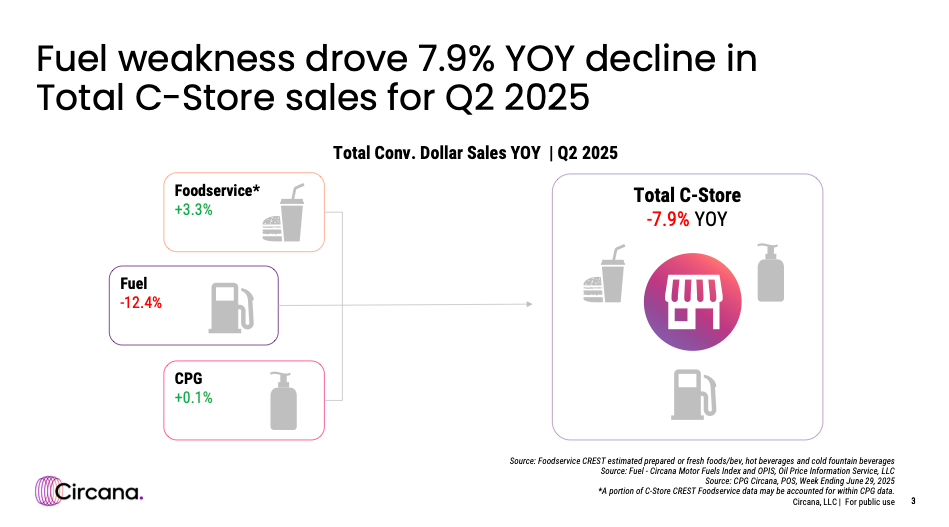

CHICAGO — America’s convenience stores are at a crossroads. Once synonymous with gas pumps and quick snack runs, the sector is undergoing a dramatic transformation. According to Circana’s U.S. C-Store Landscape Q2 2025 report, total sales slipped nearly 8 percent year over year, pulled down by a steep decline in fuel. Yet, behind the headline numbers lies a more complex story. Foodservice, alcohol and shifting shopper habits are reshaping what the modern C-store looks like and where the future growth may lie.

From Gasoline to Good Eats

Fuel still accounts for more than 60 percent of C-store revenue, but its dominance is fading. The average number of gallons per buyer continues to decline, and for many retailers, this means the focus is shifting to the inside of the store. Foodservice sales climbed more than 3 percent in the second quarter, even though overall traffic fell. Larger average checks, up 5 percent, helped offset fewer visits as shoppers demonstrated a willingness to spend more on quality meals on the go.

That shift is especially evident at food-forward chains like Wawa, Sheetz, Casey’s and Buc-ee’s. These operators are beginning to resemble fast casual competitors more than gas stations, particularly at breakfast and lunch. Still, C-stores are losing share in beverages, such as coffee, to a new wave of drink specialists offering functional sodas, protein-infused refreshers, and other trendy options.

Packaged Goods Hold Their Ground

Consumer packaged goods are proving resilient, although growth remains modest. Sales in C-stores rose just 0.1 percent year over year while unit sales declined nearly 3 percent. Multi-outlet retailers, by comparison, saw a rise in units, underscoring the challenge convenience operators face in competing on price and variety. Some categories underperformed, including snacks and non-alcoholic beverages; however, candy received a boost due to the Easter holiday falling in the second quarter.

Regional results highlight the uneven landscape. California, the Northeast and the Plains all posted year-over-year gains, while most other regions slipped. Price per unit growth slowed but still outpaced the broader market, meaning C-stores generated more dollars per trip, even as traffic declined.

Alcohol Drives Bigger Baskets

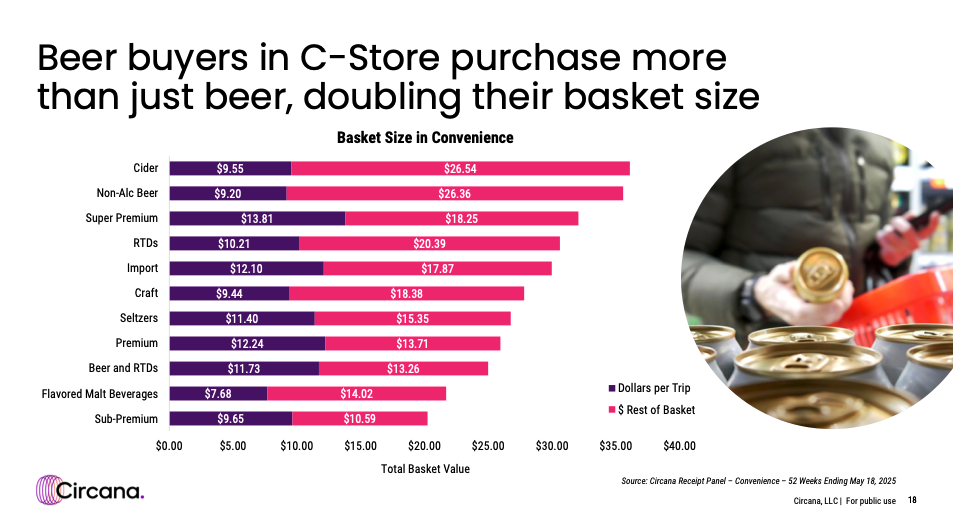

Alcohol remains a critical traffic driver. Singles dominate the category, with the highest household penetration and repeat purchase rates. On average, singles buyers make 36 trips a year, compared to 18 for 12-pack buyers. Hispanic consumers, Gen X, and rural households are especially heavy shoppers of beer and ready-to-drink (RTD) cocktails.

Spirits are also booming, led by tequila and premixed cocktails. Meanwhile, traditional beer categories, such as premium and sub-premium, lag behind other retail channels. Importantly, beer buyers in convenience stores typically purchase more than just alcohol, often doubling their basket size compared to other shoppers.

Shopper Shifts Create New Pressures

One of the most significant changes in recent quarters is the decline in spending among Hispanic shoppers. Historically, this group has been a source of strong growth for convenience stores. Now traffic is softening in states such as Texas, California, Arizona and New Mexico. Rising job insecurity and immigration concerns are leading to fewer outings, smaller gatherings, and a preference for larger retailers that offer lower prices and greater anonymity.

Outlook: Value, Variety, and Innovation

Circana’s analysis suggests that the future of the channel hinges on three priorities:

- Elevating Foodservice – Investing in fresh, premium, and daypart-focused offerings to capture consumers seeking quality and convenience.

- Maximizing Alcohol Impulse – Leaning into singles and RTDs while innovating around spirits and non-alc options.

- Re-engaging Hispanic Shoppers – Tailoring Assortments and Messaging to Reconnect with This Key Demographic

While fuel remains a drag on the channel, consumer sentiment has improved, and shoppers continue to show interest in food, beverages and innovative formats. The C-store of the future will be defined less by the pump and more by its ability to deliver value, variety and quality that resonates with a changing consumer base.

This article is based on Circana’s U.S. C-Store Landscape Q2 2025 report. Circana provides research, data and analytics that help retailers and brands understand shopper behavior and uncover growth opportunities across channels. Learn more at Circana.com.