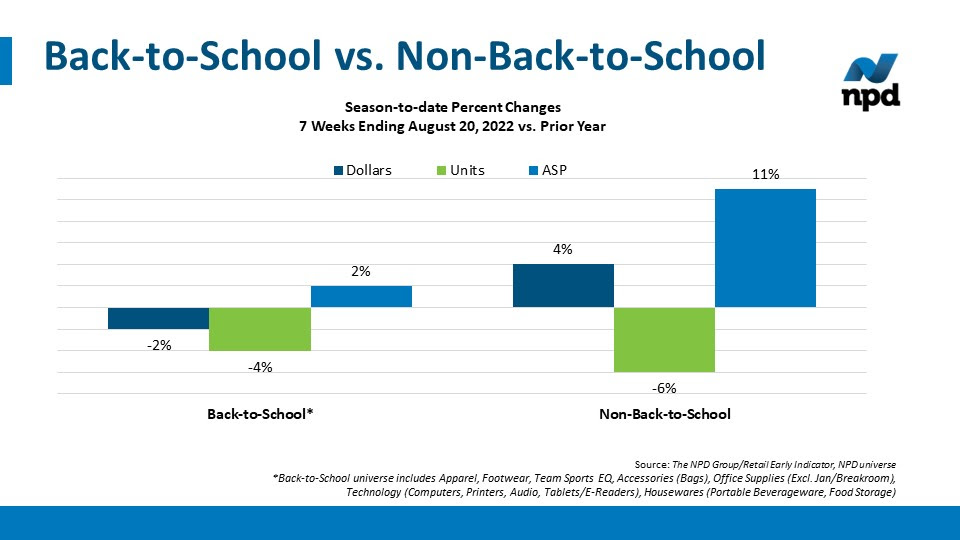

PORT WASHINGTON — Rising prices and consumers shopping for more immediate needs has disrupted early back-to-school shopping season performance. In the first seven weeks of the back-to-school shopping season, U.S. non-school-related general merchandise sales revenue grew 4%, while school spending fell short of last year’s results. In a recent survey, 41% of back-to-school shopping hold-outs are waiting for sales, according to The NPD Group, which recently merged with Information Resources, Inc. (IRI) to create a leading global technology, analytics and data provider.

“Consumers are balancing their return to school, work, and social activities, while retaining some pandemic-related behaviors, and prioritizing their purchases accordingly,” said Marshal Cohen, chief retail industry advisor for NPD. “Consumers have been more focused on travel and social activities this summer, pushing the 2022 back-to-school shopping peak later. This is another example of here-and-now shopping leading to shallower retail spending peaks, with sales realized over a longer stretch of time.”

Portable beverageware and coloring and art supply categories were among the fastest growing school-related categories in the early part of this season, demonstrating some attention being paid to school needs. However, the continued strong sales revenue growth in beauty and the automotive aftermarket further illustrate that the majority of the consumer’s spending remains focused on other activities.

“Consumers are still spending on summer fun, and the back-to-school focus has yet to kick into high gear – but it will,” Cohen said. “While retailers have clearly begun to use promotions to drive more sales, marketers need to continue entice the acceleration of back-to-school purchasing in general, and create some urgency for apparel, technology, and other high-volume stragglers.”