WASHINGTON — Consumers are heading into fall with mixed emotions about the economy and their own household budgets, according to the latest Grocery Shopper Snapshot from FMI. The September survey, conducted September 4–8, reveals a growing divide between optimism and unease, with many shoppers expressing “uncertainty and angst.”

Mixed perceptions of 2025

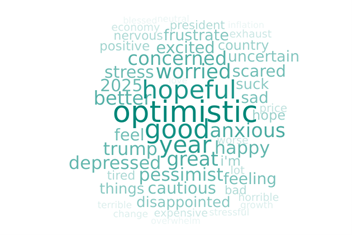

Shoppers’ views of how things are going have dimmed since June. While 39% still described their outlook as “optimistic” or “hopeful,” that share was down from 42%. Negative feelings climbed to 36% from 34%, with descriptors such as “worried,” “anxious,” and “frustrated” gaining ground.

Top concerns for consumers

Economic pressures remain front and center. Nearly two-thirds of shoppers are very or extremely concerned about inflation (63%) and rising food prices (67%). The U.S. economy broadly weighs heavily on 60% of respondents, while 48% now say they worry about the job market, up from 41% in June. Tariffs continue to draw concern from 57% of shoppers, but the list of anxieties has widened to include food safety information, vaccine access, and medication costs.

Shoppers are also paying attention to global and structural challenges, such as the wars in Ukraine and the Middle East, weather-driven crop shortages, and labor supply issues in agriculture.

Spending shifts and resilience

In response, 72% of consumers report changing their spending habits, with the largest share (45%) simply cutting overall household spending. About one in five have modified travel plans or postponed major purchases. Still, resilience is evident: 81% of shoppers say they feel in control of their grocery budget.

FMI noted that it will continue to track these trends through its ongoing Grocery Shopper Snapshot and U.S. Grocery Shopper Trends series.