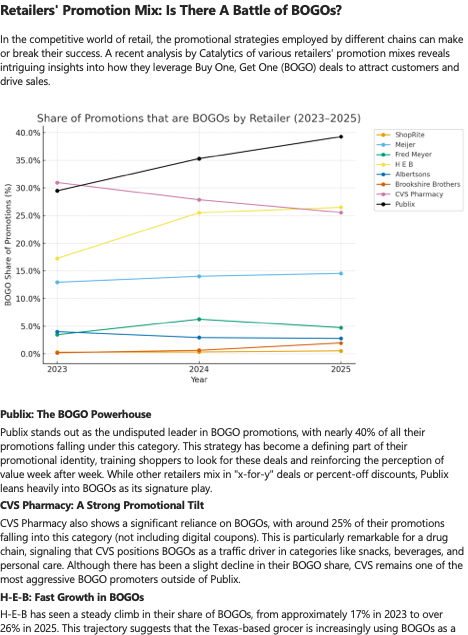

NEW YORK — In the competitive retail world, the promotional strategies employed by different chains can make or break their success. A recent analysis by Catalytics of various retailers’ promotion mixes reveals intriguing insights into how they leverage Buy One, Get One (BOGO) deals to attract customers and drive sales.

Publix: The BOGO Powerhouse

Publix stands out as the undisputed leader in BOGO promotions, with nearly 40% of all its promotions falling under this category. This strategy has become a defining part of their promotional identity, training shoppers to look for these deals and reinforcing the perception of value on a weekly basis. While other retailers mix in “x-for-y” deals or percent-off discounts, Publix leans heavily into BOGOs as its signature play.

CVS Pharmacy: A Strong Promotional Tilt

CVS Pharmacy also shows a significant reliance on BOGOs, with approximately 25% of its promotions falling into this category (excluding digital coupons). This is particularly remarkable for a drug chain, signaling that CVS positions BOGOs as a traffic driver in categories like snacks, beverages, and personal care. Although there has been a slight decline in their BOGO share, CVS remains one of the most aggressive BOGO promoters outside of Publix.

H-E-B: Fast Growth in BOGOs

H-E-B has seen a steady climb in its share of BOGOs, from approximately 17% in 2023 to over 26% in 2025. This trajectory suggests that the Texas-based grocer is increasingly using BOGOs as a competitive lever against both Walmart and regional players. If this momentum continues, H-E-B could rival CVS as the number two BOGO player nationally.

Meijer: Steady, Moderate BOGO User

Meijer maintains a consistent mid-teens share of BOGOs, ranging from 13% to 15% over the past three years. This balance reflects their strategy: BOGOs are important, but not overused. Instead, Meijer leans more on multi-buy (x-for-y) and price-off deals to round out their promotional mix.

Fred Meyer: Volatile Strategy

Fred Meyer's BOGO strategy appears to be more opportunistic than systematic, with their share of BOGOs fluctuating heavily. They peaked at 6% of promotions in 2024 before dropping back down in 2025. This volatility is likely tied to regional campaigns or vendor funding, making them less predictable in shopper expectations compared to Publix or H-E-B.

Albertsons: Declining BOGO Reliance

Albertsons exhibits the opposite trend to H-E-B, with its BOGO share declining from around 4% in 2023 to approximately 2.8% in 2025. This decline could indicate a shift toward different discount types or tighter margin management as they refocus after the merger discussions have subsided. For CPG manufacturers, it means fewer opportunities to secure BOGO slots with Albertsons compared to Publix or H-E-B.

ShopRite and Brookshire Brothers: Minimal Players

Both ShopRite and Brookshire Brothers have extremely low BOGO penetration, below 2%. These retailers rely instead on other discount structures, and BOGOs are not part of their brand identity. Shoppers do not associate these banners with buy-one-get-one deals in the way they do with Publix.

Key Takeaways

The competitive landscape of BOGO promotions is dominated by Publix, with CVS and H-E-B as strong challengers. Meijer uses BOGOs steadily but as part of a diversified toolkit, while Fred Meyer is inconsistent, and Albertsons is pulling back on BOGOs. ShopRite and Brookshire Brothers participate minimally in BOGOs, relying heavily on other tactics. This paints a competitive landscape where Publix sets the BOGO benchmark, but others, especially H-E-B, are actively moving toward that model.

As retailers continue to refine their promotional strategies, the battle of BOGOs will undoubtedly remain a key area of focus in the quest to attract and retain customers.

About Catalytics: Catalytics Data International is a leading Retailer Ad and Promotions tracking company. Thousands of global users access our data from top CPG firms and have been doing so for over 13 years. Retailer circulars, feature ads, promotions, and digital coupon data are collected in the USA, Canada, Australia, and New Zealand. Click here for more information.