Table of Contents

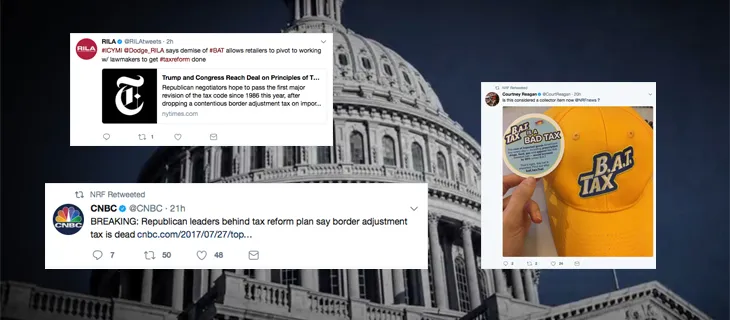

WASHINGTON — Retailers applauded congressional Republicans’ move to give up their pursuit of the border adjustment tax (BAT).

Prior to GOP leaders’ announcement of the decision on Thursday, retailers that receive many of the goods they sell from overseas had expressed concerns about the BAT, claiming it would pass hefty costs on to consumers.

The week before, it looked like retailers’ fight against BAT was heating back up, with the National Retail Federation (NRF) sending a letter to Congress titled “Congress Should Focus on Income Tax Reform, Not BAT.”

The border tax, originally created and backed by House Speaker Paul Ryan (R., Wis.), had since divided Republicans in Congress, and some of America’s biggest retailers were looking to tear it apart. The proposal would have hiked prices of imported goods to the United States.

“Today’s update on the status of tax reform is very encouraging, particularly since the border adjustment tax is no longer under consideration,” NRF president Matthew Shay said in a statement. “By removing this costly element of reform, the way has been cleared for swift action on a middle-class tax cut that will put more money in the wallet of the American taxpayer. Changing our outdated tax code is fundamental if we are to grow our economy, encourage investment and create jobs.”

The National Association of Chain Drug Stores also commended congressional leaders and the White House for the decision to set aside consideration of a border adjustment tax.

“From the beginning of this debate, NACDS aligned with Americans for Affordable Products given our strongest of concerns about the BAT. We have urged our nation’s leaders to set aside the BAT from a health and wellness perspective, from a total-store perspective, from a consumer perspective, from an employee perspective and from an employer perspective,” NACDS president and chief executive officer Steve Anderson said. “From all of these viewpoints, we commend congressional leaders and the White House for listening to the concerns raised by NACDS, by Americans for Affordable Products, and by many others, and for deciding to not pursue the BAT.”

Throughout the year, NACDS articulated its position on the BAT in outreach to the Senate Finance Committee and to the House Ways and Means Committee, as well as through congressional meetings conducted by NACDS board members.

“With BAT out, Washington has an opportunity for the first time in more than a generation to pass a tax reform plan that boosts American businesses and family budgets,” Retail Industry Leaders Association (RILA) president Sandy Kennedy said.

“As the nation’s largest private-sector employer, retailers are ready to work with lawmakers to pass tax reform that lowers corporate rates, scrutinizes deductions, keeps America competitive globally and creates a level playing field here at home,” Kennedy added.

In a joint statement on Thursday, Ryan, Senate Majority Leader Mitch McConnell (R., Ky.), Treasury Secretary Steve Mnuchin, National Economic Council Director Gary Cohn, Senate Finance Committee Chairman Orrin Hatch (R., Utah), and House Ways and Means Committee Chairman Kevin Brady (R., Texas) stressed that they remain focused on the broader issue of comprehensive tax reform.

“While we have debated the pro-growth benefits of border adjustability, we appreciate that there are many unknowns associated with it and have decided to set this policy aside in order to advance tax reform,” they stated.

Republicans reiterated their goal of starting to work on a joint tax plan through committees by this fall. Many questions remain about what shape the plan would take. While the White House released a brief summary of its goals for tax reform earlier this year, it has released little about specific policy since then.