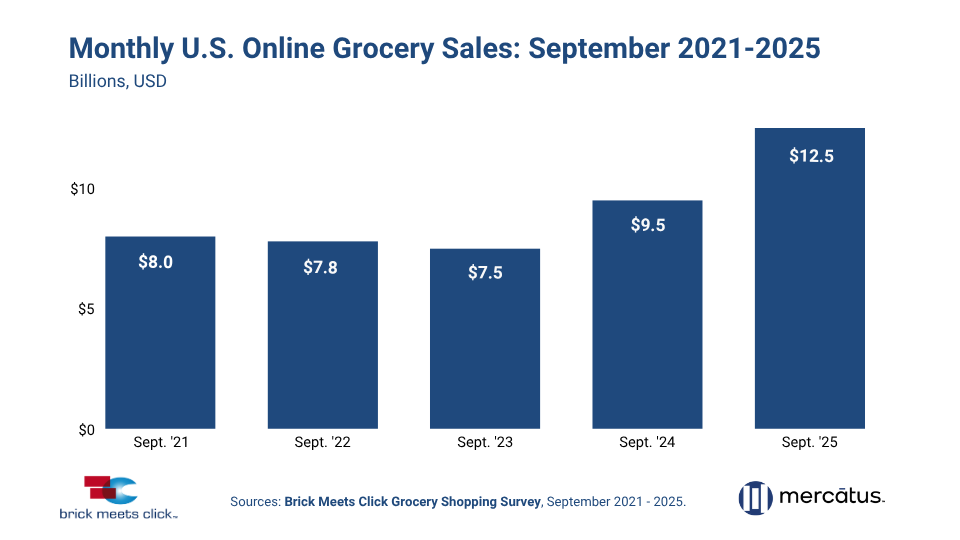

BARRINGTON, Ill. — U.S. online grocery sales reached a record $12.5 billion in September 2025, a 31% increase year over year, according to the latest Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus. This is the second consecutive month of record highs and highlights how strongly consumers are adopting digital grocery channels.

Online grocery spending made up nearly 19% of total weekly grocery expenditure, the second-highest share ever recorded—trailing only the early-pandemic surge of May 2020.

Expanding Shopper Base

The number of monthly active online grocery shoppers (MAUs) increased by 13% year over year, driven mainly by returning customers who had not ordered in several months. Delivery, Pickup, and Ship-to-Home all gained users, with Delivery reaching a new high. Notably, the 60+ age group accounted for nearly half of the overall MAU increase.

Rising Order Frequency

Shoppers placed online orders more frequently, with the rate increasing by 9% from September 2024—marking 13 consecutive months of year-over-year growth. Small Metro markets experienced the strongest gains, growing at nearly twice the rate of other regions.

Higher Spending Per Order

Average order value (AOV) also increased significantly: Delivery and Pickup combined grew by 8%, while Ship-to-Home jumped 11%, mainly driven by Amazon’s expanding same-day fresh grocery offerings. Hard Discounters and Club stores experienced particularly strong spending growth per order.

Pressure on Regional Grocers

While digital grocery shopping thrives, in-store sales are slowing—rising less than 1.5% year to date compared to 3.0% a year ago. Cross-shopping between Grocery and Mass retailers continues to grow, especially with Walmart, whose share of e-grocery orders has increased significantly. Target’s cross-shopping rate also went up but remains below Walmart’s level.

The September findings highlight a crucial shift in grocery spending toward digital platforms. For CPG brands and retailers, the trend emphasizes the need to optimize online experience and fulfillment options. For regional grocers, it sends an urgent message to defend against increasing competition from national mass players.

The Brick Meets Click Grocery Shopping Survey was conducted September 28–30, 2025, among 1,493 U.S. adults involved in household grocery shopping. The study is weighted to reflect national demographics and adjusted for internet usage.