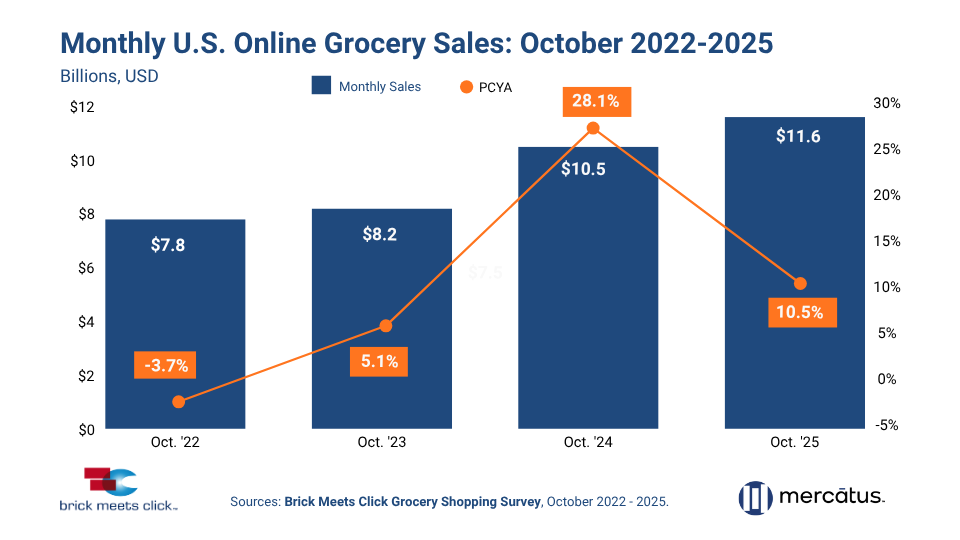

BARRINGTON, Ill. — The U.S. online grocery market continued its steady growth in October, with total eGrocery sales reaching $11.6 billion, a 10.5% increase compared to the same month last year, according to the latest Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus. The report highlights expanding user participation, emerging regional differences, and rising demand for low-cost fulfillment options as key factors behind the month’s performance.

User Base Expansion Fuels Growth

The rise in monthly active users (MAUs) remains the main driver of e-grocery growth. The MAU count increased nearly 13% year over year to a record 83.3 million households, driven by reactivated infrequent shoppers and new customers trying online grocery shopping for the first time. All three fulfillment options—Delivery, Pickup, and Ship-to-Home—saw gains, with Pickup MAUs reaching a new high.

Shifting Shopping Behaviors Highlight Regional and Demographic Gaps

Although more households are using online grocery services, their shopping behaviors vary significantly across different markets and age groups.

Order frequency growth stayed below 1% overall, held back by declines in large metro areas. Medium and small metro markets, along with rural regions, saw frequency increases between 7% and 15%. Among age groups, only shoppers age 60 and older increased their ordering activity, while younger groups ordered less. Average order values dropped nearly 3% for Delivery and Pickup, with Mass retailers experiencing the biggest declines.

Ship-to-Home Gains Momentum as a Low-Cost Alternative

Ship-to-Home continues to surpass the broader market in several metrics. Average order value increased by about 5% year over year, driven by higher spending at mass retailers and Amazon’s pure-play operations, including its same-day fresh grocery service. The segment now makes up more than 20% of all U.S. online grocery sales.

David Bishop, partner at Brick Meets Click, said the findings reinforce that online grocery growth “is not on autopilot.” The renewed strength of Amazon’s same-day offerings, he added, reflects customers gravitating toward value-oriented and convenient options.

Online Share of Wallet Climbs

Although the frequency and order size declined, online grocery stores still gained a larger share of consumer spending. Digital channels accounted for 16.3% of weekly grocery spending in October, up 110 basis points from a year earlier. Medium metro markets and younger households were the main drivers of this growth.

About the Research

The Brick Meets Click Grocery Shopping Survey is an ongoing independent research project sponsored by Mercatus. The most recent survey, conducted from October 29 to 31, 2025, surveyed 1,485 adults involved in household grocery shopping. Results were weighted to reflect the national population and adjusted for internet use to reduce non-response bias. Fulfillment options include Delivery by first- or third-party services, Pickup at stores or designated locations, and Ship-to-Home via carriers like FedEx or USPS.