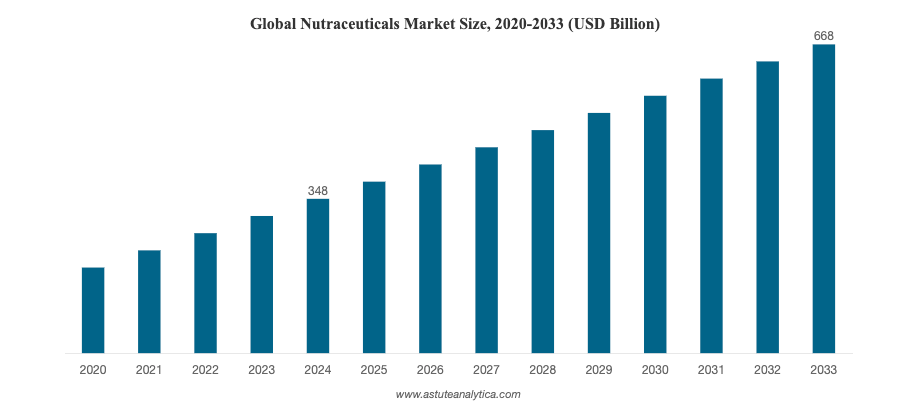

CHICAGO – According to a new report by market research and advisory firm Astute Analytica, the global nutraceuticals market is projected to nearly double over the next decade, reaching $668 billion by 2033 from $348 billion in 2024. This rapid expansion, driven by a 7.5% compound annual growth rate (CAGR), is fueled by rising consumer interest in preventive health, personalized wellness, and innovative product formats.

Nutraceutical is a marketing term used to imply a pharmaceutical effect from a compound or food product that has not been scientifically confirmed or approved to have clinical benefits. In the United States, nutraceuticals are considered and regulated as a subset of foods by the Food and Drug Administration.

The surge in demand for health-oriented products like protein bars, fortified snacks, and meal replacements underscores a broader shift toward proactive health management. Leading companies such as Optimum Nutrition, MegaFood, and Garden of Life are pushing the envelope in areas like sports nutrition, healthy aging, and cognitive wellness.

The dynamics of different regions are becoming increasingly crucial for the growth and diversification of the global nutraceutical market. Factors such as heightened health awareness, changing consumer preferences, and shifting regulations drive overall market expansion. North America is at the forefront, bolstered by high consumer awareness and major industry players such as ADM and Cargill, investing in sectors including probiotics, prebiotics, and plant-based proteins. There, adaptable regulations and the rising prevalence of chronic diseases are propelling the demand for preventive health solutions.

Preventive care is emerging as a central theme, particularly amid alarming trends in noncommunicable diseases (NCDs). With the World Health Organization reporting over 1 billion obese individuals and 537 million diabetics worldwide in 2023, consumers are increasingly turning to dietary supplements as a frontline defense. Ingredients such as berberine are gaining traction for their efficacy in managing blood sugar levels without harmful side effects. According to a 2020 study, 54% of diabetic patients reported using dietary supplements, with usage rates of 30% among those aged 20–39, 51% in the 40–64 age group, and 62% in individuals over 65. Supplement use was also more prevalent among females (57%) than males (50%). Among the nutraceuticals consumed, berberine has gained attention for its scientifically supported ability to significantly lower fasting blood glucose levels without increasing the risk of hypoglycaemia, making it a promising option in diabetes management.

The COVID-19 pandemic sparked a surge in demand for immunity-boosting supplements, a trend that persists. Products containing vitamins C and D, zinc, and other immune-supportive nutrients continue to drive sales. Market leaders, including GNC, Herbalife, and Nature’s Bounty, have expanded product lines in response, with consumer interest now extending to stress relief, gut health, and energy enhancement.

Despite growth, the industry faces persistent hurdles. Regulatory inconsistencies between regions hamper standardization and consumer trust. In the U.S., for example, the Dietary Supplement Health and Education Act of 1994 limits FDA oversight, allowing some unverified products into the market. Supply chain issues persist, with up to 80% of ingredients imported, leaving the sector vulnerable to disruptions.

More companies are adopting third-party certifications from bodies like USP and NSF International to address these challenges. Consumers are increasingly willing to pay a premium for clinically validated products, with studies indicating a willingness to spend an additional USD 252 on products proven to have no side effects.

The future of nutraceuticals lies in personalization, according to Astute Analytica. Advances in artificial intelligence, wearable tech, and omics sciences are reshaping the landscape, enabling tailored supplementation based on individual biomarkers and lifestyle factors. Companies like Bioniq and Nuritas are leveraging AI to create precision products, while tools like continuous glucose monitors and the Oura Ring are helping consumers fine-tune their supplement routines in real time.

Nanotechnology is also playing a transformative role, enhancing nutrient bioavailability through innovative delivery systems such as dissolvable oral pouches. This tech-forward approach is making supplements more efficient, accessible, and appealing across demographics.

Major industry players, including Nestlé, Danone, BASF, Herbalife, ADM, and DSM, are expanding through acquisitions and scientific advancements. Notable developments include Nestlé’s muscle health breakthrough and Danone’s acquisition of Functional Formularies, reflecting a strategic push into targeted health solutions.

The nutraceuticals market is evolving into a cornerstone of preventive healthcare. Innovations in AI-powered diagnostics, smart delivery systems, and clinical validation are transforming consumer expectations. As the global burden of lifestyle-related diseases continues to rise, the market for personalized, functional nutrition is set to thrive.