CHICAGO — Protein is becoming one of the most important growth engines across grocery and mass retail, with its influence visible in both center-store aisles and perimeter categories. According to a new survey by Numerator, 78% of households report monitoring protein in their diets, giving it more mindshare than tracking sugar, fat, or calories. While whole foods, such as poultry, eggs, dairy, and meat, remain dominant, consumer attention is rapidly expanding to protein shakes, powders, bars, and fortified everyday items, ranging from salty snacks to desserts and coffee creamers.

The opportunity for retailers lies in the widening gap between “interest versus usage.” While many shoppers have yet to adopt protein-fortified snacks or indulgences, they express strong openness to trying them. That gap is already yielding results: fortified snacks and desserts have experienced outsized household and trip growth over the past four years, far outpacing non-fortified versions of the same products. Consumers are increasingly viewing fortified options as healthier, especially when they help meet daily protein goals without requiring significant lifestyle changes.

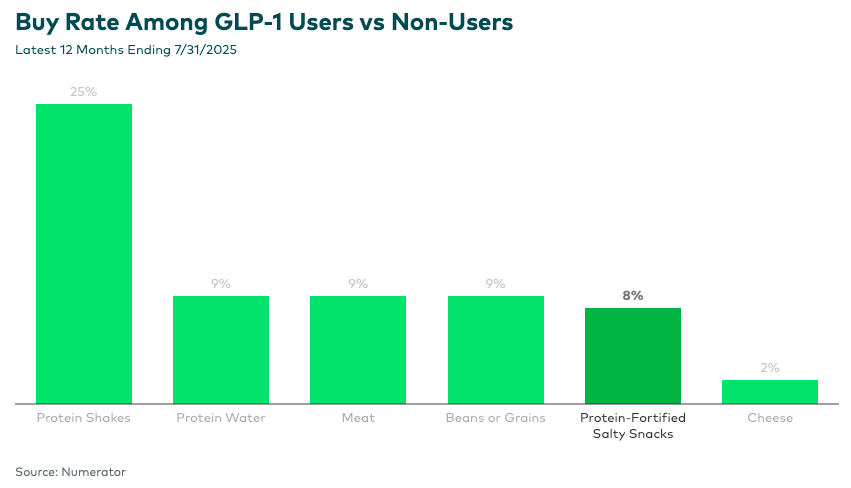

Another key force reshaping the market is the rise of GLP-1 medications. As adoption of drugs like Ozempic and Wegovy grows, protein demand is accelerating. GLP-1 households spend 25% more on protein shakes and show above-average spending in categories such as fortified snacks, protein water, and meat. For retailers, that represents a structural shift in basket composition, with protein positioned to be a long-term driver of both unit growth and basket value.

Barriers to purchase remain. More than one-third of shoppers avoid protein powders and bars, citing cost and concerns over artificial ingredients. But fortified foods and beverages are overcoming many of these objections, winning over new shoppers and expanding categories such as breakfast cereals, where high-protein options have attracted new buyers even as children’s cereal consumption has declined.

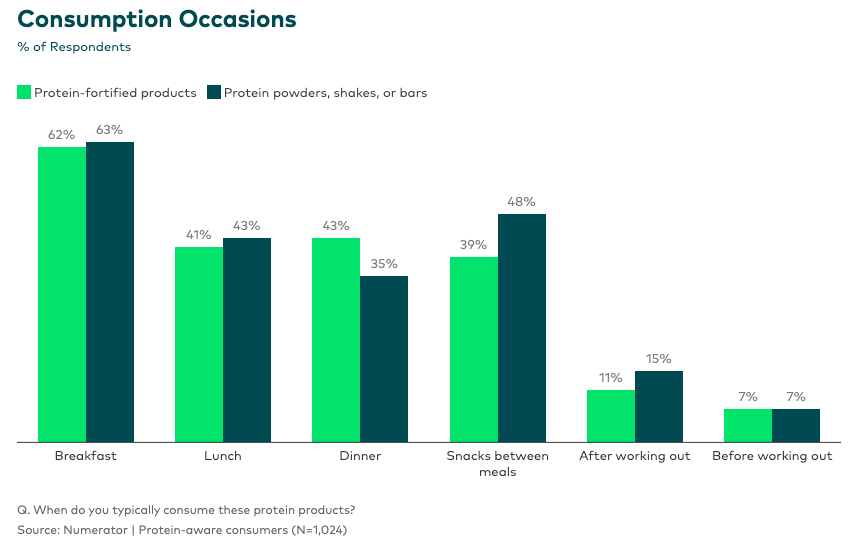

For mass retailers, the message is clear: consumers are actively seeking protein across dayparts and occasions. Breakfast remains the most common entry point, but opportunities for innovation abound in snacks, indulgent foods, and dinner meals. By expanding assortments, highlighting protein claims on packaging and in-store displays, and promoting fortified options through targeted marketing campaigns, retailers can capitalize on the protein trend to drive sales and enhance their positioning among health-conscious shoppers.