NEW YORK — Don’t sleep on the mass market beauty industry. That’s the word from retailers and brands that believe that despite sagging numbers, affordable beauty is about to surge.

Over the past three years, prestige beauty growth has outstripped mass. Although mass is larger in total dollars because of the number of outlets, the gap is closing.

The trend continued for the first half of 2024, according to data released by Circana. U.S. prestige sales grew by 8%, while sales at mass merchants were flat.

More troubling was the fact that unit movement in mass declined, says Larissa Jensen, senior vice president of beauty and industry advisor at Circana. She adds that unit sales are the “best indicator of consumer demand.”

The drug channel showed a decrease in dollar sales and is a major reason for the overall flat growth. Mass sales were down slightly, but food grew as some supermarket chains expanded beauty departments. Dollar stores also showed a spike in sales, based on Circana reports. Mass players still dominate two areas — skin care and hair care.

Higher-income shoppers, those earning more than $100,000, continue to boost prestige. Mass retailers remain in a quest to grab more of their spending. Masstige is one place where mass merchants can thrive.

Circana’s Jensen says masstige — products that fit between mass and class — is not the size of mass at only 10%, but it is growing faster than prestige and mass. In the first quarter of 2024, masstige sales were up 16%, which beat out prestige at a 15% advance and mass with a 3% incline.

There are many who feel prestige is softening and will be impacted more than mass. Efforts to shore up the mass market are kicked into high gear. Increased activity from celebrities and sports stars, the expansion of dupes, and product innovations are expected to lasso shoppers back to mass stores. New brands are emerging that are launching in drug and discount stores.

A perfect example is the wildfire success online and in stores of actress Blake Lively’s new hair brand, Blake Brown. The collection sold out within hours online and in many Target stores upon its launch in early August.

Seven years in the making, the collection is inspired by Lively’s personal routine of shampoos, hair masks and styling products. It’s based on the right balance of strength and moisture and doesn’t include a traditional conditioner. “To me, conditioner is like a diluted, watered-down mask. Masks work for me, so I use them instead of a conditioner,” Lively explained in a Target question and answer with the star. The launch coincided with the much-awaited film version of Colleen Hoover’s “It Ends With Us.”

Athletes join Hollywood stars in the push for mass brands. The recent Olympics put several mass market brands on the pedestal. Several high-visibility athletes represent mass brands. Gymnast

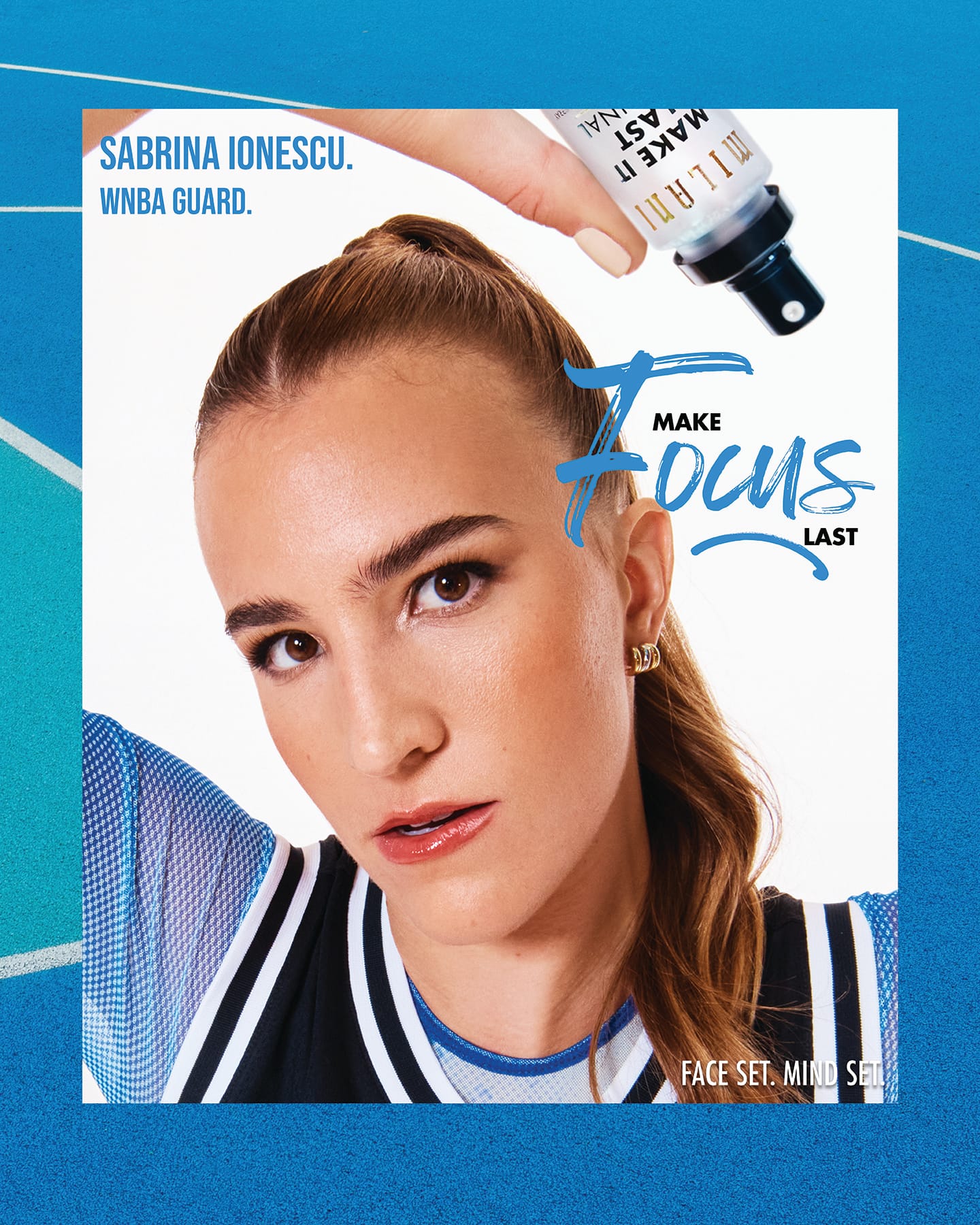

Jordan Chiles is part of a cadre of athletes promoting Milani’s Face Set. Mind Set campaign. She joined basketball pro Sabrina Ionescu, volleyball star Chiaka Ogbogu, and weightlifting champion Mattie Rogers in the brand’s first sports partnership that Jeremy Lowenstein, Milani’s chief marketing officer, says helped push sales in the fast-growing brand. The brand’s Make It Last Setting Spray was featured as a tie-in for its long-lasting benefits — even when competing.

KISS was also in the spotlight thanks to its collaboration with Suni Lee. She’s the face — and nails — of the new KISS at-home nail, Salon X-tend Starter Kit. It consists of an LED lamp, a soft-gel adhesive and a set of 30 nails. It is already in the top 10 items in nails across multi-outlet stores as ranked by Circana.

Sally Hansen proved collabs for nail products resonate with guys, too. The leader in nail color inked a deal with basketball star Jared McCain, who is know for showing off his colorful talons. The former Duke star signed with the Philadelphia 76ers.

Many other brands, from Procter & Gamble to L’Oréal, have highly visible connections with athletes. Also, Maybelline just became the first cosmetics partner for the TCS New York City Marathon. Brand activations will include a cheer zone along the race and a Maybelline running team. The world-renowned race will highlight Maybelline’s long-stay items, such as its Super Stay Matte Ink.

After a rebound following the pandemic, makeup is slowing down. But that hasn’t stopped innovation. Profusion Cosmetics, reacting to an uptick in travel, released an Artistry-on-the-Go kit with a variety of eye, lip and face items priced at $16. Tapping into the hybrid makeup trend with skin care benefits infused into cosmetics, Profusion also introduced Feel Good Long Skin Protector. Licenses are also a huge part of the brand’s appeal, according to Sharon Wang, the brand’s vice president. Casper and Jurassic Park are among the new licenses in her arsenal.

She is also a pacesetter in what is becoming more important in mass — sustainable packages. “We continue to repackage as we edge toward having all of our products in sustainable packaging.”

No review of mass cosmetics is complete without honoring the impact e.l.f. has made on shelves and Wall Street. The company celebrated its 20th year and continues to resonate with young consumers, with Piper Sandler’s 2024 Taking Stock With Teens Survey putting it at No. 1. But its fast-to-market, valued-price products hit the mark with all generations. The brand just reported its 22nd quarter of growth and surpassed $1 billion in sales. e.l.f. surpassed L’Oréal to become the second-largest brand in mass makeup, with a 12% share, per company data.

e.l.f. is a mass brand that thinks like a premium player. Its campaigns and collabs are savvy — not the typical middle-of-the road fare. Some examples include its Super Bowl spots starring Jenifer Coolidge and its 2023 ad starring members of the “Suits” cast. Its collaborations are eye-opening, including one with Liquid Death. e.l.f. proves shoppers can spend less and still use on-trend makeup.

There are signs that consumers are pulling back on spending, which could portend a trade-down to mass options. While that hasn’t happened yet and consumers are clinging to prestige beauty to treat themselves, many think the pendulum is about to swing.

Dupe culture is still going strong and is viewed as a boost to mass, too.

Buying a “knockoff” of a premium product has become cool. Alternative options are especially strong in makeup, such as lip oils and fragrances. Drug stores are chock full of alternatives, such as Milani Hydrating Lip Stain and Fine’ry fragrances.

Trends emerging include renewed interest in indie brands, especially safe products for Gen Alpha. Several examples include Talomi, billed as a worry-free makeup for tweens; Bright Girl, a skin care for girls ages 8 to 20; and dot dot dash masks from the company that created Patchology.

Wellness is expected to reach a broader audience in the years to come. Michelle LeBlanc, vice president of merchandising for beauty, personal care and Hispanic Center of Excellence at CVS, says she’s captivated by new companies inspired by the founder’s personal experiences to create products to meet untapped needs.

Falling under that scope is greater acceptance of women’s health, with new lines emerging, including Hygiene Hero’s Vipstick Serum and Antevorta, a feminine hygiene line inspired by Chinese medicine.

Brick-and-mortar stores’ biggest challenge could come not only from Amazon but the growth of TikTok Shop. NielsenIQ platforms like TikTok, Temu, eBay, Shein, Mercari and Poshmark command 6.2% of e-commerce sales — TikTok alone garners 2.6% of the total.

A dark cloud hovering over mass beauty is theft, which has caused retailers to lock down beauty departments. A walk through a Walmart in Saratoga Springs, N.Y., revealed almost every shelf in the store had some merchandise under glass. For mass marketers to give prestige a run for the money in beauty, the industry must find solutions to unlock products.