CVS and FARE partner on Teal Pumpkin Project® for an inclusive Halloween

The Teal Pumpkin Project urges households to provide non-food treats for trick-or-treaters, ensuring all children—regardless of food allergies—can enjoy the holiday.

The Teal Pumpkin Project urges households to provide non-food treats for trick-or-treaters, ensuring all children—regardless of food allergies—can enjoy the holiday.

The redesign marks PepsiCo’s shift from a “house of brands” model to a “branded house” strategy.

The redesigned VG’s Grocery features a modern look that improves the shopping experience while celebrating the local community.

The company says it will now “operate like the world’s biggest startup.”

Grubhub customers can now order from Instacart’s network of more than a thousand national, regional, and local retail banners across the U.S.

Potbelly will keep its current brand and menu, while using RaceTrac’s scale in real estate, operations, food innovation, and marketing.

The spooky season is becoming a key driver for consumer engagement and cross-category sales.

The scholarship honors students from diverse academic backgrounds who have demonstrated leadership

Health-focused consumers and major CPG investments are propelling steady growth in protein-enriched foods, beverages, and wellness products across the United States.

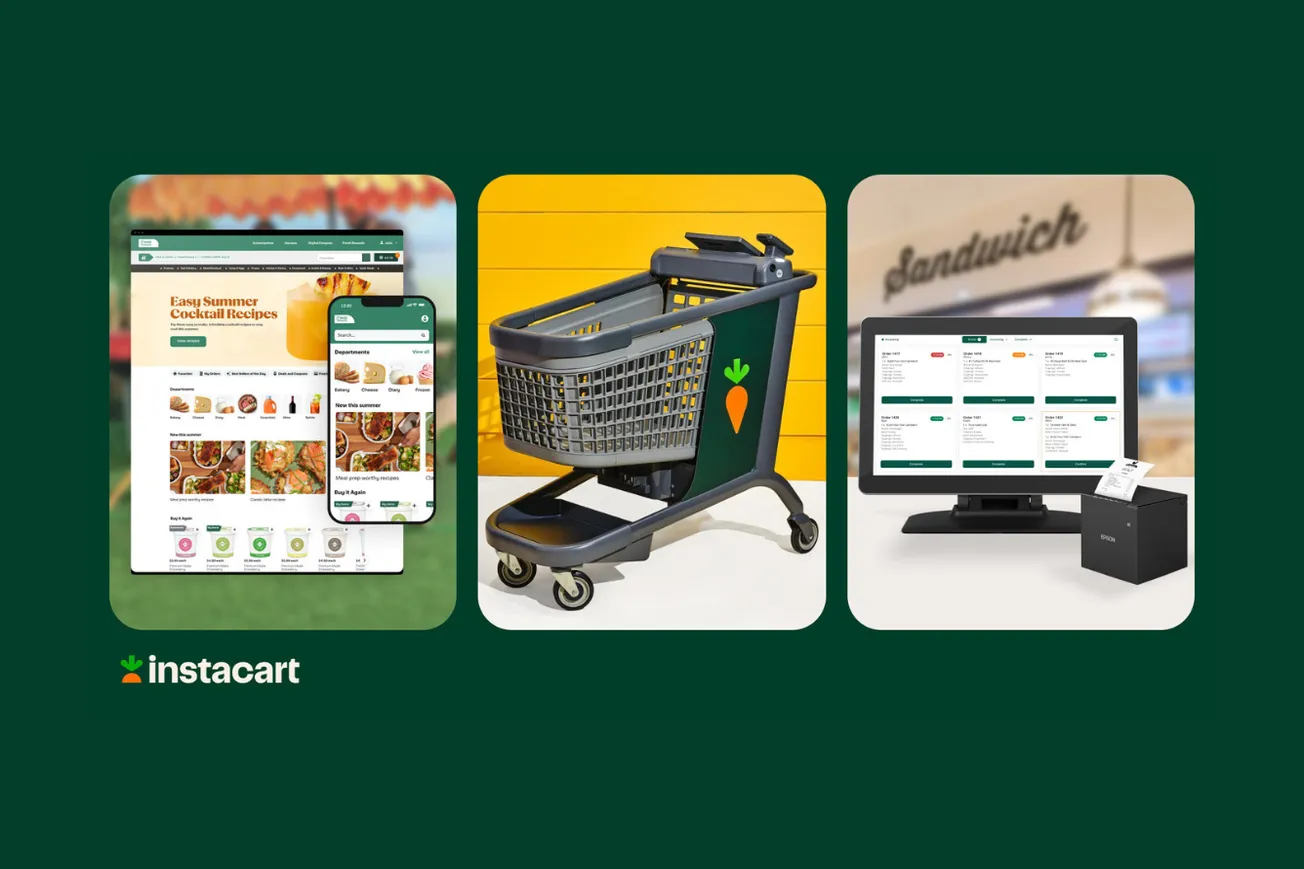

Independent grocers nationwide are adopting Instacart’s solutions like Caper Carts, FoodStorm, and Storefront Pro to streamline operations and enhance the shopping experience in-store and online.

“For our company to have continued success, we need associates who are ready to take the next step in their Publix careers.”

The 2025 NACS Show attracted 25,136 attendees from 73 countries, marking the third consecutive year of record-breaking crowds for the host city.

Trade groups call for clear definitions and fee transparency to protect consumer data rights.

Probiotics, once limited to dairy, now energize drinks, snacks, and supplements, fueled by science and growing consumer interest in functional nutrition.

The Pennsylvania-based convenience store chain expands regionally with a 14,000-square-foot flagship offering food, fuel, and entertainment.

The focus was on people, ideas, and potential. The industry displayed its agility with AI tools improving operations, new flavors, and healthier snacks.