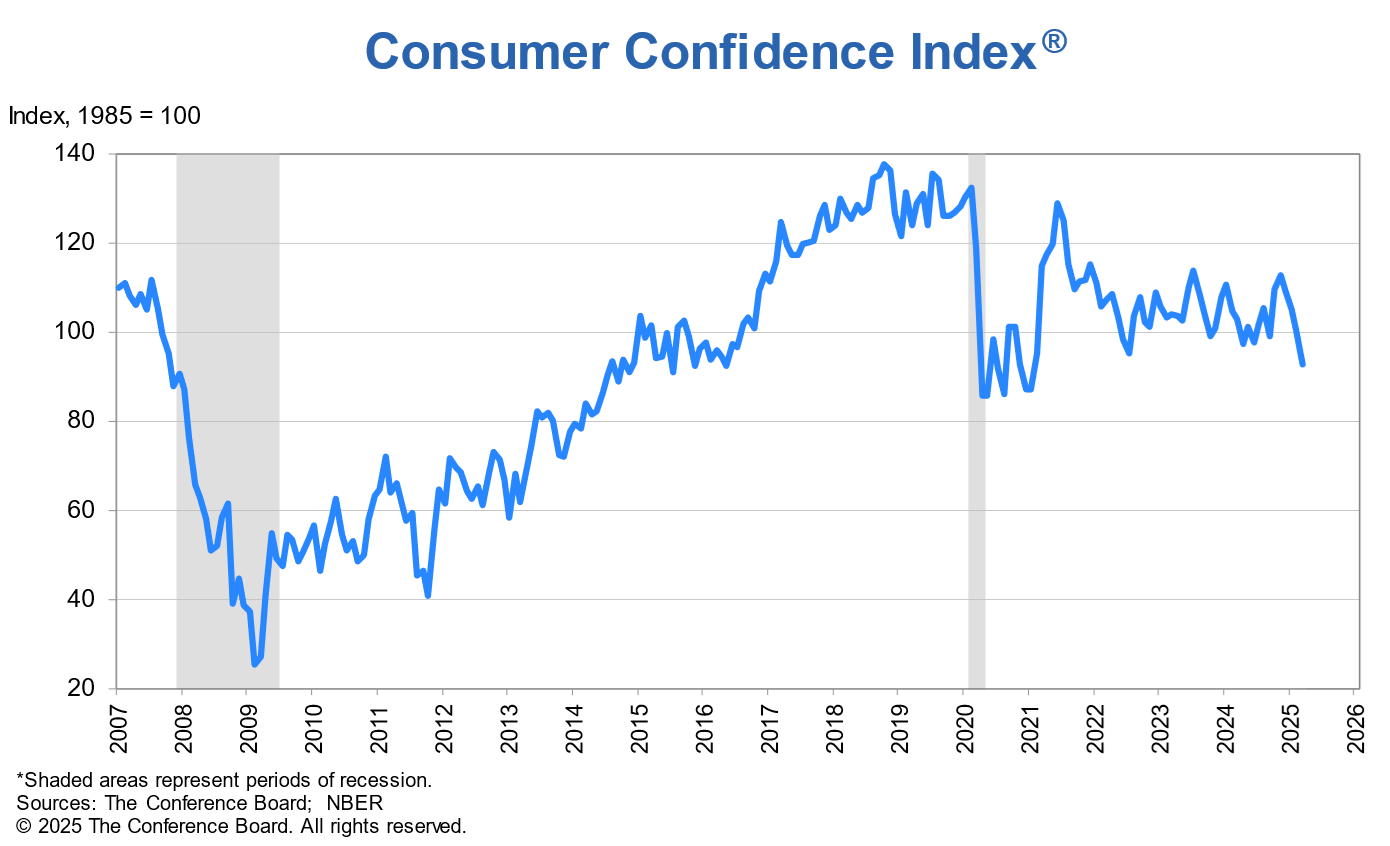

NEW YORK — U.S. consumer confidence continued its downward spiral in March, dropping for the fourth consecutive month as concerns over the economy deepened. The Conference Board Consumer Confidence Index fell 7.2 points to 92.9, its lowest since 2022.

Particularly alarming was the Expectations Index, which plummeted by 9.6 points to 65.2—the weakest reading in 12 years. The sharp decline in expectations for future income, business conditions, and labor markets suggests Americans are increasingly wary of an economic downturn. The Present Situation Index, which reflects consumers’ assessment of current business and labor market conditions, also fell, though less dramatically, by 3.6 points to 134.5.

“Consumer confidence declined for a fourth consecutive month in March, falling below the relatively narrow range that had prevailed since 2022,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “Of the Index’s five components, only consumers’ assessment of present labor market conditions improved, albeit slightly. Views of current business conditions weakened to close to neutral. Consumers’ expectations were especially gloomy, with pessimism about future business conditions deepening and confidence about future employment prospects falling to a 12-year low. Meanwhile, consumers’ optimism about future income—which had held up quite strongly in the past few months—largely vanished, suggesting worries about the economy and labor market have started to spread into consumers’ assessments of their personal situations.”

Guichard added: “Likely in response to recent market volatility, consumers turned negative about the stock market for the first time since the end of 2023. In March, only 37.4% expected stock prices to rise over the year ahead—down nearly 10 percentage points from February and 20 percentage points from the high reached in November 2024. On the flip side, 44.5% expected stock prices to decline (up 11 ppts from February and over 22 ppts more than November 2024). Meanwhile, average 12-month inflation expectations rose again—from 5.8% in February to 6.2% in March—as consumers remained concerned about high prices for key household staples like eggs and the impact of tariffs.”

The data suggests that older consumers are driving the decline in confidence. Those over 55 reported the steepest drop in optimism, followed by individuals aged 35 to 55. In contrast, younger consumers under 35 saw a modest rise in confidence, fueled by a more positive assessment of the present economic situation.

Households across most income levels shared in the pessimism, except for those earning more than $125,000 annually, who remained relatively steady in their outlook.

March also saw a sharp reversal in consumer expectations for the stock market. For the first time since late 2023, more consumers expect stock prices to decline than rise. Only 37.4% believe stock prices will go up in the next year, a nearly 10-point drop from February, while 44.5% expect a downturn.

Meanwhile, inflation concerns remain front and center. Consumers’ 12-month inflation expectations climbed from 5.8% in February to 6.2% in March, with high prices for essential goods like food continuing to weigh on household budgets. The share of consumers expecting higher interest rates also grew, reaching 54.6%, further dampening optimism about economic conditions.

Consumers are increasingly citing economic and policy uncertainty in their assessments of the financial landscape. Comments about the federal administration’s policies—both positive and negative—featured prominently in survey responses. Additionally, concerns over the impact of tariffs and trade policies on household expenses appear to be rising.

On a six-month moving average, purchasing plans for homes and cars declined. However, interest in buying big-ticket items like appliances and electronics increased, possibly in anticipation of future price hikes due to tariffs.

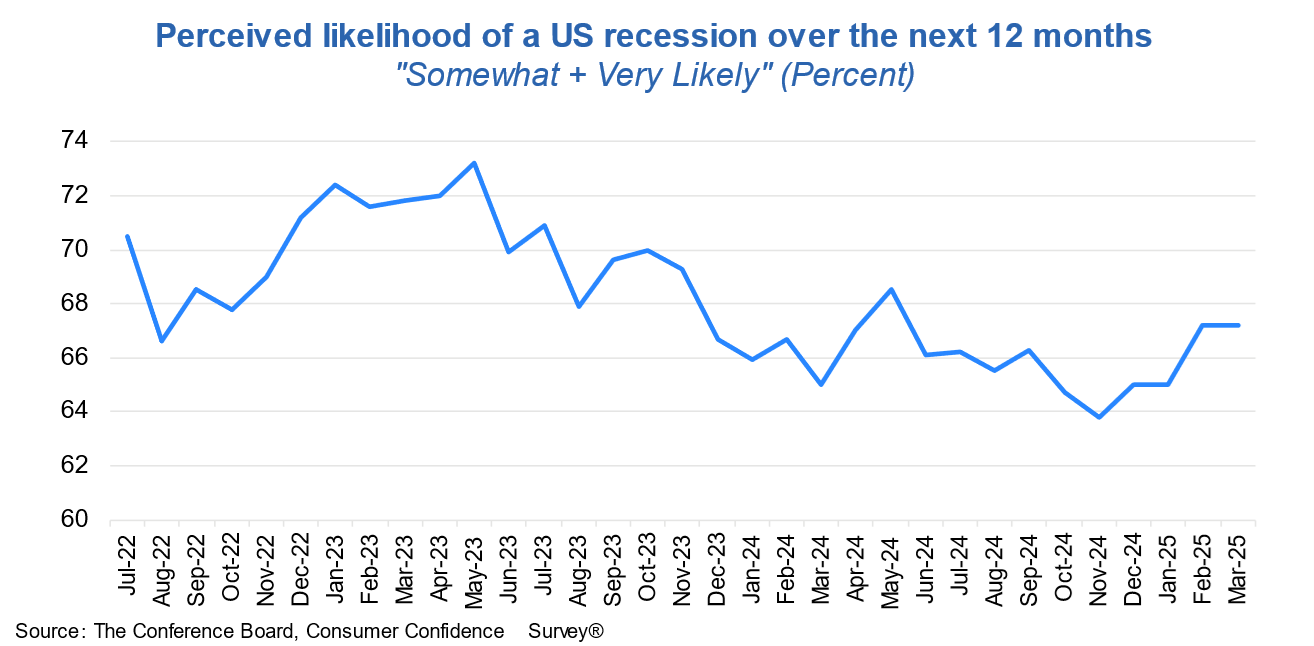

Consumers’ expectations for business conditions and job availability have worsened significantly. The proportion of consumers anticipating a recession over the next 12 months remains at a nine-month high.

- 17.7% of consumers said business conditions were “good,” down from 19.1% in February.

- 16.6% said business conditions were “bad,” up from 14.8%.

Consumers’ views of the labor market improved slightly in March.

- 33.6% of consumers said jobs were “plentiful,” unchanged from February.

- 15.7% of consumers said jobs were “hard to get,” down from 16.0%.

With confidence at a multi-year low and inflation expectations creeping upward, economists warn that consumer spending—the backbone of the U.S. economy—could weaken further in the months ahead, increasing the risk of a downturn.