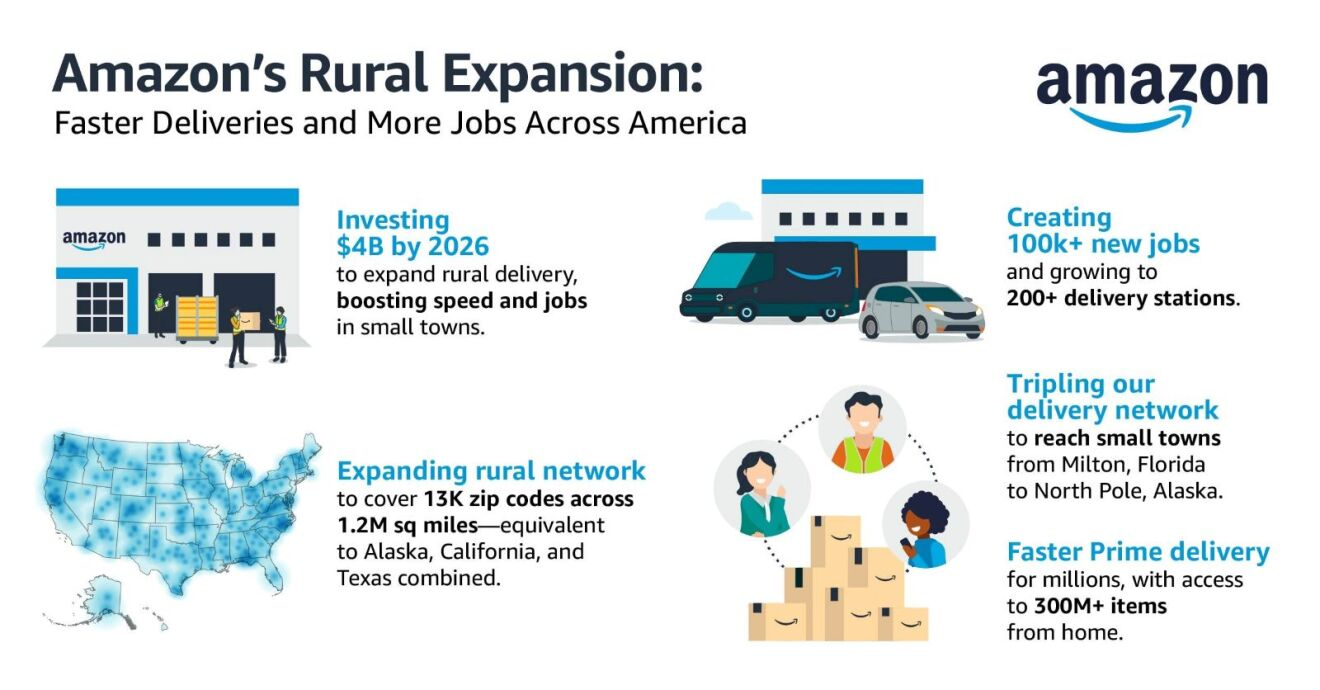

SEATTLE — In a strategic move with significant implications for the retail landscape, Amazon has announced a $4 billion investment to expand its logistics infrastructure across rural America. The company plans to triple the size of its rural delivery network by the end of 2026, accelerating delivery speeds and extending its retail reach to underserved communities nationwide.

In an article on Amazon's website, Udit Madan, Senior Vice President of Amazon Worldwide Operations, details the expansion plan. The investment will fund over 200 rural delivery stations, increasing Amazon’s capacity to deliver more than one billion additional packages per year to customers in more than 13,000 ZIP codes—an area roughly the size of Alaska, California, and Texas combined. More than 100,000 new jobs and contract opportunities will be created through a mix of full-time, part-time, and flexible delivery roles and partnerships with small businesses through Amazon's Delivery Service Partner (DSP), Amazon Flex, and Hub Delivery programs.

“Amazon opening a delivery station in our town has been an incredible boon for our community,” said Mayor Roslyn White of Abbeville, Louisiana. “Not only has it created more than 300 jobs for our residents, it has dramatically improved delivery speeds. Amazon's investment is paying dividends for our local economy, and improving quality of life.”

From a retail perspective, the logistics build-out enables faster and more reliable delivery of Amazon’s vast online catalog, now more than 300 million items with Prime shipping, making it more accessible to rural consumers. Since launching its rural delivery initiative in 2020, Amazon has already seen a 50% improvement in delivery speeds across small towns. Once the expansion is complete, average delivery times in these areas are expected to be cut in half.

For Amazon, the logistics push also supports a broader retail strategy: enabling Prime members in even the most remote parts of the country to enjoy the same rapid delivery, product availability, and price competitiveness that urban customers already experience. A 2024 Profitero study cited by Amazon found the retailer’s prices to be 14% lower than those of major U.S. competitors, reinforcing its appeal as a low-cost, high-convenience option for rural shoppers.

Beyond direct-to-consumer delivery, Amazon’s Hub Delivery program offers new revenue opportunities for local retailers, like flower shops and cafés, to act as micro-logistics hubs, earning up to $27,000 annually by helping with last-mile deliveries.

For the broader retail industry, Amazon’s expansion signals a long-term bet on rural markets and a challenge to legacy carriers who have retreated from these high-cost zones.