Bentonville, AR —Walmart Inc., the world's largest retailer, reported strong fiscal Q3 FY2025 results today. The company significantly exceeded market expectations and reaffirmed its position as a consumer favorite amid economic uncertainties. The retail giant raised its full-year outlook, highlighting robust growth in sales, e-commerce, and global advertising.

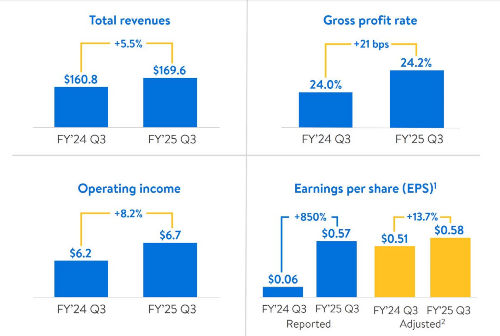

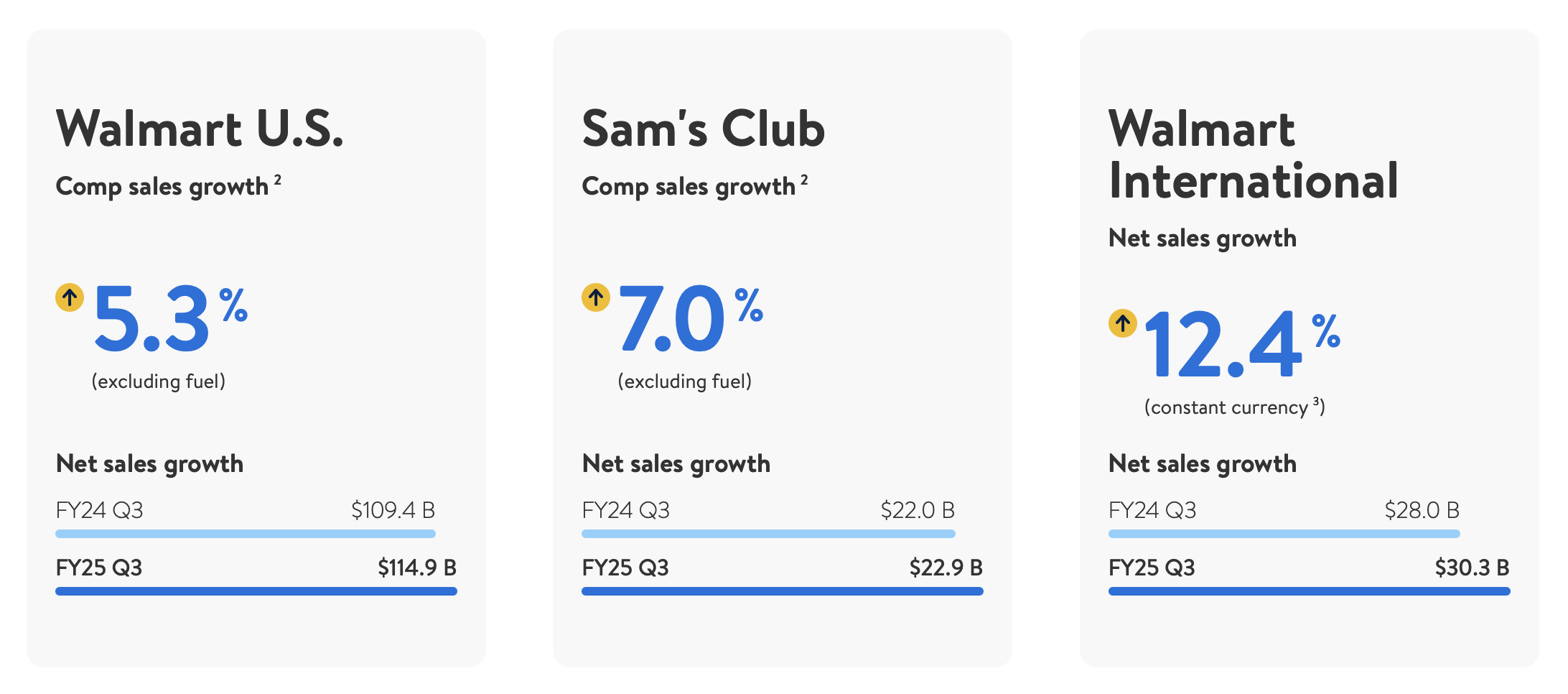

For the quarter, Walmart posted revenue of $169.59 billion, beating analyst projections of $167.5 billion. Adjusted earnings per share came in at $0.58, surpassing estimates by $0.05. Same-store sales in the U.S. grew 5.3%, driven by a 3.1% increase in foot traffic and a 2.1% rise in average transaction value.

"Our team delivered a strong quarter, showcasing our ability to navigate challenges and serve customers effectively," said Walmart CEO Doug McMillon. "We are well-positioned for the holiday season with value-driven offerings that meet our customers' needs."

Key Highlights:

- E-commerce Surge: Global e-commerce sales soared 27%, propelled by store pickup and marketplace transactions. Walmart Connect, the company's advertising arm, recorded 28% growth.

- Technology Investments: Walmart leveraged AI to enhance its product catalog, automating tasks that would have required exponentially more labor, underscoring its commitment to innovation.

- International Success: Walmart International reported an 8% revenue growth to $30.3 billion, with significant contributions from Flipkart in India and strong performance in Mexico and China.

- Resilience in Groceries: Grocery sales, which constitute 60% of Walmart U.S.'s revenue, saw mid-single-digit growth, driven by increased demand for pantry staples.

Guidance Update:

Walmart has raised its FY2025 net sales growth forecast to 4.8%- 5.1%, up from its previous range of 3.75%- 4.75%. Adjusted operating income is expected to grow by 8.5%- 9.25%, and full-year adjusted earnings per share are projected between $2.42 and $2.47, higher than earlier guidance.

Strategic Positioning:

Amid persistent inflation and shifting consumer preferences, Walmart has successfully attracted value-conscious shoppers, including higher-income households. Analysts attribute its success to competitive pricing, omnichannel capabilities, and an expanding private-label portfolio.

With the holiday season underway, Walmart remains optimistic. "Our customers are ready, and we're ready for them," McMillon added, signaling confidence in sustaining the momentum into Q4.

Market Reaction:

Walmart's stock rose over 3% in premarket trading, adding to its impressive 65% year-to-date gain. Analysts have responded mainly positively, citing Walmart's strong execution and diversified growth drivers.