NETHERLANDS – Retailers worldwide are accelerating efforts to modernize payment systems as they respond to evolving consumer expectations, competitive pressures, and operational efficiencies. According to the 2025 KPMG Modernizing Payments report, 83% of retailers are upgrading or planning to upgrade their payment infrastructure, despite more than half (56%) completing a major modernization program within the past year.

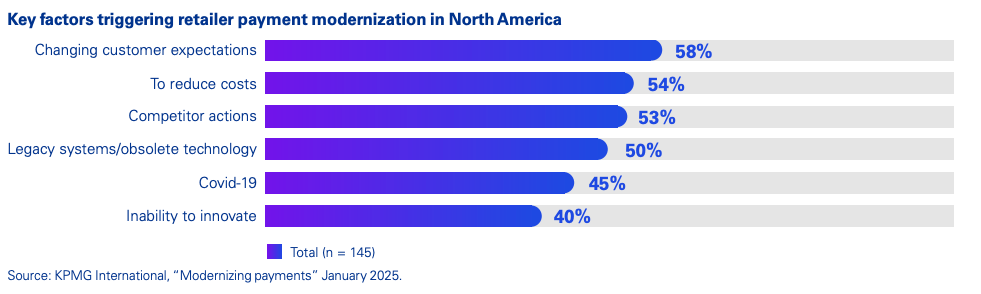

Retailers' motivations for upgrading payment systems vary across sectors:

- Customer expectations lead the way: 58% of retailers cite changing consumer expectations as the top trigger for modernization, followed by competitor actions and cost reductions at 54%.

- Legacy system limitations: Online retailers mainly focus on replacing outdated technology, while two-thirds of luxury retailers report an inability to innovate with existing systems as a significant challenge.

- The rise of digital payments: More than two-thirds of surveyed retailers already offer a digital wallet or plan to do so, and 60% have introduced or intend to launch digital apps.

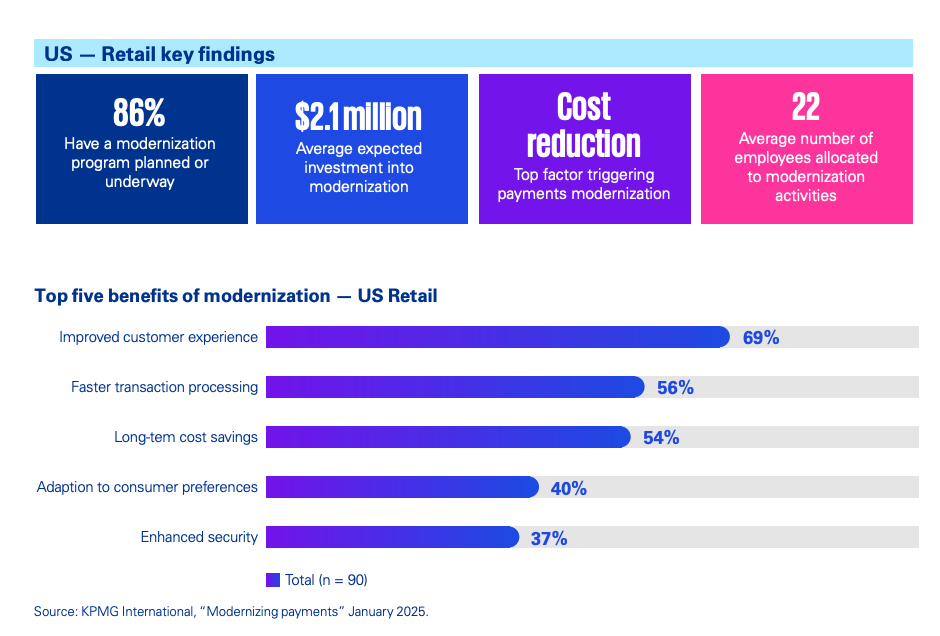

As digital payments become the norm, retailers are making significant investments to modernize their platforms:

- The top two priorities for payment modernization are digital payments implementation/upgrades (61%) and adding new payment methods (58%).

- Cost remains the biggest hurdle, with 64% of retailers citing it as their primary challenge. This is followed by staff training and transition management (56%) and concerns about infrastructure disruption (48%).

- North American retailers focus on enhancing transaction speed, while European retailers increasingly turn to Payment Service Providers (PSPs) instead of traditional banks.

The report says modernizing payments isn’t just about speed—it's about enhancing the overall shopping experience and leveraging data for more innovative engagement.

Efforts to reduce transaction friction aim to streamline the purchasing process and remove obstacles that could deter customers from completing sales. Retailers are integrating payments more closely with fulfillment systems, allowing personalized offers and seamless transactions across in-store and digital platforms.

“Implementing and integrating new payments platforms can be complex and time-consuming. Despite these challenges, executives recognize the benefits of payment modernization as a catalyst for growth and innovation,” said Courtney Trimble, Lead of Global Payments at KPMG International and Lead of Payment Capability Banking KPMG in the US.

Additionally, payment data is a key tool for building stronger customer profiles. Retailers increasingly integrate payment data with order history, fulfillment systems, and loyalty programs, creating a more complete view of customer behavior. This approach supports more targeted marketing, personalized product recommendations, and increased opportunities for repeat business.

Retailers must prioritize digital payment solutions as younger consumers continue to shift away from traditional payment methods. Mobile wallets, contactless payments, and app-based transactions are gaining popularity, influencing how businesses structure their payment offerings.

“Consumers, particularly younger generations, are increasingly opting for contactless payments, mobile wallets and other digital solutions over traditional cash and credit cards,” said Duleep C. Rodrigo, National Sector Leader, Consumer and Retail at KPMG in the US.

Three-fifths of retailers have already launched an app or plan to do so, reflecting the growing demand for seamless digital shopping experiences. While in-person shopping remains popular, younger consumers increasingly expect quick and efficient payment options, driving retailers to adopt modern digital solutions.

However, frictionless payments also have risks. While digital transactions improve speed and convenience, they introduce new security concerns. In particular, contactless payments and mobile wallet transactions require strong cybersecurity measures to protect consumer data and prevent unauthorized transactions.

Despite the benefits, upgrading payment systems remains costly and complex. Many retailers are investing heavily in new technology while managing system integration challenges, training staff, and ensuring smooth transitions across multiple sales channels.

With businesses operating across various platforms, connecting POS, payment, fulfillment, and supply chain systems is essential to maintaining a consistent customer experience. A well-integrated system helps retailers optimize operations, reduce costs, and improve overall efficiency.

With digital transactions becoming the preferred method for most consumers, retailers that fail to modernize risk falling behind. While costs and operational challenges remain, the long-term gains in efficiency, security, and customer loyalty make payment modernization a priority for the industry.

According to KPMG, as the shift toward digital payments continues, investments in real-time transaction capabilities, AI-powered personalization, and enhanced security will define the next era of retail innovation.