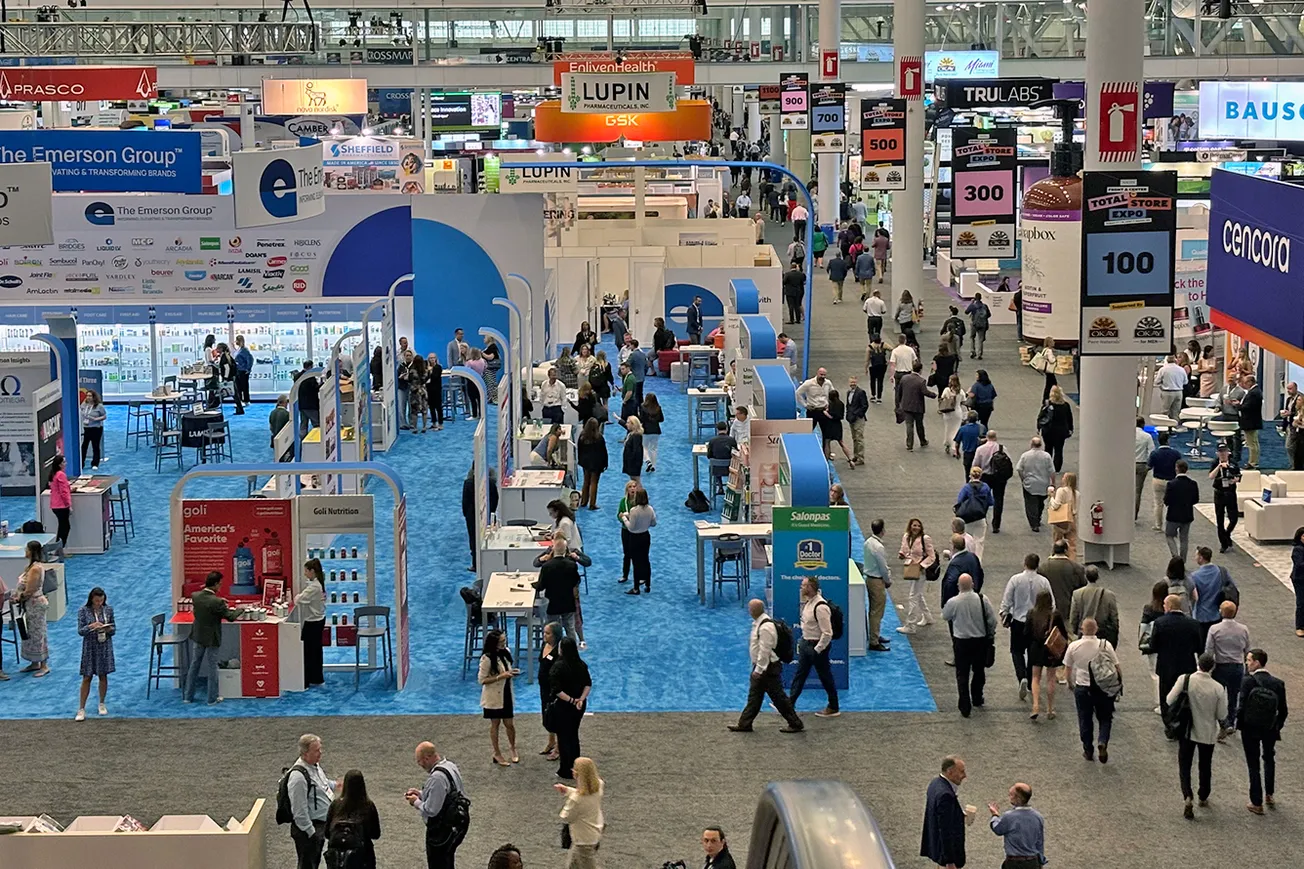

Much has been discussed about the phenomenal rise of retail media networks (RMNs) in the digital space dominated by Amazon, which has 75% market share and is now the third-largest ad network in the world behind Google and Facebook. Powered by retailers’ first-party data from e-commerce transactions and loyalty programs, there are now over 200 RMNs worldwide, and retail media is the fastest-growing ad channel, projected to grow to over $100 billion in ad spend by 2027.

Emarketer predicts that by 2027 advertiser spending on this channel will be bigger than connected TV, digital audio and traditional television combined and will nearly tie with social media as the No. 2 channel for advertising dollars. It’s these astonishing revenue numbers accompanied by high profit margins that are drawing more and more retailers into the space — almost weekly there’s a launch announcement for a new RMN.

In the physical space the story is very different. Very few retailers have built out RMNs in their physical stores, the largest being Walmart’s in-store RMN with 170,000 screens chainwide. The Walmart in-store network along with Sam’s Club, Costco, Target and Best Buy were all kick-started with an obvious use case, how to get brand-safe privately programmed content on TVs merchandised in store. These channels were dubbed TV Walls and gave shoppers the opportunity to compare different TV brands displaying content that reflected the in-home experience.

TV Walls became the first in-store media channels, with retailers displaying ads alongside sports clips, movie clips, etc. Some retailers then expanded the network footprint, adding screens in highly trafficked aisles, key departments and at checkout. For example, Walmart launched the next generation of its in-store RMN in 2008, the Walmart Smart Network, adding more screens across the store and describing it as the first “shopper-intelligent network at retail.”

These early in-store retail network operators used intercept studies from market research companies like Nielsen and Liberman to measure viewership and establish the media value of a particular channel. Interviews conducted with shoppers would be used to determine key metrics like number of shoppers in a department, average time spent watching screens and ad effectiveness.

These studies helped build the framework for establishing the media value of in-store screens. Today’s advertisers are expecting more robust measurement approaches for in-store RMNs, leveraging technologies like AI-driven audience measurement, beacons and radar sensors.

Over the last year we’ve moved into a new phase for in-store RMNs, with many more retailers planning to build media networks in physical stores across multiple categories. What’s driving this next generation of in-store RMNs is an attempt by these retailers to level the RMN playing field, leveraging their in-store traffic and significant reach. These retailers understand that the vast majority of shoppers still shop in physical stores, they’re in buying mode on the shopping trip, and ads on screens can influence purchase behavior and drive incremental sales lift.

If we take 7-Eleven as an example, this chain can’t come anywhere close to the media revenue Walmart, Target or Kroger can generate in the digital space because so much more digital commerce is happening with these chains. In the physical space, though, with 13,000 stores across the U.S. and Canada, 80 million loyalty members and 12 million daily shoppers a 7-Eleven in-store RMN could be a formidable competitor for advertising dollars.

One of the biggest challenges retailers have when embarking on building an in-store RMN is where to start. Our recommendation is to start by installing a proof of concept in a couple of flagship stores to flesh out the design of the network with leadership approval. Then do a broader supplier-funded pilot in a statistically relevant number of stores to measure viewership. At this point the network can be installed chainwide and monetized by internal sales teams, third-party monetization platforms, or a combination of both.

The future really is bright for in-store retail media, which has enormous potential to have a big impact on a retailer’s bottom line if expertly built and operated. We’re excited to see the evolution of this channel and anticipate that by the end of 2025 the number of in-store screens will have increased significantly across multiple categories.

Susie Opare-Abetia is the founder and chief executive officer of Wovenmedia, an in-store retail media solutions provider. She can be reached at sopare@wovenmedia.com. Wovenmedia has a unique offering that combines powerful software with a full suite of services and a premium content library. The company’s proven expertise at building and managing retail media networks drives customer engagement across thousands of screens at retail. For more information go to wovenmedia.com.