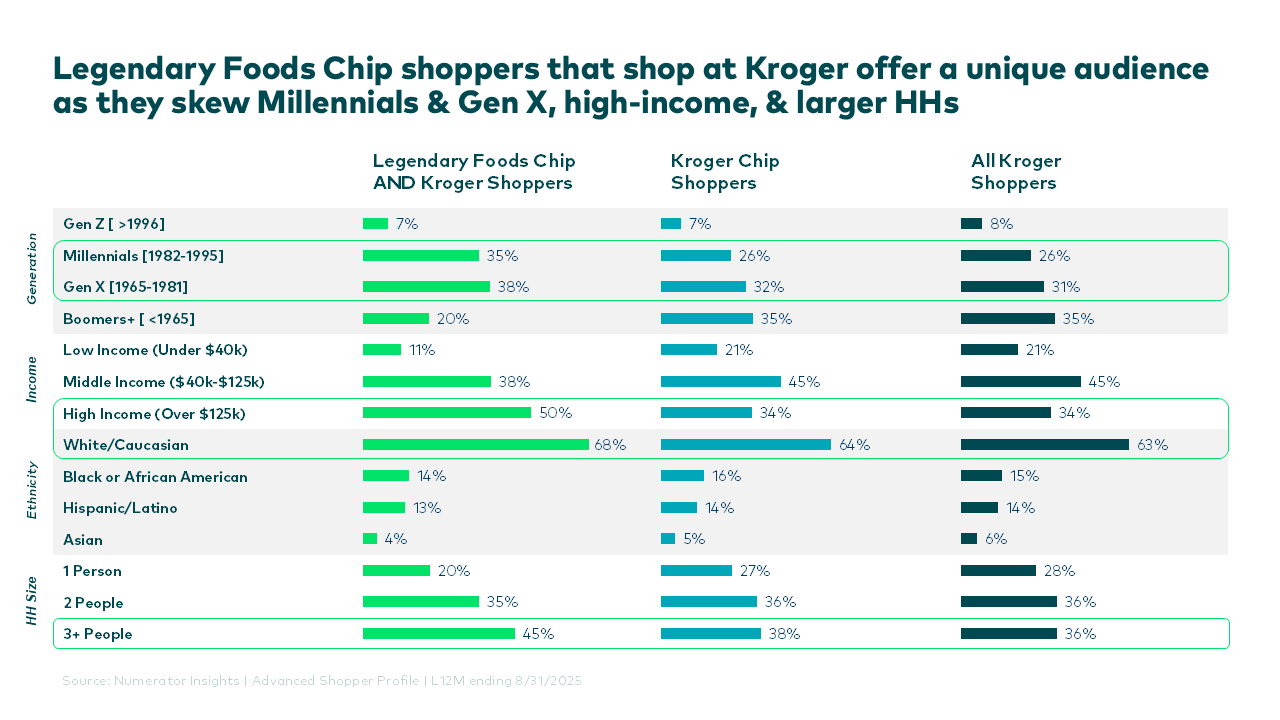

For brands aiming to grow their presence within an existing retailer, Numerator highlighted Legendary Foods at Kroger. Over half of Legendary Foods shoppers already visit Kroger, yet only 8 percent purchase the brand there. In the past year, Kroger shoppers spent nearly $94 million on Legendary Foods, but only $4.5 million in Kroger stores. Closing even one percentage point of that gap could generate roughly $300,000 in additional sales for Kroger.

Legendary Foods also shows how to demonstrate category growth. Its Chips line appeals to a mostly separate audience, with only 7.7 percent of shoppers purchasing both Chips and Toaster Pastries. The Chips segment is expanding, with 274,000 more households buying only Chips year over year and a 7% increase in buy rate. These customers buy the category more frequently, spend more per visit, and make larger baskets.

Data from Numerator indicates that this exclusive Chips segment now includes 729,000 households and $11.1 million in forecasted sales, which currently go to competitors outside Kroger. Capturing just 10 percent of that spend could add about $1.1 million to Kroger’s revenue.

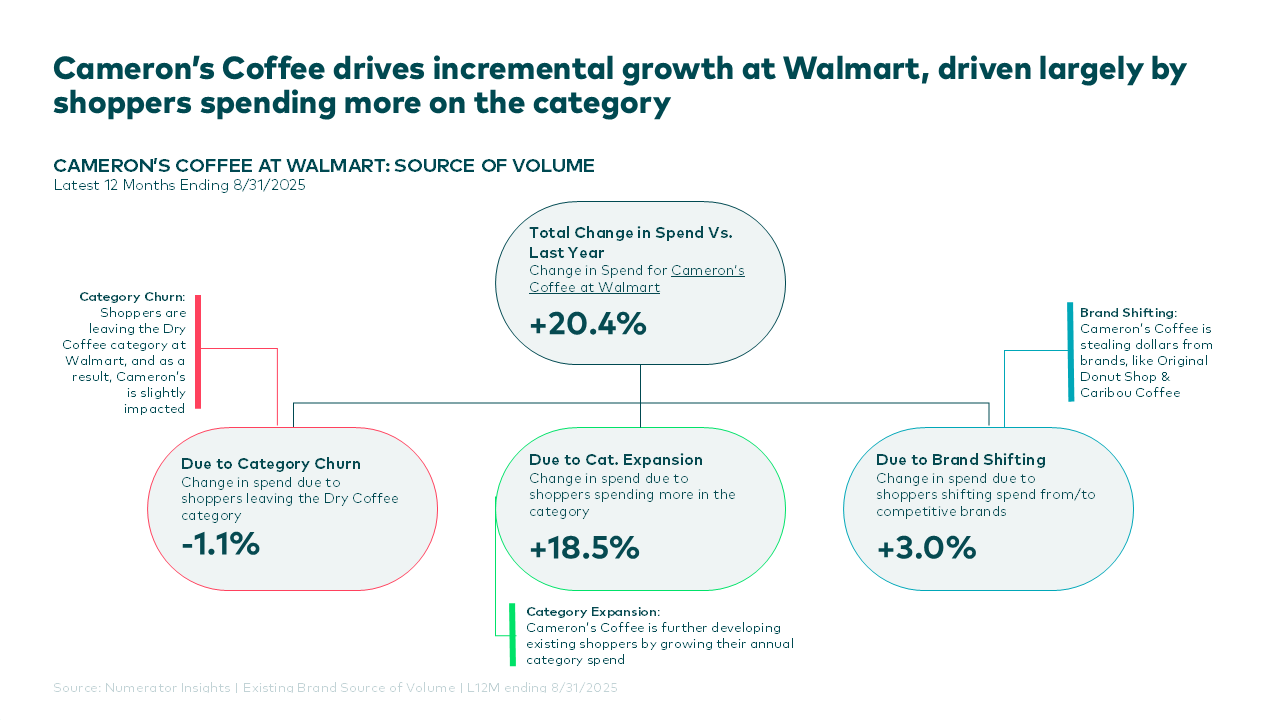

When it comes to protecting existing distribution, Cameron’s Coffee at Walmart shows how behavioral data can demonstrate ongoing value. Cameron’s increased sales by 9 percent at Walmart through higher purchase frequency, more shoppers, and more trips, while Walmart’s overall dry coffee category also grew, indicating that the brand helped expand the aisle rather than just shift share.

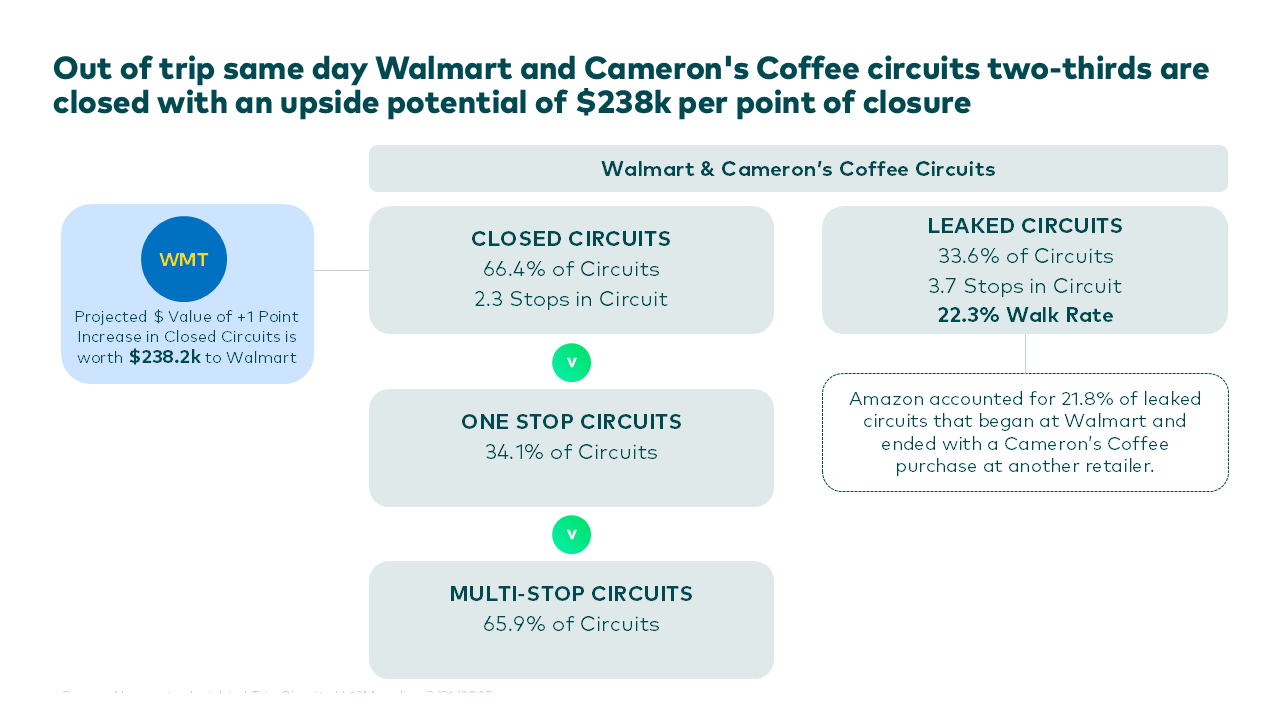

Walmart already wins about two-thirds of shopping circuits that include a Cameron’s purchase, but analysis shows that gaining just one more point in those circuits would be worth $238,000. Circuit and trip data also reveal that 22 percent of these circuits involve shoppers visiting Walmart before ultimately buying Cameron’s elsewhere, highlighting missed conversion opportunities.

Cameron’s shopper profile further bolsters the defense story. The brand dominates among Millennial families with middle- to high-income households, and its buyers take 1.7 times more trips, spend 1.8 times more annually, and build larger baskets in Walmart’s dry coffee aisle than average shoppers. Loyal households that buy Cameron’s two or more times are even more engaged with the category across all key metrics, reinforcing the long-term value of keeping the brand on the shelf.

Across all three examples, Numerator emphasized that retailers prioritize brands that boost the category and overall store, not those that merely compete within the current market. Emerging brands that use behavioral data to quantify additional shoppers, trips, and dollars, identify high-value shopper segments, and directly target a retailer’s leakage and growth gaps are best positioned to succeed.

Brands looking to develop similar data-driven pitches, expand their assortment, or secure shelf space can contact Numerator at hello@numerator.com or their Numerator account representative.