WASHINGTON – The U.S. economy added 228,000 jobs in March, significantly surpassing economists’ expectations of 140,000 and marking a sharp increase from February’s revised total of 117,000. The latest jobs report from the Bureau of Labor Statistics highlights continued labor market resilience despite growing economic uncertainty surrounding President Donald Trump’s sweeping trade policies and federal workforce cuts. The unemployment rate increased slightly to 4.2% from 4.1% in February.

Key sectors contributing to the job gains included health care, social assistance, transportation, and retail. “Retail trade added 24,000 jobs in March, as workers returning from a strike contributed to a job gain in food and beverage retailers (+21,000). General merchandise retailers lost 5,000 jobs. Employment in retail trade changed little over the year,” the report states.

Health care alone added nearly 54,000 jobs, while restaurants and bars saw an increase of about 30,000 positions. However, federal employment continued to decline, with 4,000 jobs lost in March following an 11,000-job reduction in February. This decline reflects the impact of significant workforce reductions ordered by the Trump administration.

Despite the strong employment numbers, investors remained wary. Thursday’s stock market plunge, one of the worst since the COVID-19 pandemic, signaled deep concerns about the long-term effects of Trump’s new tariffs, which impose duties of up to 50% on certain imports. Financial markets continued to tumble Friday morning, with stock futures dropping further as analysts weighed the economic repercussions of escalating trade conflicts.

“This report isn’t likely to be seen as more important than the trade war,” said Kathy Jones, Chief Fixed Income Strategist at Charles Schwab. Goldman Sachs echoed similar sentiments, noting that while the labor market’s strength helps alleviate fears of an immediate downturn, investors are now more focused on the broader economic impacts of Trump’s aggressive tariff policies.

While job creation remained strong, signs of strain in the labor market emerged. The outplacement firm Challenger, Gray & Christmas reported that U.S.-based employers announced 275,240 job cuts in March, a staggering 60% increase from February and the third-highest monthly total on record. Major layoffs included:

- Cleveland-Cliffs: 1,200 job cuts in Michigan and Minnesota

- Whirlpool: 650 layoffs in Iowa

- Wolfspeed: 180 job cuts in North Carolina

- Milgard Manufacturing: 397 job losses in California

- SPS Technologies: 251 layoffs in Pennsylvania

These cuts, alongside the federal government’s workforce reductions, raise concerns about the sustainability of job growth in the coming months. Additionally, Trump’s plans for mass deportations of undocumented workers could exacerbate labor shortages in industries that rely heavily on immigrant labor, potentially driving up wages and inflation.

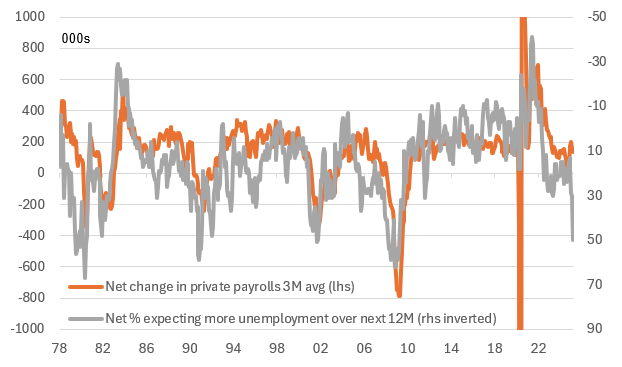

The job market has cooled from the robust post-pandemic hiring spree of 2021-2023, but it has remained resilient despite high interest rates and policy-driven turbulence. However, consumer confidence is slipping, with the University of Michigan’s consumer sentiment survey revealing that two-thirds of Americans expect unemployment to rise over the next year—the highest reading in 16 years.

“The market needed today’s number,” said Seema Shah, Chief Global Strategist, Principal Asset Management. “Everyone knows that economic weakness is coming, but at least we can be reassured that the labor market was robust coming into this policy-driven shock and therefore, the slowdown should not be overly steep.”

“Next month is when hard data is likely to start showing signs of what soft data has already been signalling,” Shah wrote in a note to clients Friday morning.

As the second quarter of 2025 begins, analysts are watching closely to see how Trump’s trade policies, federal workforce reductions, and broader global economic conditions will impact the U.S. labor market and economy in the months ahead.

“The U.S. economy is in good shape at the start of the second quarter, but the ongoing trade war has increased the risk of near-term recession dramatically,” Ershang Liang of PNC Economics wrote in a commentary Thursday.