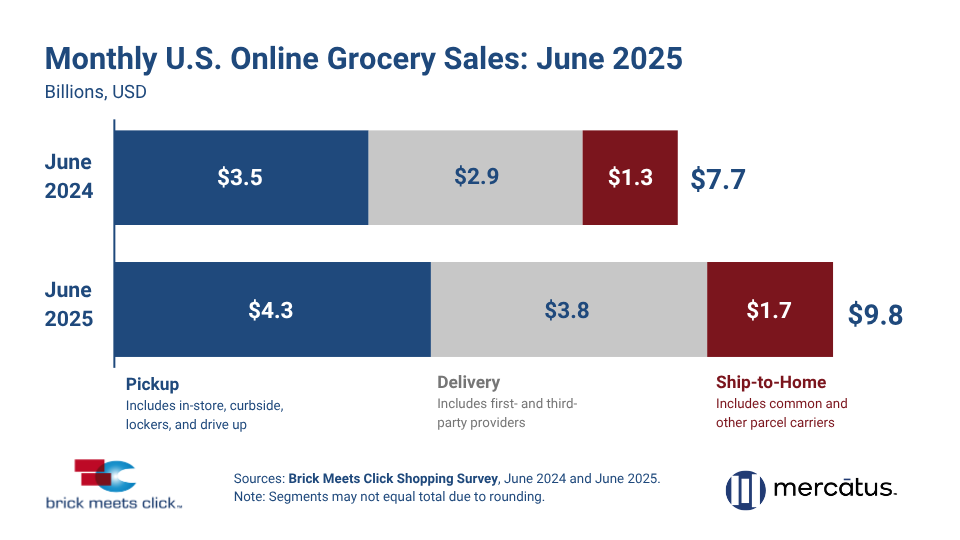

July 18, 2025 — The U.S. online grocery market posted another strong performance in June, with egrocery sales reaching $9.8 billion, a 27.6% increase from June 2024, according to the latest Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus.

The growth was broad-based across all egrocery fulfillment methods, reflecting changing consumer behaviors and accelerating shifts in where and how Americans buy groceries.

Key Fulfillment Channel Performance:

- Delivery sales surged to $3.8 billion, up 29% YOY, fueled by higher monthly active users (MAUs), more frequent orders, and increased average order value (AOV).

- Pickup remained the top egrocery method at $4.3 billion, a 25% gain, as consumers continue to value the convenience and control it offers.

- Ship-to-Home grew the fastest, climbing 33% YOY to $1.7 billion, as more households adopted this method and spending per order rose.

Free Delivery Drives Growth

A key driver behind the Delivery boom is the growing perception that Delivery is now “free” for many consumers, thanks to subscription services and fee waivers, removing a long-standing barrier to adoption.

In-Store Sales Decline

While online channels thrived, in-store grocery sales declined in June, indicating a more significant shift in consumer preferences. Many households are now turning to egrocery services as their primary method for food shopping.

Retail Landscape Shifts: Mass and Value Formats Surge

The June report also highlights ongoing changes in where shoppers choose to buy groceries:

- Walmart gained nearly 1 percentage point in primary grocery store share.

- Hard discounters like Aldi added almost 1.5 points.

- Traditional supermarkets lost more than 2 points over the same period.

Supermarkets Losing Ground to Walmart Online

Supermarkets are facing rising online competition from mass retailers. In June, 1 in 4 households that ordered groceries online from a Supermarket also placed an online order with Walmart — a 400-basis-point increase year-over-year.

This cross-shopping trend has grown every June since 2020, indicating increasing loyalty challenges for regional and traditional grocers.

A Critical Moment for Regional Grocers

Mark Fairhurst, Chief Growth Marketing Officer at Mercatus, offers a strong call to action for regional grocers: “If you’re a regional grocer, these results should be a wake-up call: Take control of your customer data and put it to work to stay competitive.“

Fairhurst stressed the importance of connected digital experiences, personalized engagement, and data-driven strategies to defend market share and retain loyal shoppers in an increasingly digital grocery environment.