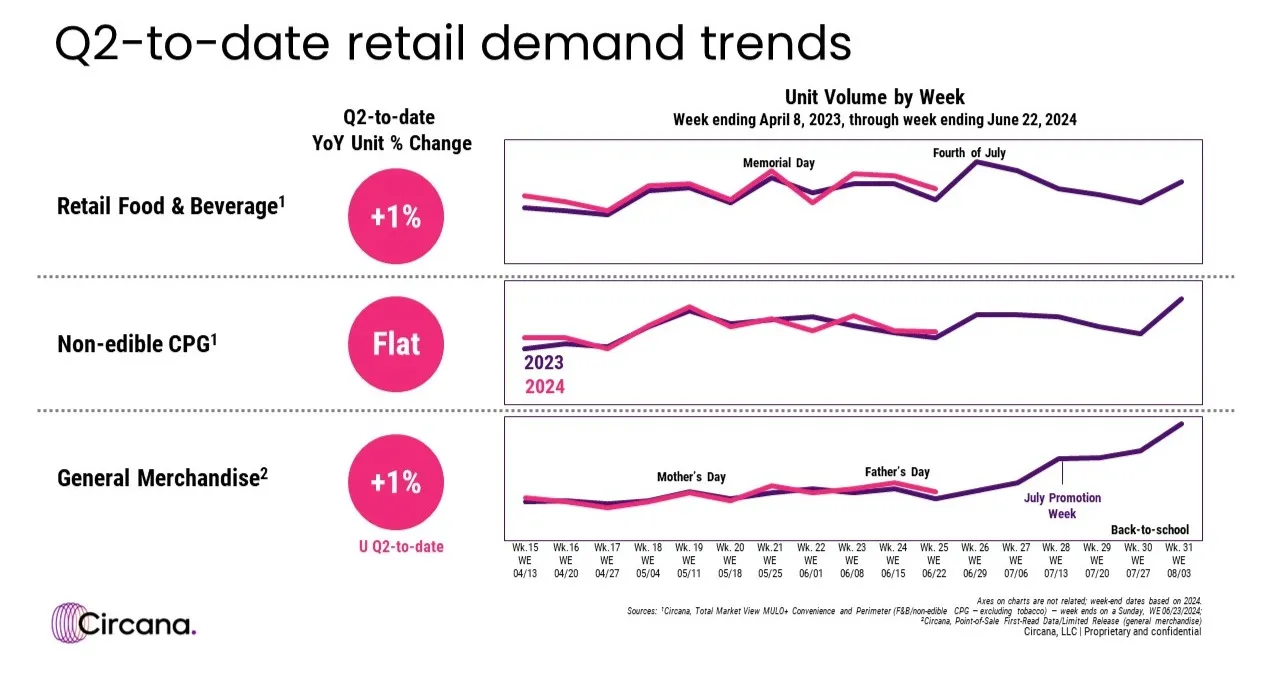

CHICAGO — U.S. retail sales numbers in June resembled May performance. During the four weeks ending June 29, 2024, revenue across the combined view of discretionary general merchandise and consumer packaged goods (CPG) once again grew 1%, and unit demand remained level with the same time last year.

The steadying of unit sales, flattening average selling price comparisons, increased value options and promotional engagement are signals of continued movement toward consumer spending stabilization, according to Circana, the leading advisor on the complexity of consumer behavior.

“A growing group of consumers are living with a budget and assessing the need with an eye on value,” said Marshal Cohen, chief retail industry advisor for Circana. “They are also figuring out how to save money without giving up what they really want — cutting back in one area of their budget to free up money to spend on the occasional splurge purchase.”

Amid the stabilization occurring across discretionary and non-discretionary retail spending, there are stories of growth. Top-performing products show consumers' willingness to spend lives on. The desire for little luxuries and social media's influence continue to break through budgetary boundaries. Through the first half of 2024, the hottest sellers ranged from categories like lip makeup and hair styling to portable beverageware and specialty kitchen appliances. Cutting back in one area of spending helps to fuel needs-based spending like auto maintenance, as well as splurge purchases like sprucing up a wardrobe, powered vehicles for the kids and taking up pickleball as a new hobby. The appeal of innovative products remains paramount. Circana’s New Product Pacesetters 2024 report reveals consumers are most eager to try new food and beverage products like carbonated sports and energy drinks and meal solutions.

“Consumers simply need to be given a reason to buy — a reason that resonates enough to warrant allocating part of their limited budget,” added Cohen. “Growth in the current retail climate depends on not only taking advantage of spontaneous event-based spending, but also identifying and activating on the reasons that will stimulate spending and create new sales peaks.”