PROVIDENCE, R.I. — United Natural Foods Inc. (UNFI) has filed a lawsuit against Goldman Sachs Group Inc. and others, alleging improper conduct by the financial advisors that were retained to advise the food wholesaler on its bid to acquire Supervalu Inc.

The lawsuit, filed in the Supreme Court of the State of New York, seeks damages as well as the recovery of advisors’ “ill-gotten gains.”

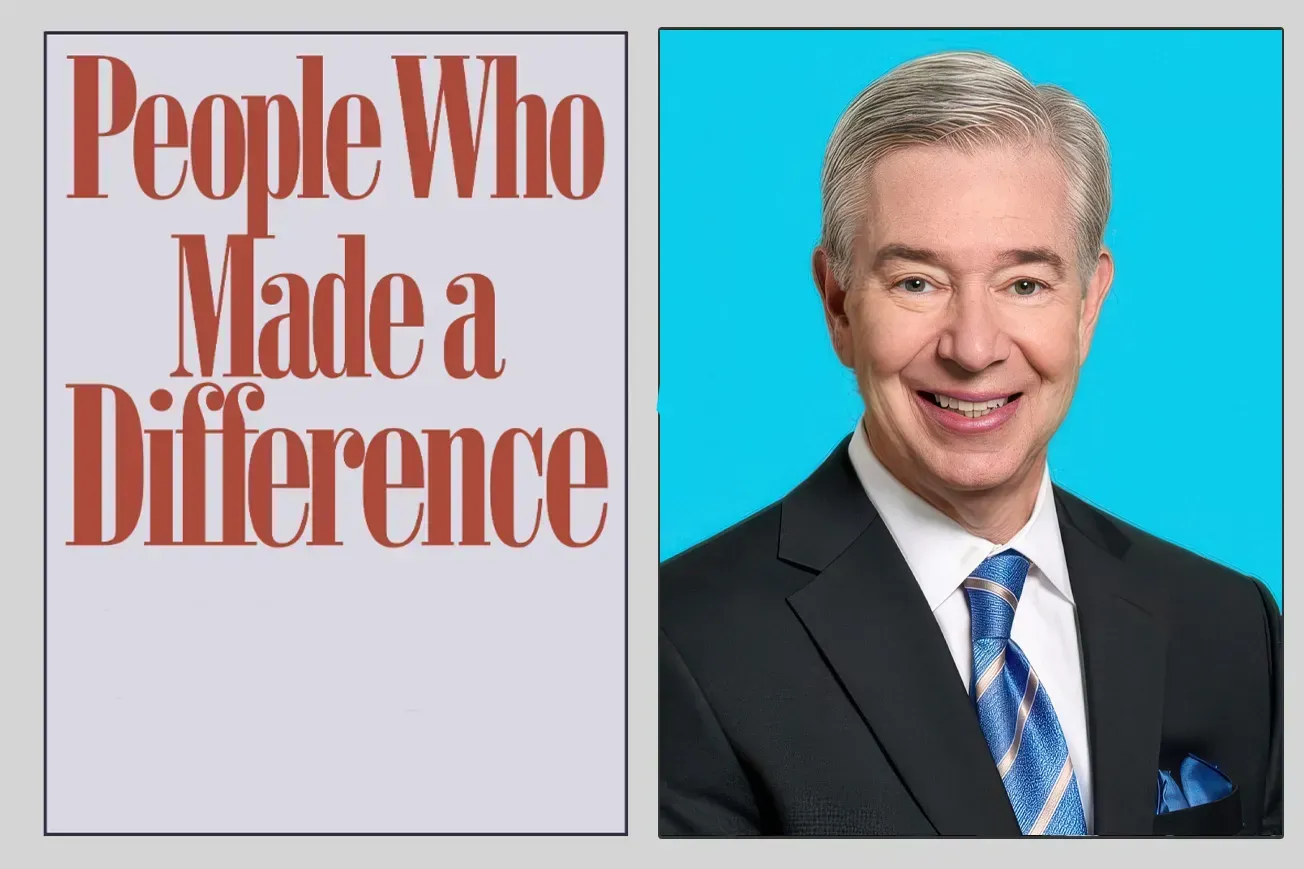

“We feel we have an obligation to hold Goldman Sachs and others accountable for the ways in which they materially harmed UNFI and its shareholders in arranging the financing and managing related activities for our acquisition of Supervalu,” commented UNFI chairman and chief executive officer Steve Spinner. “We expected our extremely well-paid transaction advisors to provide ethical counsel and unbiased support around this landmark acquisition, not leverage their positions to pursue larger profits for themselves and other clients at our expense and ongoing damage.”

The lawsuit alleges that New York-based Goldman Sachs used its market power and influence to exploit its client in order to maximize its compensation.

“UNFI entrusted Goldman Sachs to provide a full range of transaction advisory services and to arrange a multibillion-dollar loan for the acquisition of Supervalu. While positioning itself as UNFI’s trusted advisor on the one hand and its counter-party lender on the other, Goldman Sachs consolidated its command over all aspects of the transaction in order to extract millions in unjustifiable interest, fees and other damages suffered by the company and its shareholders,” UNFI said in a statement on Thursday.

Named as defendants in the complaint are Goldman Sachs and its principal executive overseeing the Supervalu merger, as well as Bank of America and Merrill Lynch, an investment banking division of Charlotte, N.C.-based Bank of America.

UNFI filed similar claims separately against U.S. Bank, alleging “collusive action, led by Goldman Sachs.”

A Goldman Sachs spokeswoman told Reuters that the bank believes the claims have no merit. Bank of America declined to comment.

UNFI continues to pursue the merger, Spinner commented.