CHICAGO — At a time of rapid technological development and constantly evolving consumer habits, convenience retailers face considerable challenges. In an interview with Mass Market Retailers, David Portalatin, Senior Vice President and Industry Advisor at Circana, shared insights on how the sector is accelerating its digital capabilities, leveraging first-party data, and preparing for a shift toward AI-driven agentic models that could redefine consumer engagement.

Circana’s recently released Q1 2025 U.S. C-Store Landscape Report reveals that the market is under pressure, with dollar sales declining by 2.3% and unit sales falling 5.6%. Both foodservice traffic and fuel volume continue to drop. But according to Portalatin, the most important story isn’t the decline; it’s the digital transformation happening just beneath the surface.

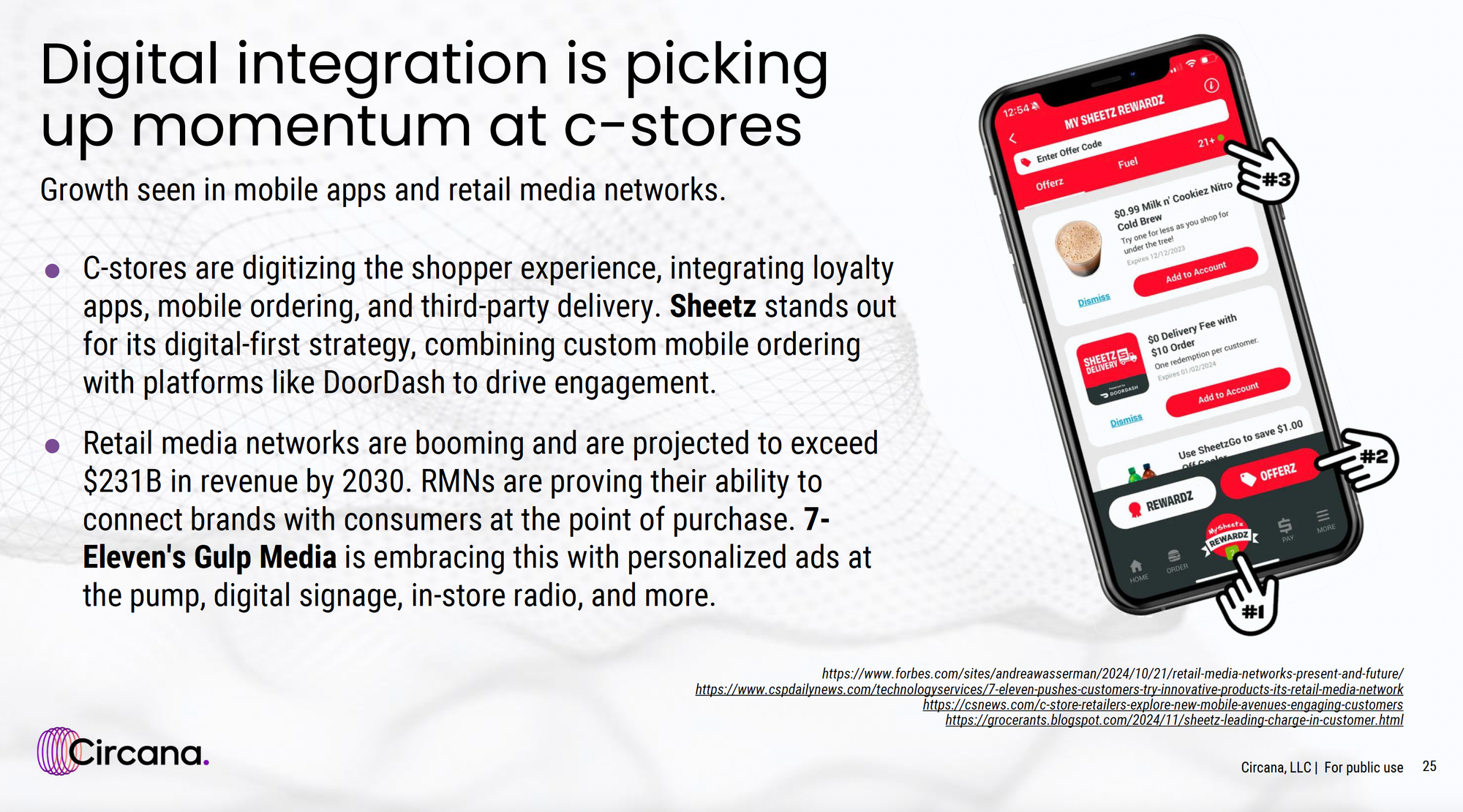

“Convenience retail has historically lagged behind the digital curve,” said Portalatin. “But they’re very rapidly catching up.”

Unlocking the Power of First-Party Data

Larger convenience chains are leading the charge by deploying loyalty programs and digital touchpoints that deepen consumer relationships. “For those larger chains that are engaging consumers more digitally, they have them in loyalty programs, and they’re going to be generating a lot of that first-party data,” Portalatin explained.

This data is becoming one of the most valuable assets in today’s retail environment, especially as consumers increasingly demand personalized interactions and seamless omnichannel experiences.

Circana, which tracks over $3 trillion in annual consumer spending across general merchandise, CPG, and foodservice, plays a pivotal role in helping retailers harness this data. “We as an organization are actually doing a lot of work to help marketers and retailers cultivate their audiences,” Portalatin said. “That’s a lot of data that you can leverage to curate much more precise brand messaging to consumers in a way that’s really relevant to them.”

For retailers with the tools and talent to act on these insights, the payoff can be significant. “This is a great opportunity for those retailers that have the wherewithal to leverage data in that way,” he added.

Currently, much of this targeting is fueled by paid advertising, which remains a valuable source of revenue for retailers and an effective way for brands to connect with high-intent audiences. But Portalatin sees bigger changes ahead.

Private Labels Attract Interest

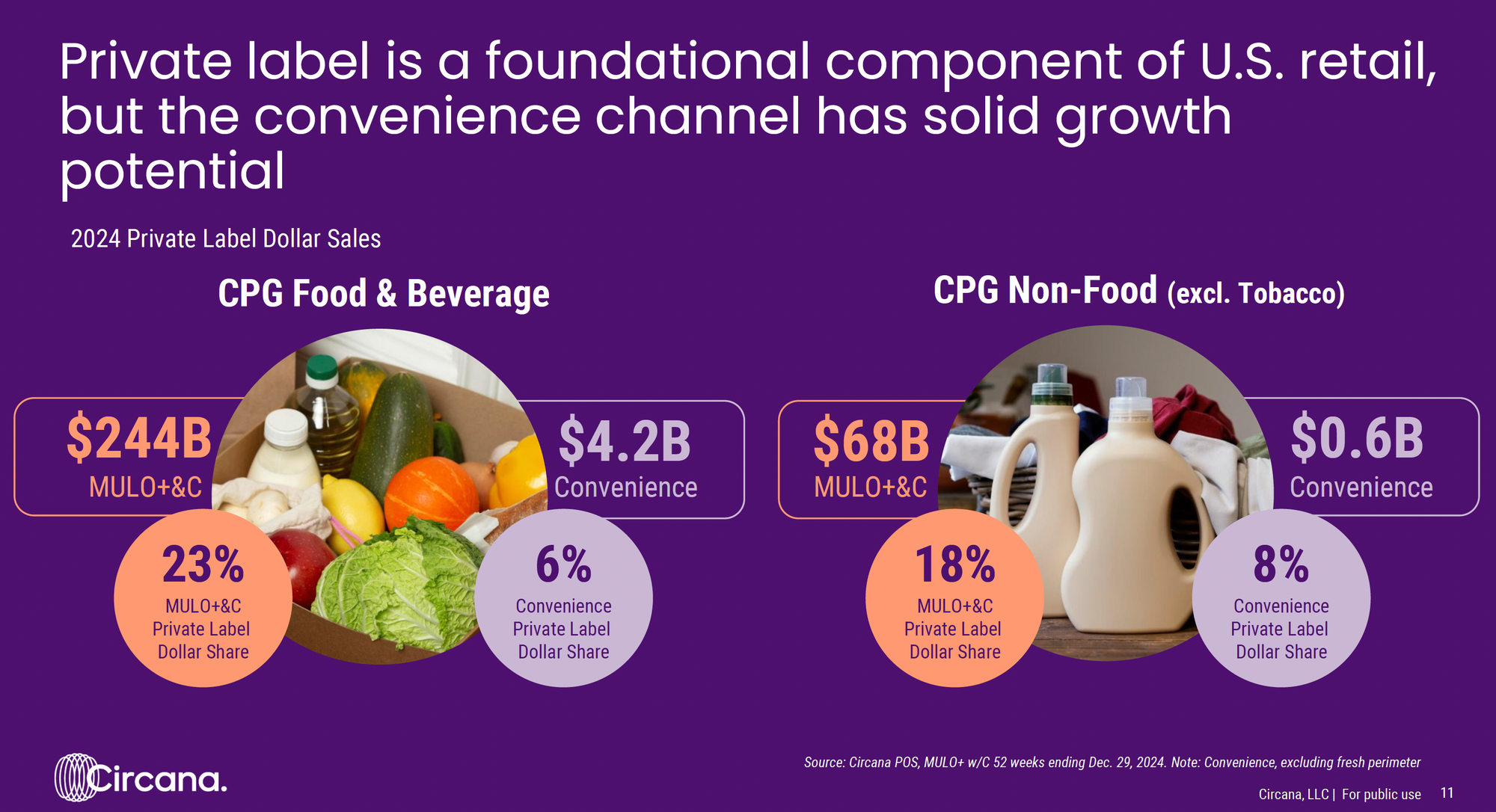

Private labels are also gaining ground in the convenience channel, as retailers look to drive differentiation and improve margins amid a competitive and inflation-sensitive landscape. “We're seeing growing interest in private brands, especially as retailers gain more insight into shopper behavior through loyalty data,” Portalatin noted.

Circana’s broader market research indicates that private label products are not only gaining consumer trust but are also becoming increasingly strategic assets for retailers seeking to build brand equity and foster customer loyalty. For convenience retailers, this represents a powerful opportunity to combine data-driven personalization with exclusive offerings that meet evolving shopper expectations.

The Next Frontier: AI-Driven Agentic Models

“One caution is the next iteration of that potentially could be an AI-driven, what they call an agentic model,” he said, “where both brands and retailers and consumers all have AI agents working on their behalf, speaking to each other autonomously to drive a lot of these decisions.”

In this emerging scenario, AI “agents” could analyze preferences, context, and behavior to deliver hyper-personalized product recommendations—not because they’re paid ads, but because they precisely match a consumer’s evolving needs. “These agents would communicate with one another to drive decisions—meaning you might be presented with product suggestions that aren’t ad-driven but are instead hyper-personalized,” Portalatin explained.

While this model could disrupt the traditional ad-supported retail media ecosystem, it also opens new doors for deeper, data-driven consumer relationships. Portalatin emphasized that retailers who adopt AI innovations and advanced data strategies will stand to gain a significant competitive advantage.

“This shift represents both a challenge and an opportunity for retailers ready to embrace advanced data and AI strategies,” he said.

Looking Ahead

As convenience retailers continue closing the digital gap, preparing for an AI-driven future could help them transform how they drive engagement, build loyalty, and grow revenue. What’s emerging is not just an innovative marketing tool, but a fundamentally different way of interacting with consumers.

For now, the challenge is real: traffic is soft, and sales are down. But for those who invest in digital infrastructure and future-ready strategies, the long-term upside could be transformative.

Key Takeaways:

- Circana’s Q1 2025 data shows sales declines but also signs of a digital pivot.

- First-party data is becoming central to retail strategy, particularly through loyalty programs.

- AI-driven agentic models could soon redefine consumer interactions, enabling fully autonomous and personalized engagement.

- Retailers willing to embrace AI and data science now may gain long-term differentiation in a crowded market.