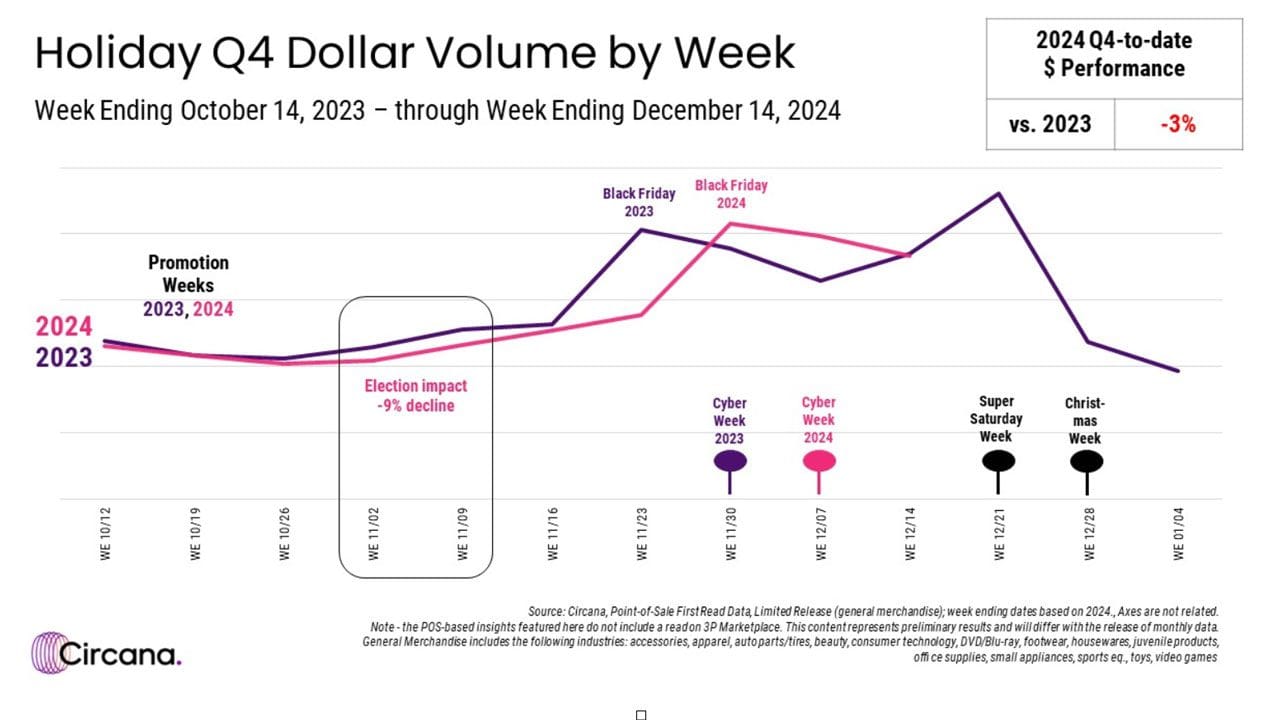

CHICAGO– Despite strong promotional performances during Black Friday and Cyber Monday, overall retail sales for the 2024 holiday season are trailing behind last year’s numbers, according to Circana, a leading advisor on consumer behavior. Season-to-date discretionary general merchandise spending remains 3% lower than 2023, reflecting challenges posed by economic factors and shifting consumer habits.

Black Friday and Cyber Monday provided a momentary lift, with spending during those promotional weeks up 3.7% compared to 2023. Black Friday week discretionary unit and dollar sales rose by 2%, while Cyber Monday week sales increased by 5%, demonstrating a resurgence in shopping momentum. However, these gains were insufficient to offset the broader 3% year-over-year decline in Q4 discretionary spending through December 14, 2024.

Circana’s analysis highlights two key disruptions impacting holiday sales: the timing of the U.S. presidential election and the late Thanksgiving holiday. A 9% dip in spending during early November coincided with the election, causing a temporary distraction. Additionally, Thanksgiving 2024 occurred a week later than in 2023, compressing the post-Thanksgiving shopping period and altering traditional sales peaks.

“Timing is everything,” noted Marshal Cohen, chief retail industry advisor for Circana. “The later Thanksgiving disrupted not only the promotional calendar but also the number of shopping days leading up to Christmas. While the measurement of this holiday season is very different, consumer behavior remains stable overall.”

Circana’s annual Holiday Purchase Intentions study revealed a slight shift in consumer behavior. Fewer shoppers planned to procrastinate this year, though 5% of holiday shoppers indicated they would wait until late December to start their purchases. Retailers are now focused on maintaining momentum through the shortened shopping window and countering a potential post-Cyber Week lull.

Retailers face an uphill battle to make this year’s single Super Saturday impactful enough to rival last year’s two-Saturday shopping event. “The next test of Holiday 2024 is maximizing the shortened shopping period, minimizing the post-Cyber Week lull, and ensuring Super Saturday’s success,” added Cohen. “This season offers lessons critical for planning Holiday 2025 strategies.”

While promotional peaks during Black Friday and Cyber Monday have bolstered short-term gains, overall performance suggests challenges ahead as retailers navigate evolving consumer habits and economic pressures.