CHICAGO—According to new data from Circana, U.S. retail sales climbed modestly in May, with a 1% increase in revenue compared to the same period last year, despite a 1% decline in unit sales. The data suggests consumers are making increasingly deliberate trade-offs, with food spending rising amid unchanged consumption levels and discretionary purchases showing signs of stress.

“Consumers are prioritizing their spending to a degree not seen since the pandemic, and consumer sensitivity to price and priority will only elevate as market pressures evolve,” said Marshal Cohen, chief retail industry advisor for Circana. “Today’s prioritization behavior is not consistent across all industries, or even consumer segments, and is likely to change in the weeks and months ahead as we navigate through the early stages of price increases and tariff-impacted product appears in stores.”

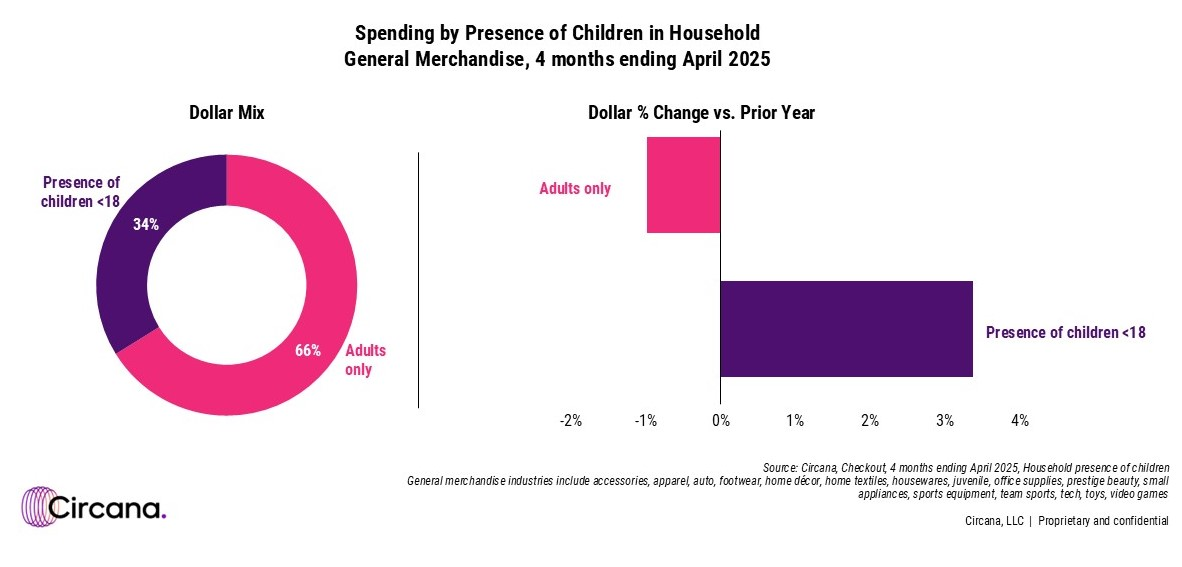

Households with children are feeling the pinch but remain a surprising source of growth. Although these households spend less overall on discretionary goods than those without children, they are currently sustaining retail growth, especially in categories seen as essential for kids. Still, Circana warns this growth may wane as economic pressures intensify.

For the four weeks ending May 31, 2025:

- With flat unit sales, food and beverage sales rose 3% in dollars.

- Non-edible CPG sales increased 1%, while unit sales declined 2%.

- Discretionary general merchandise sales fell 3% in revenue and 4% in unit sales.

Apparel spending saw the sharpest drop at the month’s end, while prestige beauty rebounded and topped general merchandise sales. Meanwhile, consumer tech declined following an earlier surge driven by tariff concerns.

“Consumer behavior is becoming predictive, particularly as it relates to discretionary purchases,” said Cohen. “Minimal changes to food spending behavior puts more pressure on general merchandise to absorb the changes made by consumers, making it critical for marketers to not only observe and react to a shift in one market segment but also view those shifts as a preview of what will come in other segments.”