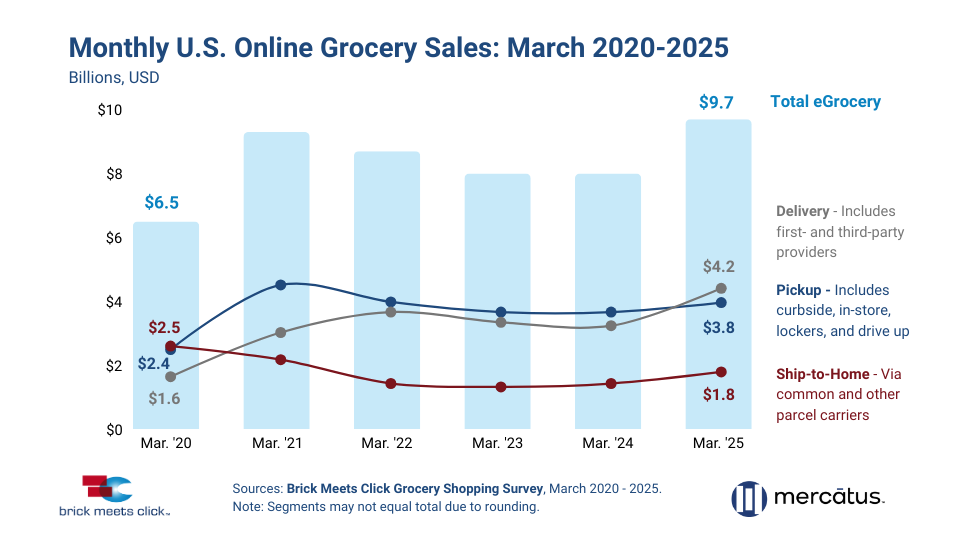

BARRINGTON, Ill. – Five years after the COVID-19 pandemic redefined how Americans shop for groceries, online grocery sales continue to surge, with March 2025 seeing a 21% year-over-year increase, reaching $9.7 billion, according to the latest Brick Meets Click Grocery Shopper Survey, sponsored by Mercatus.

The strong growth is primarily attributed to Delivery, which saw a dramatic 30%+ increase from March 2024, bolstered by aggressive discounts and expanding subscriber bases across retail channels. Delivery alone accounted for $4.2 billion in sales—outpacing Pickup ($3.8B) and Ship-to-Home ($1.8B), which has steadily declined in popularity since its pandemic peak.

“Delivery’s remarkable year-over-year rebound highlights the potency of promotional strategies that help customers save more money,” said David Bishop, Partner at Brick Meets Click. “And, memberships/subscriptions are becoming essential for retaining customers and driving more recurring revenue via gains in order frequency and average order values.”

This March also marks five years since the pandemic was declared, a milestone that underscores how enduring the shift to online grocery shopping has been. Pre-COVID, online grocery spending sat at just $2 billion monthly. That figure tripled by March 2020 and has since settled into a new normal, with March 2025 being the eighth consecutive month of sales over $9.5 billion.

Consumer behavior has evolved in parallel. In 2019, Ship-to-Home accounted for 42% of online grocery sales; in 2025, that share shrunk to 18%. Meanwhile, Delivery’s share has grown from 26% to 43%, and Pickup from 32% to nearly 39%. More consumers now use multiple fulfillment methods, with about 30% of active users switching between Delivery, Pickup, and Ship-to-Home based on convenience and availability.

Promotions appear to be a key driver. Since May 2024, grocers and third-party platforms have increasingly rolled out discounts and subscription perks, making online grocery shopping more attractive and affordable, especially for Delivery and, to a lesser extent, Supermarket Pickup services.

“Customer expectations around online grocery have only increased since COVID-19 pushed many to give it a try,” said Mark Fairhurst, Chief Growth Marketing Officer, Mercatus. “Retailers that elevate the experience with relevant offers and meaningful rewards won’t just meet shoppers’ evolving needs—they’ll build stronger connections that fuel long-term growth,” he added.

As of March 2025, 57% of U.S. households shop online for groceries—compared to under 25% pre-pandemic—and the transformation appears here to stay. As order frequency climbs, grocers will continue to face the challenge of balancing cost, convenience, and customer loyalty in an increasingly competitive digital marketplace.

For more information about March 2025 results, check out the latest Brick Meets Click eGrocery Dashboard or visit the eGrocery Monthly Sales report page for details on subscribing to the full monthly report.

Brick Meets Click conducted the most recent survey on March 30-31, 2025, with 1,699 adults, 18 years and older, who participated in the household’s grocery shopping, and a similar survey in March 2024 (n=1,810). Results are adjusted based on internet usage among U.S. adults to account for the non-response bias associated with online surveys. According to the U.S. Census Bureau, responses are geographically representative of the U.S. and weighted by age to reflect the national population of adults, 18 years and older.