WASHINGTON – Imports at the nation’s major container ports have surged as retailers prepare for potential tariff increases and supply chain disruptions, according to the Global Port Tracker report released today by the National Retail Federation and Hackett Associates. Meanwhile, a potential labor strike at East Coast and Gulf Coast ports has been narrowly avoided following the announcement of a tentative six-year labor agreement between the International Longshoremen’s Association and the U.S. Maritime Alliance.

The report highlights that fears of higher costs from proposed tariffs and labor uncertainty prompted retailers to accelerate shipments, boosting imports in December and early January. “Importers were already front-loading cargo to avoid delays, and this activity has given a significant boost to volumes,” said Ben Hackett, founder of Hackett Associates.

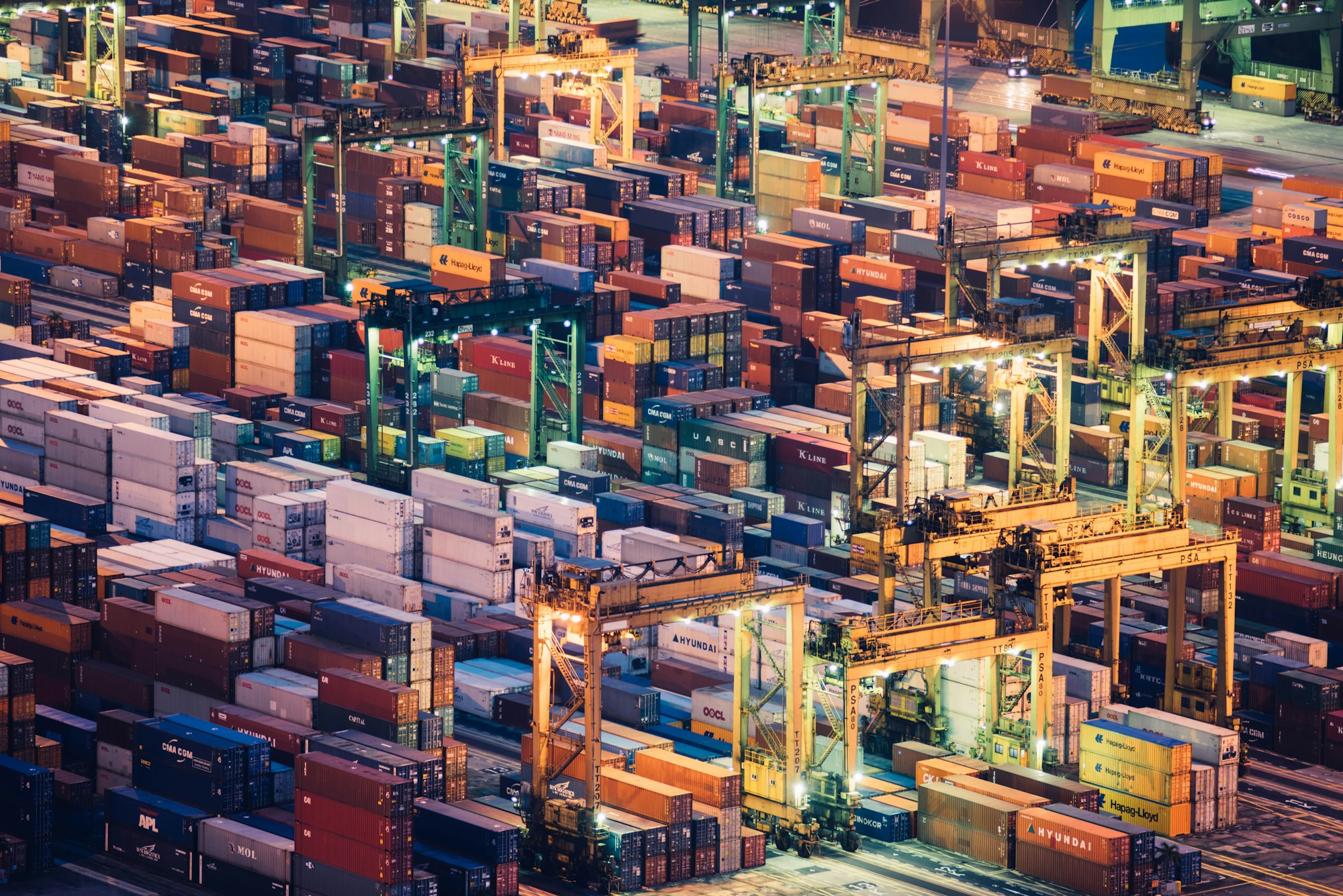

Ports handled 2.17 million Twenty-Foot Equivalent Units (TEU) in November, up 14.7% year-over-year, with December imports projected to reach 2.24 million TEU—a 19.2% increase. According to the report, this brings the total for 2024 to an estimated 25.6 million TEU, up 15.2% from 2023.

Strike Avoided with Last-Minute Labor Agreement

The tentative labor agreement, announced Wednesday, resolves immediate concerns about a potential strike that was set for January 16 following the expiration of a temporary contract extension on January 15. “The new contract brings certainty and avoids disruptions, and we hope to see it ratified as soon as possible,” said Jonathan Gold, NRF Vice President for Supply Chain and Customs Policy.

Without the agreement, this would have been the second major disruption in four months following October’s three-day walkout. However, the strike threat had already driven retailers to bring in spring merchandise early to ensure shelves remained stocked.

Broader Economic and Supply Chain Challenges

The report also notes that President-elect Trump’s proposed tariff increases are motivating retailers to secure inventory ahead of any changes, potentially shielding consumers from higher costs. January 2025 imports are forecasted at 2.16 million TEU, up 10% year-over-year, while February is expected to see a seasonal dip due to Lunar New Year factory shutdowns in China.

Global Port Tracker, produced for NRF by Hackett Associates, provides critical data on key ports, including Los Angeles/Long Beach, New York/New Jersey, and Houston. The report is available to NRF members and subscribers at NRF.com/PortTracker. Subscription information for non-members can be found at www.globalporttracker.com.