The annual back-to-school shopping rush is underway, and parents are navigating a season shaped by rising prices, sharper deal-hunting, and shifting school meal dynamics, according to a new Numerator Verified Voices survey of more than 3,000 U.S. households earlier this month.

Savings Take Center Stage

Shoppers are more cost-conscious than ever, with 57% citing price as their top priority when buying back-to-school items, up from 52% last year. About one-quarter of parents expect to spend more than last season, primarily due to higher prices. Nearly all families plan to cut costs by shopping sales (68%), comparing prices (58%), using coupons or promo codes (57%), or reusing supplies (45%).

Summer discount events such as Prime Day, Walmart Deals, and Target Circle Week also proved popular. Among retailers, Walmart earned the top spot for perceived best deals (49%), followed by Target (22%) and Amazon (12%).

Lunchbox Habits Drive Grocery Spend

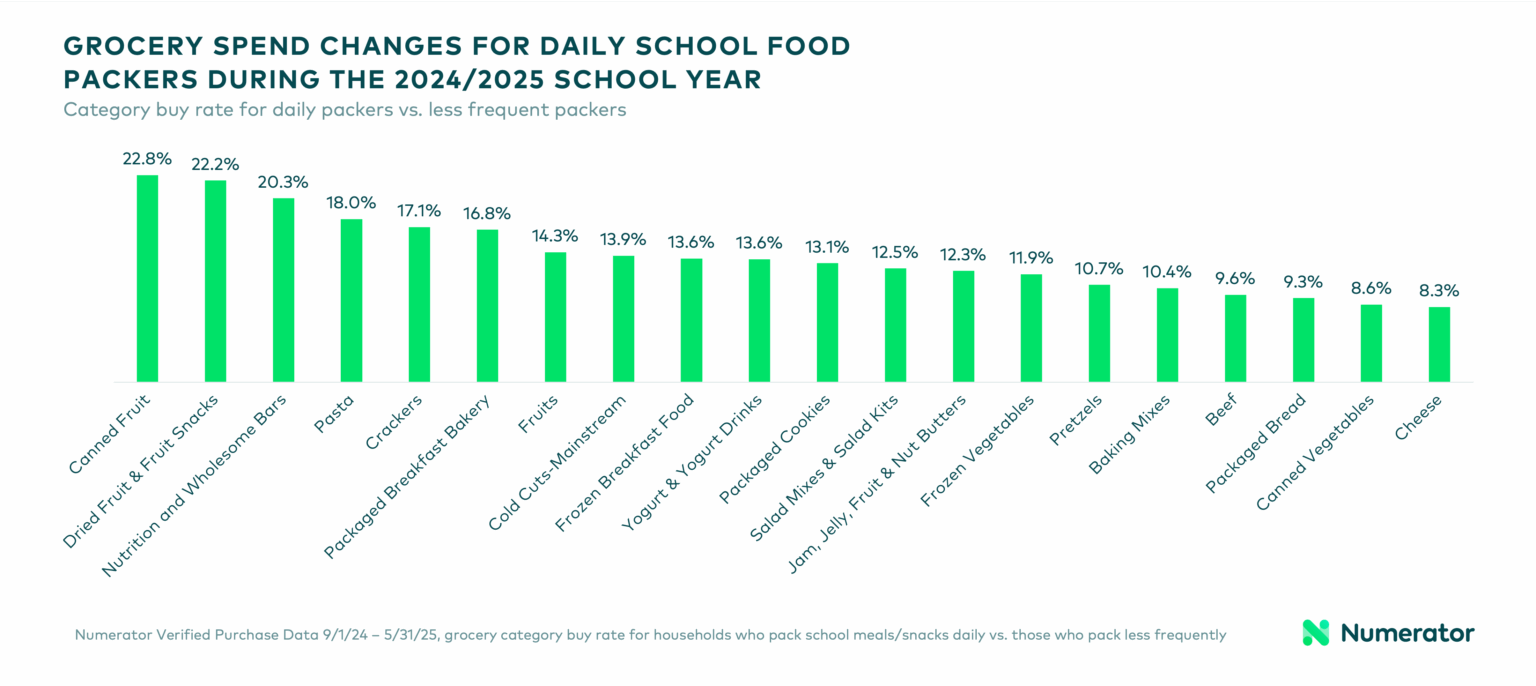

School-day meals remain a major factor in household budgets. More than half of parents (51%) pack snacks or meals daily, especially for younger children. Daily packers tend to be higher-income millennials who focus on nutrition and label reading. Popular packed items include chips, fruit, granola bars, bottled drinks, and cheese snacks.

Families who consistently packed meals spent nearly 5% more on groceries during the 2024/2025 school year than those who packed less often. The biggest increases were seen in snack and produce categories, as well as staples such as cold cuts, nut butters, bread, and cheese.

School Breakfast Cuts Into Grocery Bills

School-provided breakfast programs continue to play a crucial role, with 45% of parents reporting that their children will primarily eat breakfast at school this year. Three-fourths of those meals are free, often benefiting low-income households and families participating in SNAP/WIC.

These families spent 7.1% less on groceries overall last year, including notable decreases in produce (-17.4%) and traditional breakfast foods (-9.2%).

Outlook for Retailers

For retailers, the back-to-school season is just the beginning. Beyond August and September, families’ school-year routines, shaped by inflation, meal programs, and ongoing value-seeking behaviors, will continue to influence grocery and household spending. Brands that align promotions with these evolving needs may gain a competitive edge.